South Carolina Voluntary Petition - Form 1

Description

How to fill out Voluntary Petition - Form 1?

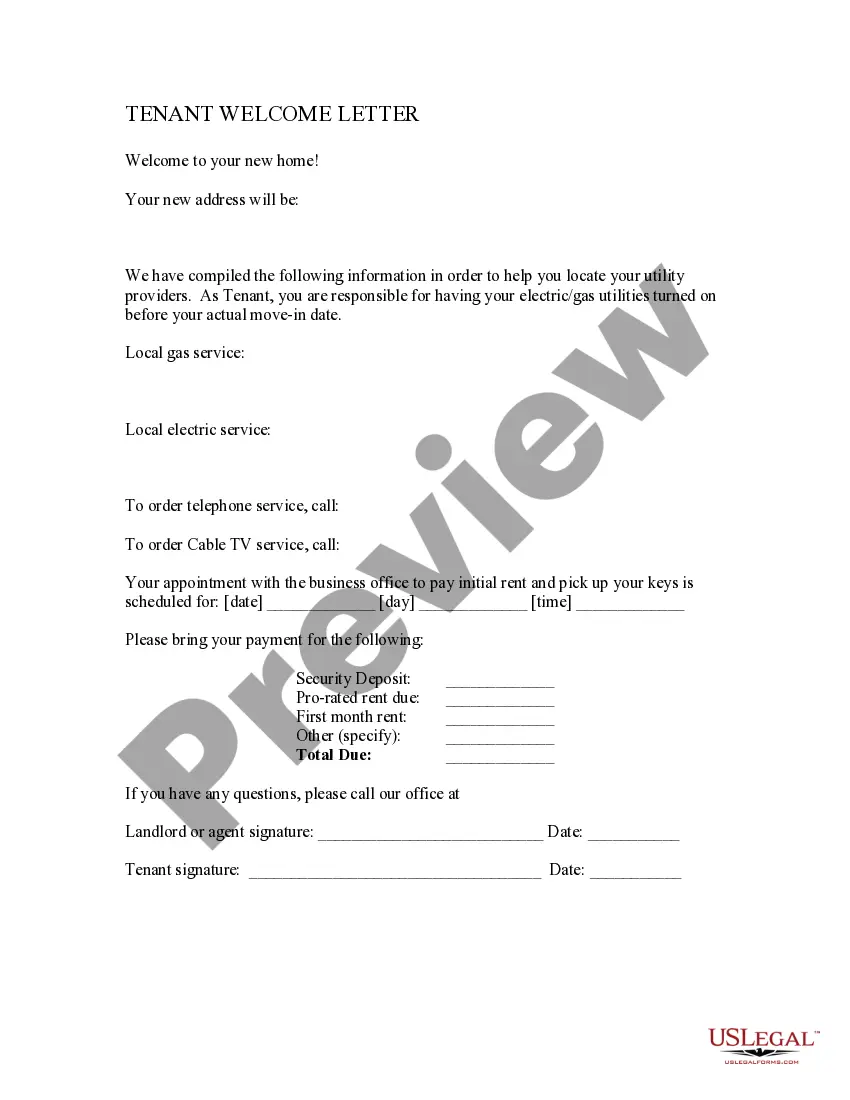

You may devote several hours on the Internet looking for the authorized papers design that suits the state and federal demands you require. US Legal Forms offers a huge number of authorized types that happen to be reviewed by specialists. It is simple to download or print out the South Carolina Voluntary Petition - Form 1 from my service.

If you already possess a US Legal Forms bank account, you can log in and click on the Acquire switch. After that, you can total, edit, print out, or indication the South Carolina Voluntary Petition - Form 1. Every authorized papers design you buy is the one you have eternally. To get another backup of any obtained form, go to the My Forms tab and click on the related switch.

Should you use the US Legal Forms internet site initially, adhere to the straightforward recommendations beneath:

- First, be sure that you have selected the correct papers design for your state/metropolis that you pick. See the form explanation to make sure you have chosen the appropriate form. If available, use the Review switch to look from the papers design at the same time.

- If you wish to discover another version of the form, use the Lookup area to get the design that suits you and demands.

- When you have located the design you would like, click on Get now to move forward.

- Choose the rates plan you would like, key in your qualifications, and register for an account on US Legal Forms.

- Comprehensive the purchase. You should use your credit card or PayPal bank account to purchase the authorized form.

- Choose the structure of the papers and download it in your device.

- Make adjustments in your papers if needed. You may total, edit and indication and print out South Carolina Voluntary Petition - Form 1.

Acquire and print out a huge number of papers layouts utilizing the US Legal Forms Internet site, which provides the biggest variety of authorized types. Use expert and express-specific layouts to tackle your business or specific demands.

Form popularity

FAQ

For the debtor listed above, a case has been filed under chapter 7 of the Bankruptcy Code. An order for relief has been entered. This notice has important information about the case for creditors, debtors, and trustees, including information about the meeting of creditors and deadlines.

Voluntary bankruptcy is a type of bankruptcy where an insolvent debtor brings the petition to a court to declare bankruptcy because they are unable to pay off their debts. Both individuals and businesses are able to use this approach.

A proof of claim is a form used by the creditor to indicate the amount of the debt owed by the debtor on the date of the bankruptcy filing. The creditor must file the form with the clerk of the same bankruptcy court in which the bankruptcy case was filed.

Voluntary Petition for Individuals Filing for Bankruptcy It contains some basic information about you (including your name and address), what type of bankruptcy you're filing, whether your debts are mostly consumer debts, and whether you have any nonexempt assets.

The federal government, as well as 42 states, have a homestead exemption that allows a person filing for bankruptcy to protect a certain amount of equity in a home. The federal exemption, which changes every three years, is $25,150 until April 2022. State exemptions may be higher or lower.

Chapter 7 is a ?liquidation? bankruptcy that doesn't require a repayment plan but does require you to sell some assets to pay creditors. Chapter 11 is a ?reorganization? bankruptcy for businesses that allows them to maintain day-to-day operations while creating a plan to repay creditors.

Chapter 7 is your better bet if you are hopelessly awash in debt from credit cards, medical bills, personal loans, and/or car loans and your income simply cannot keep up. As noted above, you're most likely going to get to keep most of your assets while erasing your unsecured debt.

At the end of the process, most of your debts will be discharged and you will no longer be under any obligation to repay them. However, certain debts, like student loans, child support, and taxes, cannot be discharged.

A social guarantor is a person who offers a guarantee not for profitmaking purposes but for any of the following, namely: Education loan, scholarship, grant for research purposes, Hire-purchase transactions for personal or non-business use and. Housing loan for personal dwelling.

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.