South Carolina Shoring Services Contract - Self-Employed

Description

How to fill out Shoring Services Contract - Self-Employed?

Finding the appropriate legal document template can be a challenge.

Certainly, there are many templates accessible online, but how do you acquire the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the South Carolina Shoring Services Agreement - Self-Employed, which you can use for both business and personal purposes.

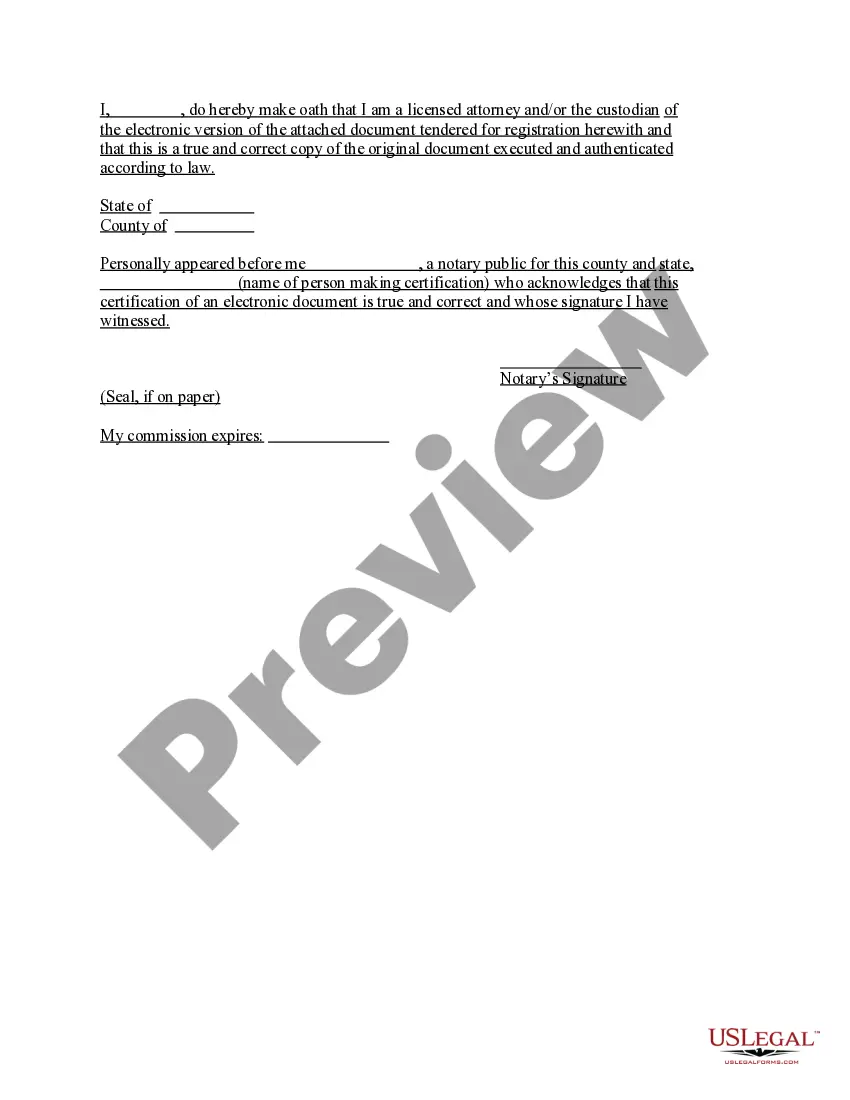

You can review the form using the Preview button and read the form details to confirm it is suitable for your needs.

- All of the documents are reviewed by professionals and comply with state and federal regulations.

- If you are already a registered user, Log In to your account and click the Download button to obtain the South Carolina Shoring Services Agreement - Self-Employed.

- Use your account to browse the legal forms you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps you should follow.

- First, make sure you have selected the correct form for your city/state.

Form popularity

FAQ

Yes, you can write your own legally binding contract as long as it meets certain legal requirements, like having clear terms and mutual agreement from both parties. It is crucial to ensure that the contract complies with state laws, particularly when it comes to a South Carolina Shoring Services Contract - Self-Employed. For additional assurance and guidance, using uslegalforms can help you create a contract that holds up in court.

Writing a self-employed contract involves defining the scope of work, including specific tasks and expectations. It is essential to detail payment terms and any expenses that will be reimbursed. Furthermore, ensure to include terms that clarify the independent contractor relationship, making it a South Carolina Shoring Services Contract - Self-Employed. To help simplify this task, uslegalforms offers helpful templates that you can customize.

Filling out an independent contractor agreement requires you to enter the names, addresses, and contact details of both parties. Next, define the scope of work, payment arrangements, and deadlines. Also, mention any additional terms, such as liability and dispute resolution procedures. Utilizing uslegalforms can help you efficiently create a South Carolina Shoring Services Contract - Self-Employed that suits your needs.

To write a contract for a 1099 employee, start by clearly stating the names of both parties and the services that will be provided. Specify the payment terms, including rates and due dates. Importantly, include a clause that addresses the independent nature of the work relationship, outlining that the individual is responsible for their own taxes and benefits. For a well-rounded approach, consider using a platform like uslegalforms for templates tailored to South Carolina Shoring Services Contract - Self-Employed.

The independent contractor rule differentiates between employees and independent contractors based on control over work and the nature of the relationship. This rule is essential for self-employed individuals, as it defines your legal status and tax obligations. If you are engaging in South Carolina shoring services, being aware of this rule can help you navigate your business more effectively.

In South Carolina, specific limits apply to the amount of work you can perform without a contractor license, typically up to $1,000 in labor and materials. If your project exceeds this threshold, obtaining a license is necessary. Understanding these regulations is vital if you plan to offer South Carolina shoring services as a self-employed contractor.

For a contract to be legally binding in South Carolina, it must have offer and acceptance, consideration, capacity, and a lawful purpose. Both parties should have a mutual understanding of the terms and obligations. By utilizing the South Carolina shoring services contract tailored for self-employed individuals, you ensure that all legal requirements are met.

An independent contractor agreement in South Carolina outlines the terms and conditions between a self-employed worker and a hiring party. It details the scope of work, payment terms, and responsibilities of both parties. This agreement is crucial for those engaging in South Carolina shoring services, as it protects the interests of both the contractor and the client.

In South Carolina, a handyman can perform numerous tasks without a license, such as minor repairs, painting, or installation of fixtures. However, invasive work like plumbing or electrical tasks may need a licensed professional. A well-defined South Carolina Shoring Services Contract - Self-Employed can ensure that your handyman services are clear and legally binding.

In South Carolina, small projects, such as minor repairs or installations that do not require extensive work, can usually be completed without a contractor's license. Examples include small remodeling tasks or basic landscaping. If you’re self-employed, use a South Carolina Shoring Services Contract - Self-Employed to outline your project scope and protect your interests.