South Carolina Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

Have you been inside a position in which you need to have files for either business or individual functions virtually every time? There are plenty of authorized file layouts available online, but getting types you can depend on isn`t straightforward. US Legal Forms gives a large number of develop layouts, like the South Carolina Approval of Incentive Stock Option Plan, which are published to meet state and federal demands.

Should you be already informed about US Legal Forms web site and have a free account, simply log in. After that, you are able to down load the South Carolina Approval of Incentive Stock Option Plan format.

Should you not have an bank account and want to begin using US Legal Forms, abide by these steps:

- Find the develop you need and make sure it is for the proper town/county.

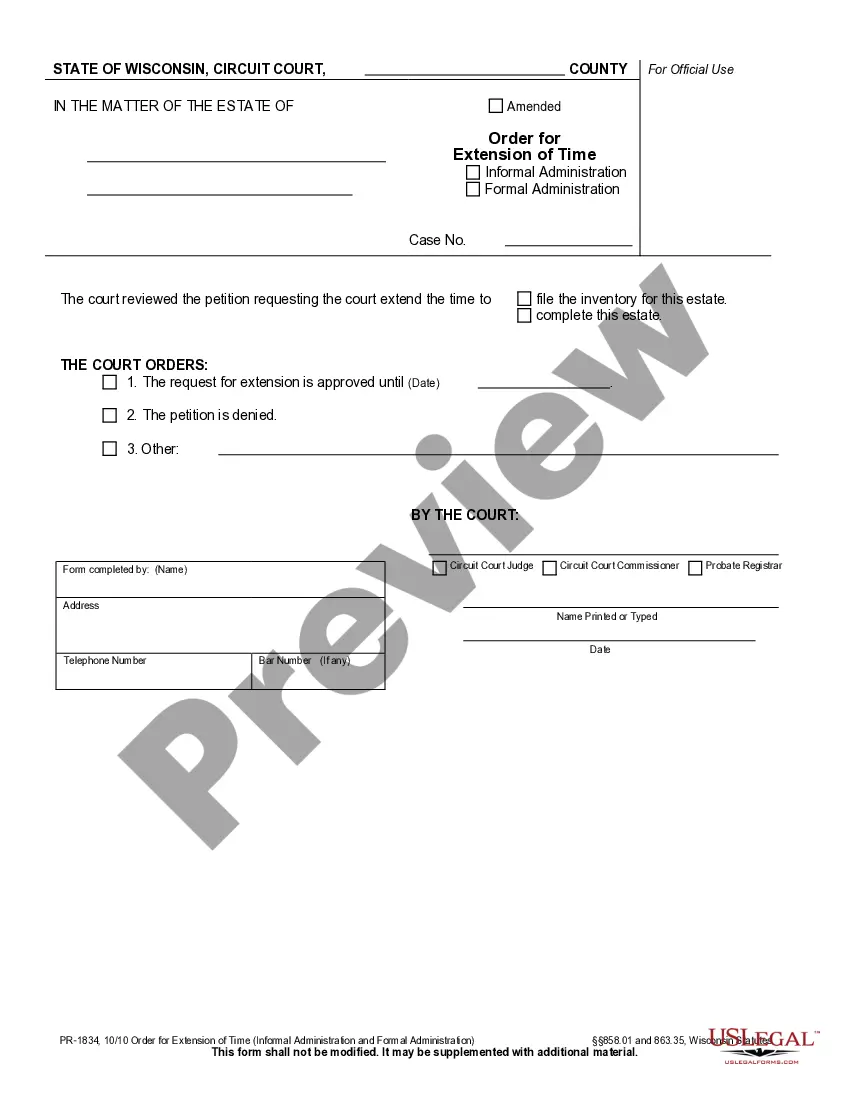

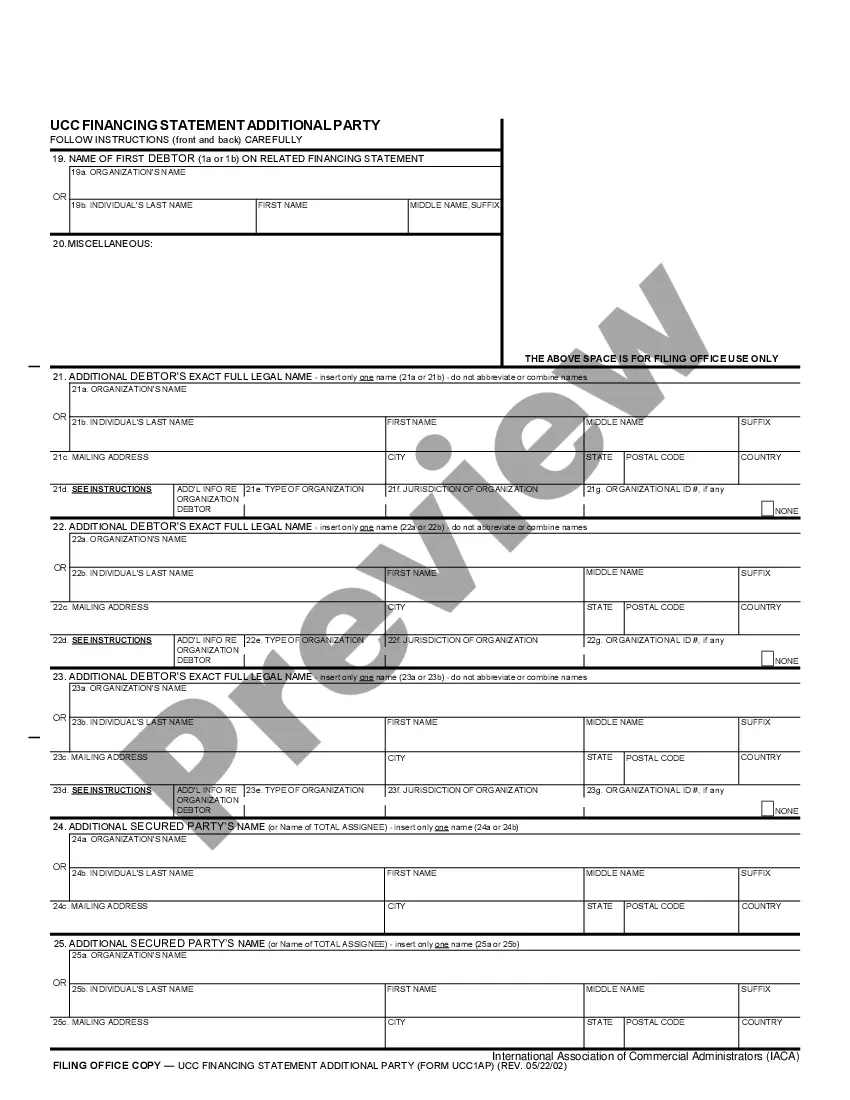

- Make use of the Review option to review the shape.

- Look at the outline to ensure that you have selected the appropriate develop.

- In the event the develop isn`t what you are searching for, make use of the Research industry to discover the develop that meets your needs and demands.

- Whenever you find the proper develop, click on Purchase now.

- Select the rates strategy you need, complete the specified information and facts to produce your account, and buy the transaction using your PayPal or credit card.

- Choose a practical file structure and down load your duplicate.

Get each of the file layouts you have purchased in the My Forms menu. You can get a extra duplicate of South Carolina Approval of Incentive Stock Option Plan at any time, if possible. Just click the needed develop to down load or print the file format.

Use US Legal Forms, probably the most extensive variety of authorized kinds, to save lots of some time and stay away from faults. The service gives appropriately manufactured authorized file layouts which can be used for a variety of functions. Generate a free account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

