Oklahoma Split-Dollar Life Insurance

Description

How to fill out Split-Dollar Life Insurance?

Choosing the right legal document format could be a battle. Of course, there are plenty of web templates available on the net, but how do you discover the legal form you will need? Take advantage of the US Legal Forms web site. The support provides thousands of web templates, for example the Oklahoma Split-Dollar Life Insurance, which can be used for organization and private demands. All the kinds are inspected by pros and fulfill federal and state specifications.

Should you be previously listed, log in to the bank account and then click the Down load option to have the Oklahoma Split-Dollar Life Insurance. Use your bank account to search from the legal kinds you possess acquired in the past. Visit the My Forms tab of your respective bank account and have another duplicate of the document you will need.

Should you be a whole new consumer of US Legal Forms, listed here are basic recommendations so that you can adhere to:

- First, ensure you have chosen the right form for the area/area. You are able to examine the shape utilizing the Review option and browse the shape explanation to ensure it will be the best for you.

- In case the form will not fulfill your expectations, take advantage of the Seach discipline to get the appropriate form.

- When you are sure that the shape is proper, select the Purchase now option to have the form.

- Opt for the rates program you would like and enter in the needed info. Make your bank account and pay money for your order making use of your PayPal bank account or Visa or Mastercard.

- Opt for the data file format and obtain the legal document format to the gadget.

- Total, change and produce and indication the received Oklahoma Split-Dollar Life Insurance.

US Legal Forms is definitely the greatest library of legal kinds in which you can discover numerous document web templates. Take advantage of the service to obtain skillfully-produced files that adhere to express specifications.

Form popularity

FAQ

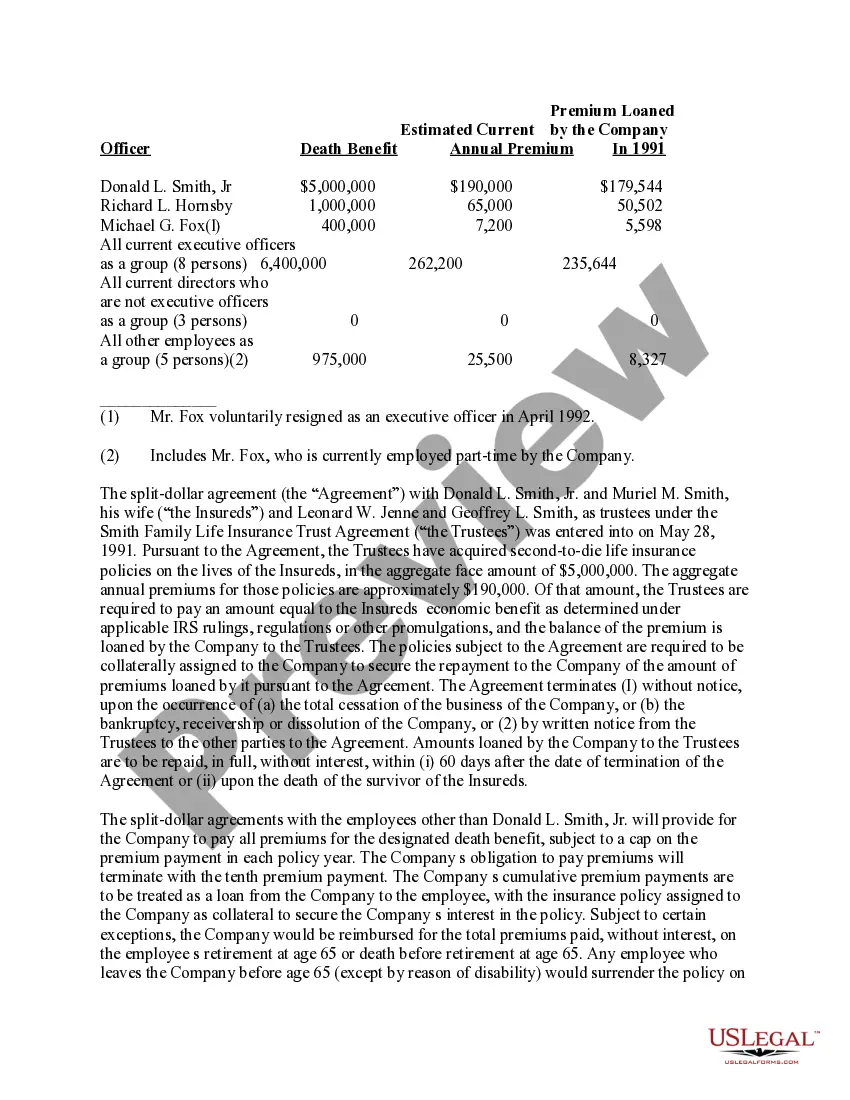

Under a collateral assignment split dollar arrangement, the business loans a key employee money to pay the premium on a life insurance policy.

