South Carolina Schedule 14D-9 - Solicitation - Recommendation Statement

Description

How to fill out Schedule 14D-9 - Solicitation - Recommendation Statement?

Are you in the situation in which you need to have files for possibly company or specific uses almost every working day? There are tons of authorized record templates accessible on the Internet, but discovering types you can trust isn`t easy. US Legal Forms delivers thousands of kind templates, just like the South Carolina Schedule 14D-9 - Solicitation - Recommendation Statement, that happen to be written to fulfill federal and state specifications.

When you are previously informed about US Legal Forms website and also have your account, just log in. Following that, you are able to acquire the South Carolina Schedule 14D-9 - Solicitation - Recommendation Statement format.

Unless you have an bank account and want to begin using US Legal Forms, adopt these measures:

- Discover the kind you need and make sure it is to the proper city/county.

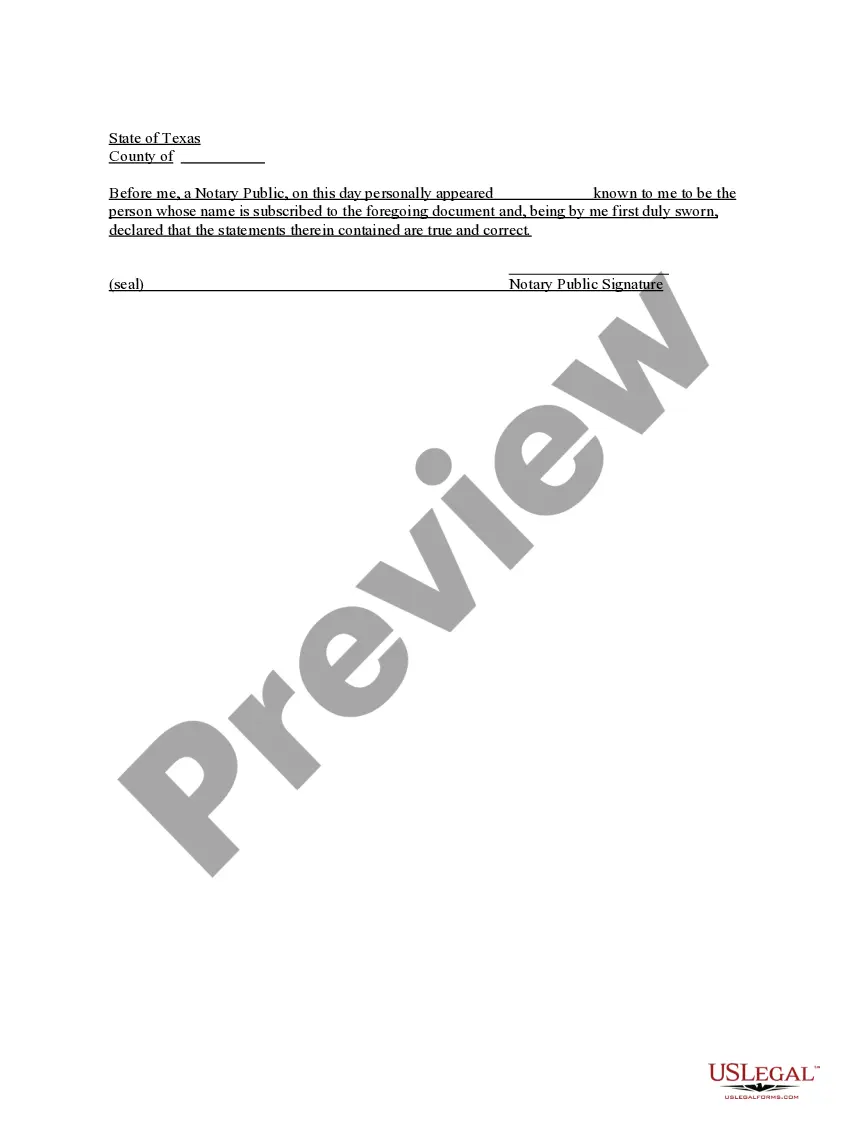

- Take advantage of the Review option to examine the form.

- See the outline to actually have chosen the appropriate kind.

- In the event the kind isn`t what you`re searching for, utilize the Look for field to get the kind that suits you and specifications.

- When you find the proper kind, click on Purchase now.

- Pick the rates program you desire, submit the necessary info to generate your account, and pay money for the order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free data file file format and acquire your version.

Locate each of the record templates you may have bought in the My Forms food selection. You can obtain a further version of South Carolina Schedule 14D-9 - Solicitation - Recommendation Statement at any time, if required. Just go through the needed kind to acquire or print out the record format.

Use US Legal Forms, the most substantial selection of authorized varieties, to save lots of efforts and steer clear of mistakes. The service delivers professionally made authorized record templates that you can use for an array of uses. Create your account on US Legal Forms and commence making your life easier.

Form popularity

FAQ

Schedule 14D-9 is a filing with the Securities and Exchange Commission (SEC) when an interested party, such as an issuer, a beneficial owner of securities, or a representative of either, makes a solicitation or recommendation statement to the shareholders of another company with respect to a tender offer.

A tender offer is a proposal that an investor makes to the shareholders of a publicly traded company. The offer is to tender, or sell, their shares for a specific price at a predetermined time. In some cases, the tender offer may be made by more than one person, such as a group of investors or another business.

Regulation 14D (§§ 240.14d?1 through 240.14d?101) shall apply to any tender offer that is subject to section 14(d)(1) of the Act (15 U.S.C. 78n(d)(1)), including, but not limited to, any tender offer for securities of a class described in that section that is made by an affiliate of the issuer of such class.

Question 162.07. Question: Rule 14e-1(c) requires that an offeror in a tender offer either pay the consideration offered or return the securities tendered ?promptly? after the withdrawal or termination of the tender offer.

Schedule TO-T is a form that must be filed with the Securities Exchange Commission (SEC) by any entity that makes a tender offer for another company's equity securities, as registered under the Securities Exchange Act of 1934. The "TO" in schedule TO stands for "tender offer," and the "T" for "third party."

The details can vary, but in general, the tender offer process looks something like this: A buyer (or multiple investors) offers to purchase shares at a set price typically agreed to by the company. The company confirms the offer price and gets preliminary approval from its board of directors (BOD).

Every tender offer must be open a minimum of 20 business days. Every offer has an initial expiration date (i.e., the end of the 20th business day), but this expiration date may be extended by the bidder.

Schedule 14D-9 is a filing with the Securities and Exchange Commission (SEC) made by a target company in response to a tender offer made by an interested party. A Schedule 14D-9 is required in any instance when shareholders have to sell a significant portion of their shares in exchange for cash or other securities.