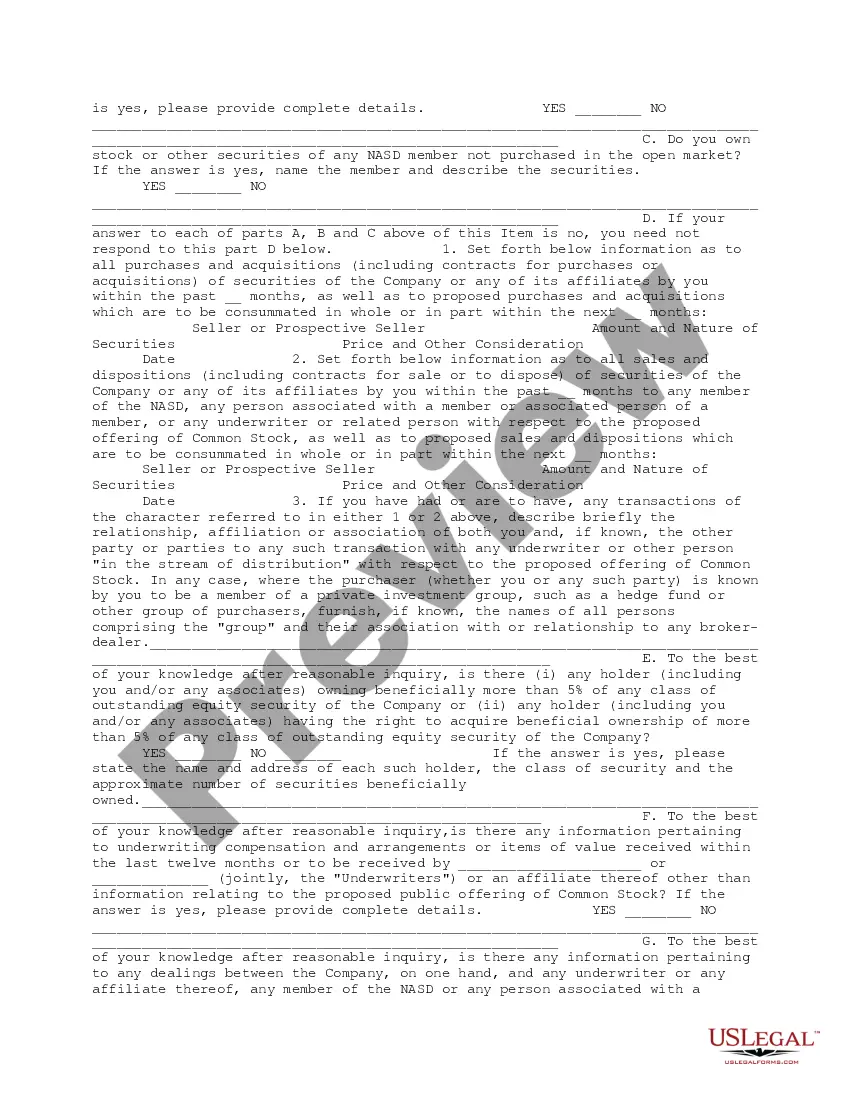

This form is a due diligence questionnaire that pertains to the preparation and filing of the Registration Statement. It is necessary that the company be supplied with answers to the questions in this questionnaire from the holders of at least 5 percent of the outstanding securities of the company in business transactions.

South Carolina Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent

Description

How to fill out Comprehensive Questionnaire For Shareholders Including Officers And Directors Holding At Least Five Percent?

Selecting the ideal legal document template can be challenging. Naturally, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service offers thousands of templates, including the South Carolina Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent, suited for business and personal needs. All forms are vetted by experts and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to acquire the South Carolina Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent. Use your account to access the legal forms you have previously purchased. Navigate to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are some straightforward steps you can follow: First, ensure you have chosen the correct form for your city/area. You can review the form using the Review option and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search field to find the correct form. Once you are confident that the form is satisfactory, click the Purchase now button to obtain the form.

US Legal Forms is the largest repository of legal forms where you can discover various document templates. Utilize this service to download professionally crafted documents that comply with state standards.

- Select the pricing plan you prefer and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the document format and download the legal document template to your device.

- Fill out, edit, print, and sign the downloaded South Carolina Comprehensive Questionnaire for Shareholders Including Officers and Directors Holding at Least Five Percent.

Form popularity

FAQ

Rights of all shareholders All company shareholders have the right to: Inspect company information, including the register of members (s. 116 Companies Act 2006) and a record of resolutions and minutes (s. 358) without any charge.

As mentioned above, shareholders can remove a director before the expiration of his or her period of office by way of an ordinary resolution. However, written resolutions cannot be used to remove a director, the voting must take place at an actual general meeting of the shareholders.

Shareholders can be Directors and Officers but need not be. Officers can be Directors and vise versa...but, again, need not be. Since Shareholders elect the Directors and Directors elect the officers, it is apparent that Shareholders hold the ultimate position of authority in a company.

Company directors can also be shareholders in any company limited company by shares. You can dually manage a company as a director and be the sole shareholder.

Courts have traditionally ruled that a corporate board of directors has responsibility to the corporation, not individual shareholders.

Yes. In most jurisdictions it is possible (and common) that the same person acts as shareholder and director of the company.

Shareholders and directors have two completely different roles in a company. The shareholders (also called members) own the company by owning its shares and the directors manage it. Unless the articles say so (and most do not) a director does not need to be a shareholder and a shareholder has no right to be a director.

A majority shareholder is a person or entity who holds more than 50% of shares of a company. If the majority shareholder holds voting shares, they dictate the direction of the company through their voting power.

While the boards often act, at least in the opinion of shareholder activists, like the board and the CEO are in charge, shareholders always have had the theoretical right to get rid of anyone they want. The firing of an individual board member by the CEO or the rest of the board is more common.

To allot new shares, existing members will need to waive pre-emption rights on the allotment of shares. The prospective members should deliver a letter of application to the company, and the board of directors (or members, if required by the articles) must approve the allotment and record it in the register of members.