South Carolina Code §12-6-3587 allows a taxpayer a credit against income taxes equal to 25% of the costs incurred in the purchase and installation of a solar energy system, including a small hydropower system or ?geothermal machinery and equipment? for heating water, space heating, air cooling, energy efficient ...

South Carolina Code §12-6-3515 allows a taxpayer, who is entitled to and claims a federal charitable deduction for a gift of land for conservation or for a qualified conservation contribution on a qualified real property interest located in South Carolina, to claim a South Carolina income tax credit equal to 25% of the ...

The credit cannot exceed $250 per acre of property to which the qualified conservation contribution or gift of land for conservation applies. The total credit claimed by a single taxpayer cannot exceed $52,500 per year. Any unused credit may be carried forward until used.

SECTION 12-6-545. Income tax rates for pass-through trade and business income; determination of income related to personal services.

South Carolina Code §12-6-3360(C)(1) provides a tax credit against South Carolina income tax, bank tax, or insurance premium tax for a qualifying business creating new jobs in this State.

South Carolina Code §12-6-3535(B) allows a taxpayer an income tax credit equal to 25% of the rehabilitation expenses for a certified historic residential structure located in South Carolina. The rehabilitation expenses must, within a 36-month period, exceed $15,000 to qualify for the credit.

South Carolina Code §12-6-2252 (i.e., the single sales factor apportionment method) provides that a taxpayer whose principal business in South Carolina is manufacturing or any form of collecting, buying, assembling, or processing goods and materials in this state or whose principal business in South Carolina is selling ...