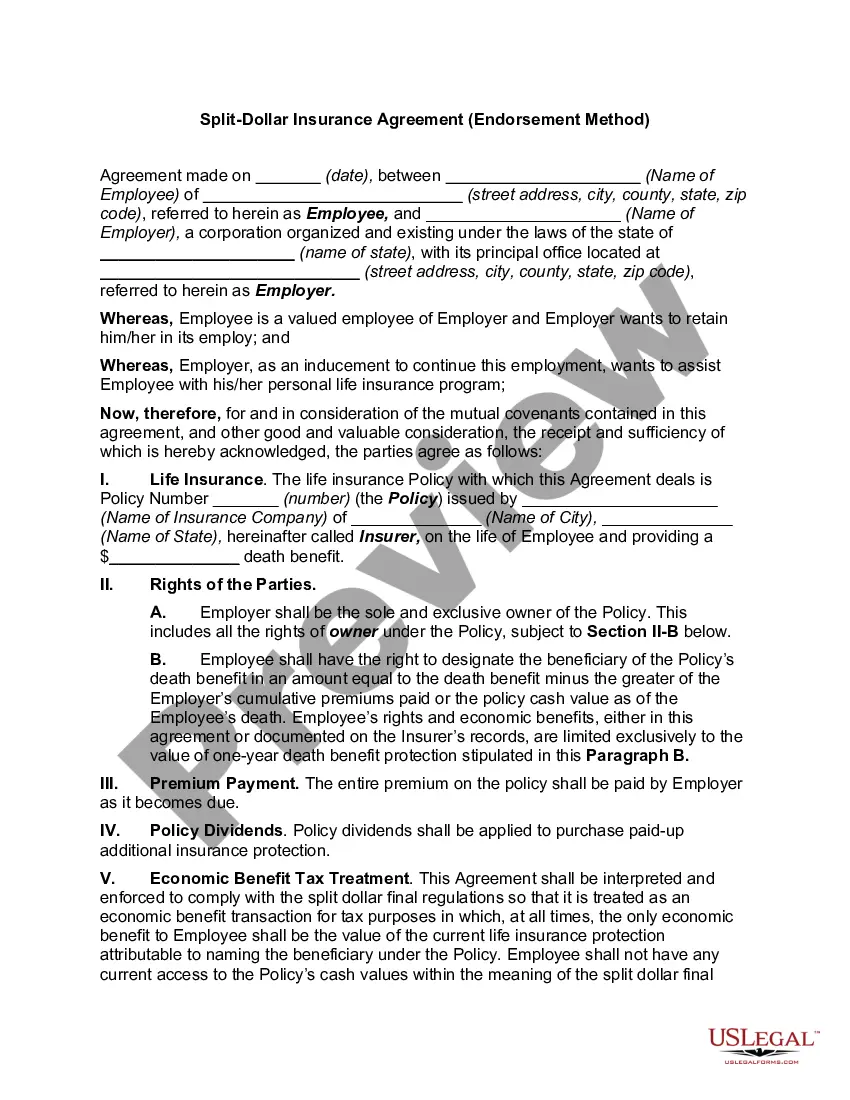

The two most common forms of split-dollar life insurance are economic benefit and loan arrangements.

There is no cost to the employee-participant unless the policy is transferred to them. This endorsement split-dollar plan is most often used to provide a low-cost death benefit to the employee-participant as a fringe benefit or where the employer wishes to own the policy and/or obtain key person protection.

