South Carolina Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

Choosing the best lawful file format might be a battle. Naturally, there are a lot of web templates accessible on the Internet, but how can you obtain the lawful develop you will need? Use the US Legal Forms site. The support offers 1000s of web templates, like the South Carolina Proposal to Approve Adoption of Employees' Stock Option Plan, which you can use for business and private needs. All the types are examined by pros and meet state and federal needs.

Should you be currently signed up, log in in your account and click the Down load button to find the South Carolina Proposal to Approve Adoption of Employees' Stock Option Plan. Make use of account to appear through the lawful types you may have purchased formerly. Proceed to the My Forms tab of your account and obtain yet another backup in the file you will need.

Should you be a fresh customer of US Legal Forms, listed below are simple guidelines that you should follow:

- Initial, make sure you have chosen the right develop for your city/county. You are able to check out the shape using the Review button and study the shape description to ensure it will be the best for you.

- When the develop fails to meet your preferences, use the Seach field to find the proper develop.

- Once you are sure that the shape is acceptable, go through the Acquire now button to find the develop.

- Choose the costs strategy you would like and type in the essential info. Make your account and pay for the order using your PayPal account or charge card.

- Select the document formatting and down load the lawful file format in your gadget.

- Full, modify and produce and signal the received South Carolina Proposal to Approve Adoption of Employees' Stock Option Plan.

US Legal Forms is the most significant collection of lawful types where you can see numerous file web templates. Use the company to down load expertly-created paperwork that follow condition needs.

Form popularity

FAQ

Although stock option plans offer many advantages, the tax implications for employees can be complicated. Dilution can be very costly to shareholder over the long run. Stock options are difficult to value. Stock options can result in high levels of compensation of executives for mediocre business results. The pros and cons of offering employee stock options hcamag.com ? news ? general ? the-pros-an... hcamag.com ? news ? general ? the-pros-an...

Employee Stock option plan or Employee Stock Ownership Plan (ESOP) is an employee benefit scheme that enables employees to own shares in the company.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash. WHAT IS AN ESOP? HOW DOES AN ESOP WORK? american.edu ? tlcc ? esops-info-sheet american.edu ? tlcc ? esops-info-sheet

Management Stock Option Plan means any stock option plan which may be adopted by the Company for the benefit of the employees of the Company or its Subsidiaries, as the same may from time to time be amended or supplemented. Management Stock Option Plan Definition | Law Insider Law Insider ? dictionary ? manageme... Law Insider ? dictionary ? manageme...

The term employee stock option (ESO) refers to a type of equity compensation granted by companies to their employees and executives. Rather than granting shares of stock directly, the company gives derivative options on the stock instead.

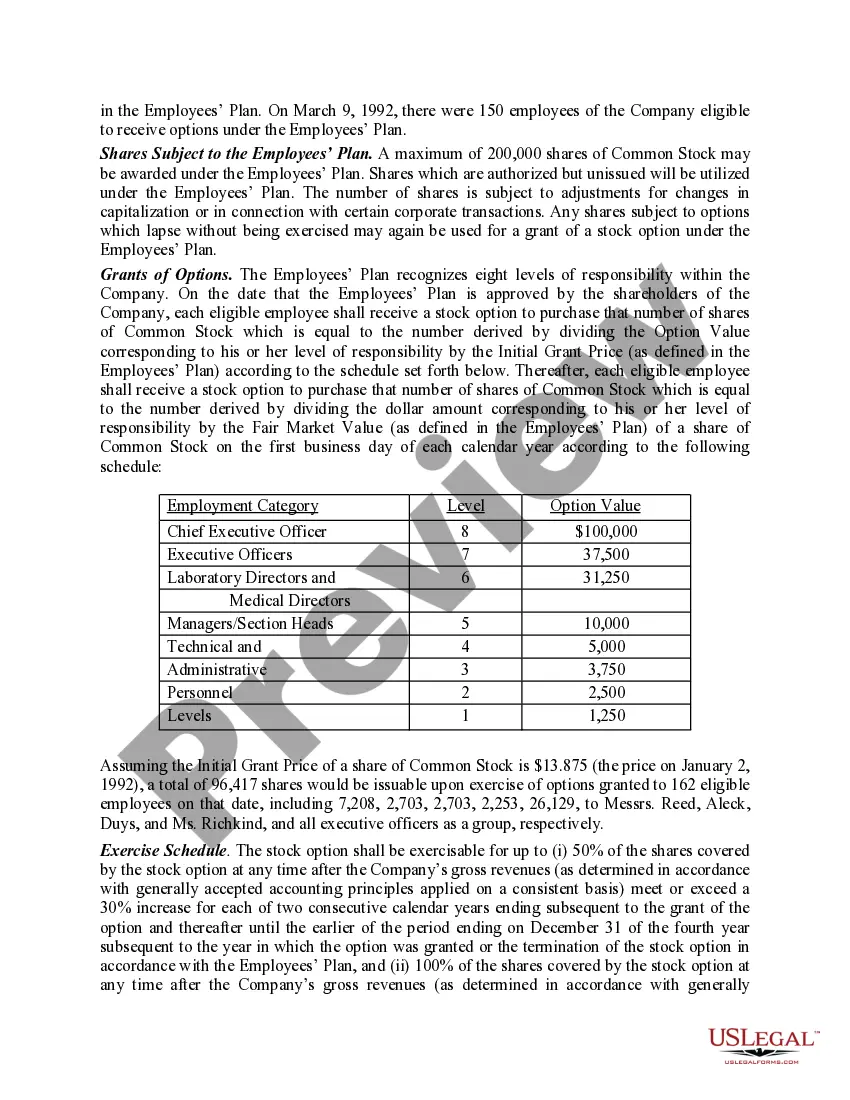

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Stock Options Explained: What You Need to Know - Carta Carta ? equity-101-stock-option-basics Carta ? equity-101-stock-option-basics

An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.