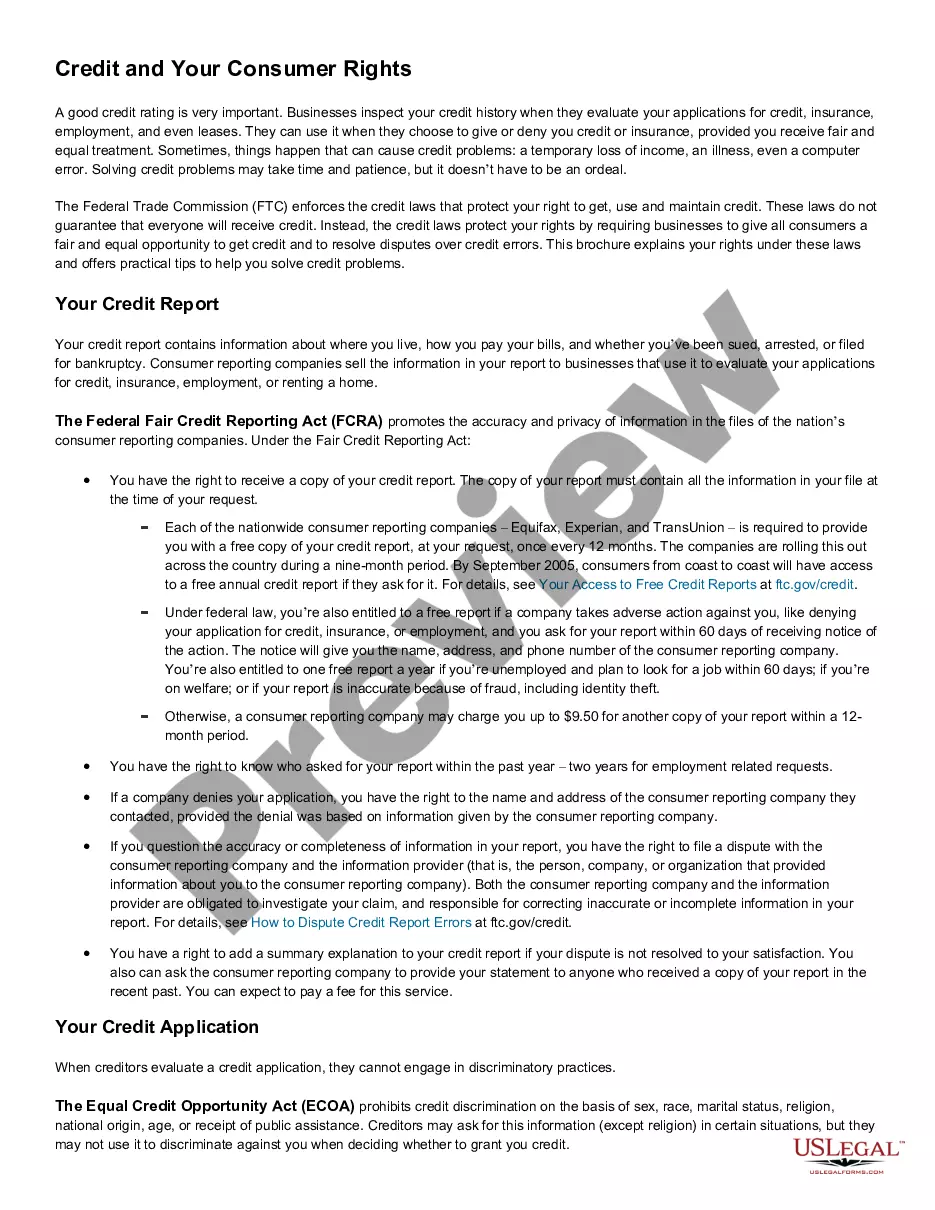

South Carolina A Summary of Your Rights Under the Fair Credit Reporting Act

Description

How to fill out A Summary Of Your Rights Under The Fair Credit Reporting Act?