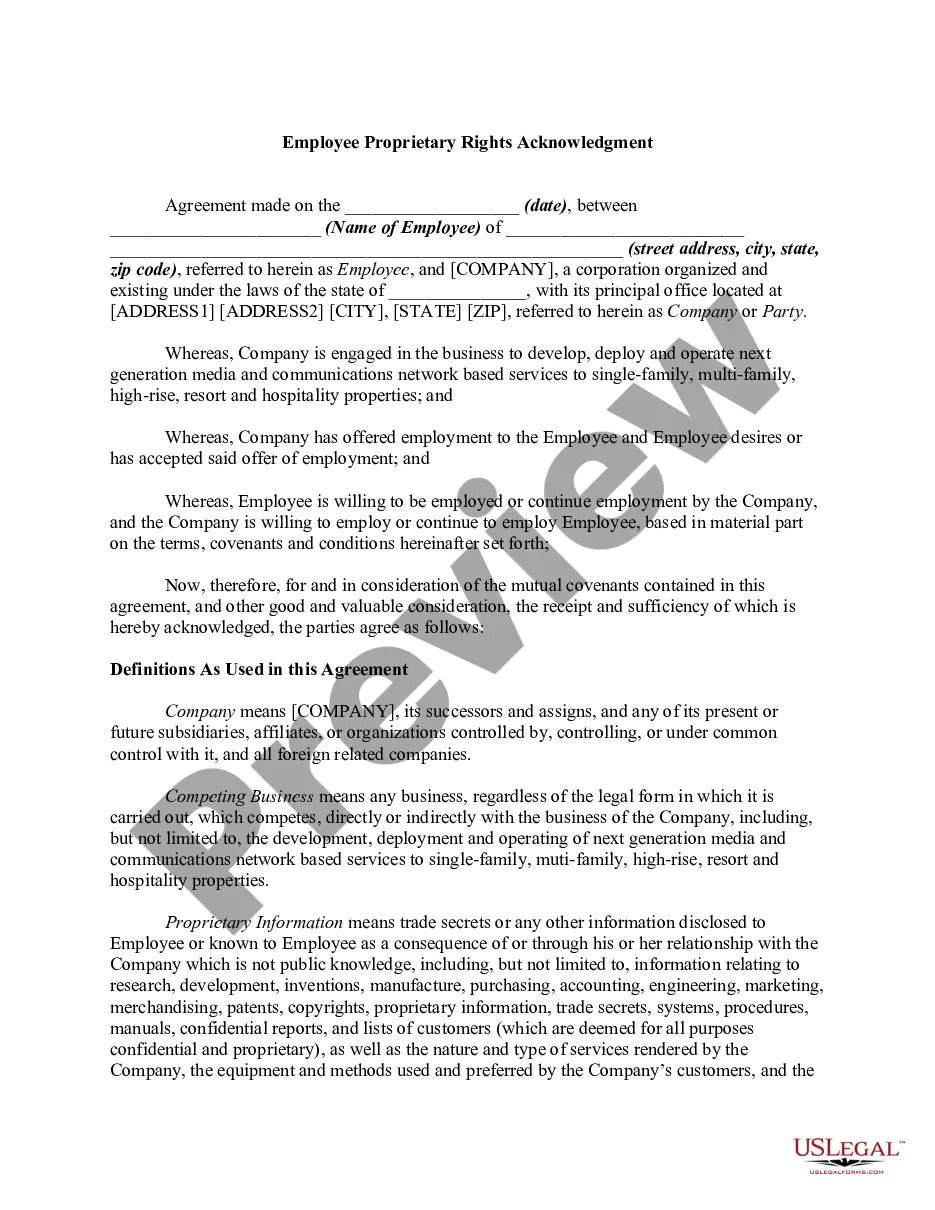

Split-dollar life insurance is an agreement where two parties ? an employer and an employee ? agree to split the benefits, and sometimes the costs, of a life insurance policy. The employer pays the life insurance premium, in whole or in part, on a cash value life insurance policy purchased on the life of the employee.

Reverse Split Dollar is an arrangement in which an employee owns a life insurance policy on her own life and endorses death benefit to her employer. How it works during life.

There are 2 types of split dollar plans. Collateral assignment / loan regime. Endorsement split dollar / economic benefit regime.

Split Dollar Loan Regime Agreement & Contract Generally, at the employee's death, the employer receives a portion of the death benefit (usually equal to the total premiums plus interest from the loan) and the employee's beneficiary receives the balance.

Yes, you can designate multiple beneficiaries when you purchase your life insurance policy. When doing so, you will assign each beneficiary a percentage of the death benefit. For example, you could name your two children as equal beneficiaries with 50% allocated to each.