Kentucky Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee

Description

How to fill out Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee?

Are you within a situation the place you require documents for both business or personal purposes virtually every working day? There are tons of authorized document layouts available on the Internet, but finding kinds you can depend on isn`t simple. US Legal Forms offers thousands of develop layouts, just like the Kentucky Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee, which can be written to fulfill state and federal needs.

When you are already informed about US Legal Forms internet site and get a merchant account, just log in. Afterward, you are able to down load the Kentucky Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee template.

If you do not have an bank account and would like to start using US Legal Forms, follow these steps:

- Find the develop you need and make sure it is to the right town/area.

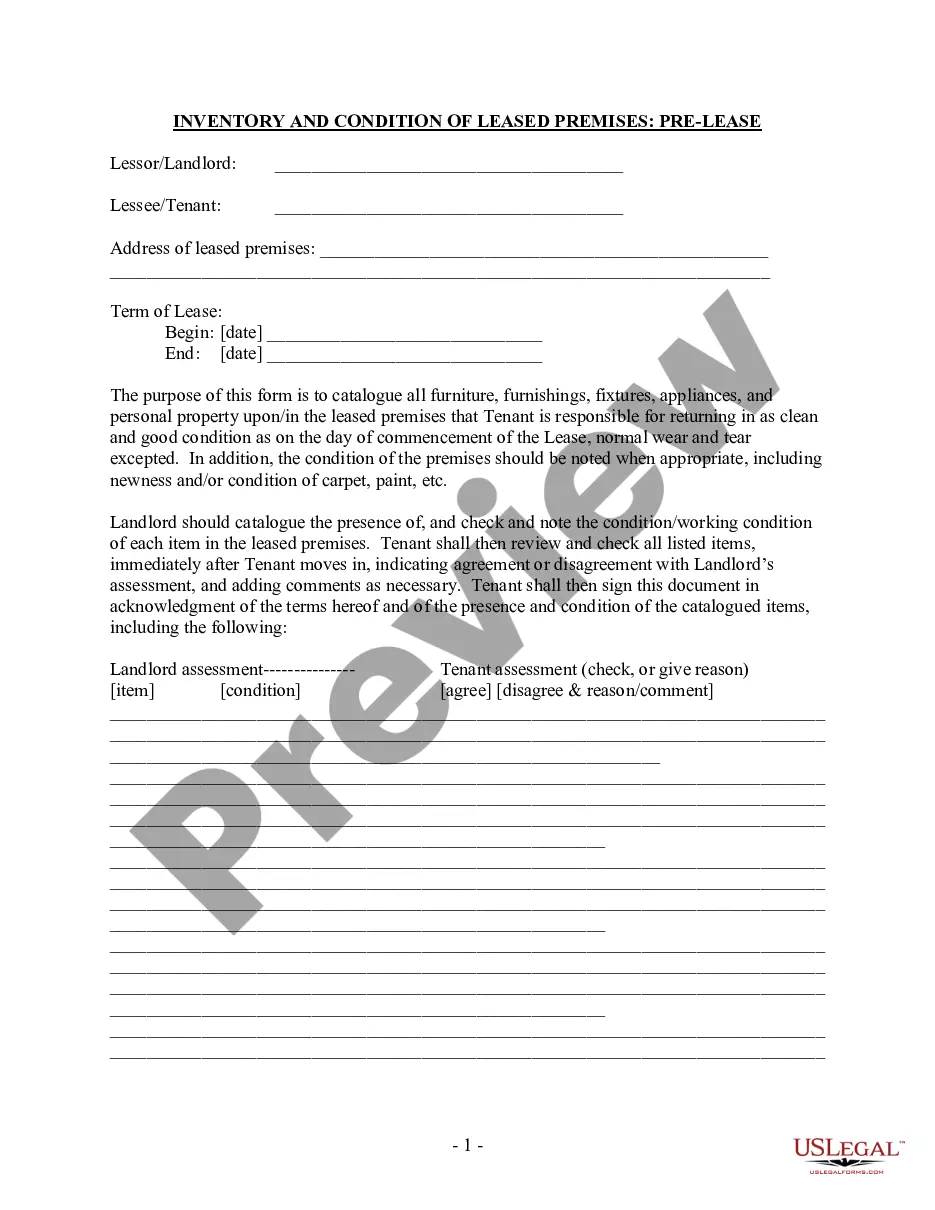

- Use the Preview button to check the shape.

- Read the explanation to ensure that you have chosen the appropriate develop.

- In the event the develop isn`t what you`re searching for, use the Look for area to obtain the develop that meets your needs and needs.

- If you find the right develop, click Buy now.

- Opt for the pricing program you need, submit the necessary details to create your account, and pay for an order with your PayPal or charge card.

- Select a handy document format and down load your version.

Locate every one of the document layouts you may have purchased in the My Forms menus. You may get a more version of Kentucky Jury Instruction - 10.10.1 Reasonable Compensation To Stockholder - Employee at any time, if needed. Just select the required develop to down load or print out the document template.

Use US Legal Forms, one of the most substantial collection of authorized forms, in order to save time as well as avoid faults. The assistance offers expertly manufactured authorized document layouts that you can use for a range of purposes. Produce a merchant account on US Legal Forms and initiate producing your daily life a little easier.