If you have to full, download, or printing lawful papers templates, use US Legal Forms, the largest variety of lawful kinds, that can be found on the Internet. Utilize the site`s simple and hassle-free search to get the paperwork you want. A variety of templates for enterprise and personal functions are categorized by classes and states, or search phrases. Use US Legal Forms to get the South Carolina A Summary of Your Rights Under the Fair Credit Reporting Act with a number of click throughs.

In case you are already a US Legal Forms consumer, log in for your account and click on the Obtain switch to get the South Carolina A Summary of Your Rights Under the Fair Credit Reporting Act. Also you can accessibility kinds you earlier acquired in the My Forms tab of the account.

If you are using US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the form for your right metropolis/region.

- Step 2. Utilize the Preview solution to check out the form`s information. Do not forget to read the explanation.

- Step 3. In case you are not happy with the kind, take advantage of the Search industry near the top of the screen to discover other models of your lawful kind format.

- Step 4. Once you have identified the form you want, click on the Purchase now switch. Pick the prices plan you choose and include your credentials to sign up for the account.

- Step 5. Approach the purchase. You can utilize your credit card or PayPal account to accomplish the purchase.

- Step 6. Pick the structure of your lawful kind and download it on your own gadget.

- Step 7. Total, revise and printing or signal the South Carolina A Summary of Your Rights Under the Fair Credit Reporting Act.

Every single lawful papers format you buy is your own property eternally. You have acces to every single kind you acquired in your acccount. Go through the My Forms segment and decide on a kind to printing or download yet again.

Contend and download, and printing the South Carolina A Summary of Your Rights Under the Fair Credit Reporting Act with US Legal Forms. There are millions of expert and condition-distinct kinds you can utilize for your enterprise or personal needs.

Form popularity

FAQ

The Fair Credit Reporting Act of 1970 ensures that consumer reporting agencies use procedures which are fair and equitable to the consumer with regard to the confidentiality, accuracy, and relevancy of personal information. FAIR CREDIT REPORTING ACT Flashcards - Quizlet quizlet.com ? fair-credit-reporting-act-flash-cards quizlet.com ? fair-credit-reporting-act-flash-cards

? You have the right to know what is in your file. In addition, all consumers are entitled to one free disclosure every 12 months upon request from each nationwide credit bureau and from nationwide specialty consumer reporting agencies. See .consumerfinance.gov/learnmore for additional information.

The Fair Credit Reporting Act (FCRA) , 15 U.S.C. § 1681 et seq., governs access to consumer credit report records and promotes accuracy, fairness, and the privacy of personal information assembled by Credit Reporting Agencies (CRAs).

Four Basic Steps to FCRA Compliance Step 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must: ... Step 2: Certification To The Consumer Reporting Agency. ... Step 3: Provide Applicant With Pre-Adverse Action Documents. ... Step 4: Notify Applicant Of Adverse Action.

CFPB Launches FCRA Rulemaking to Eliminate Creditor Use of Medical Debt. On September 21, 2023, with limited time to digest the comments received by September 11, 2023 from the request for information regarding medical payment products, the Consumer Financial Protection Bureau (CFPB) started the FCRA rulemaking process ... CFPB Launches FCRA Rulemaking to Eliminate Creditor Use of Medical ... consumerfinancemonitor.com ? 2023/09/27 consumerfinancemonitor.com ? 2023/09/27

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act.

The Act (Title VI of the Consumer Credit Protection Act) protects information collected by consumer reporting agencies such as credit bureaus, medical information companies and tenant screening services. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Fair Credit Reporting Act | Federal Trade Commission Federal Trade Commission (.gov) ? legal-library ? browse ? statutes Federal Trade Commission (.gov) ? legal-library ? browse ? statutes

The FCRA is designed to protect the privacy of consumer report information ? sometimes informally called ?credit reports? ? and to guarantee that information supplied by consumer reporting agencies (CRAs) is as accurate as possible. Consumer Reports: What Insurers Need to Know ftc.gov ? business-guidance ? resources ? co... ftc.gov ? business-guidance ? resources ? co...