South Carolina Matching Gift Form

Description

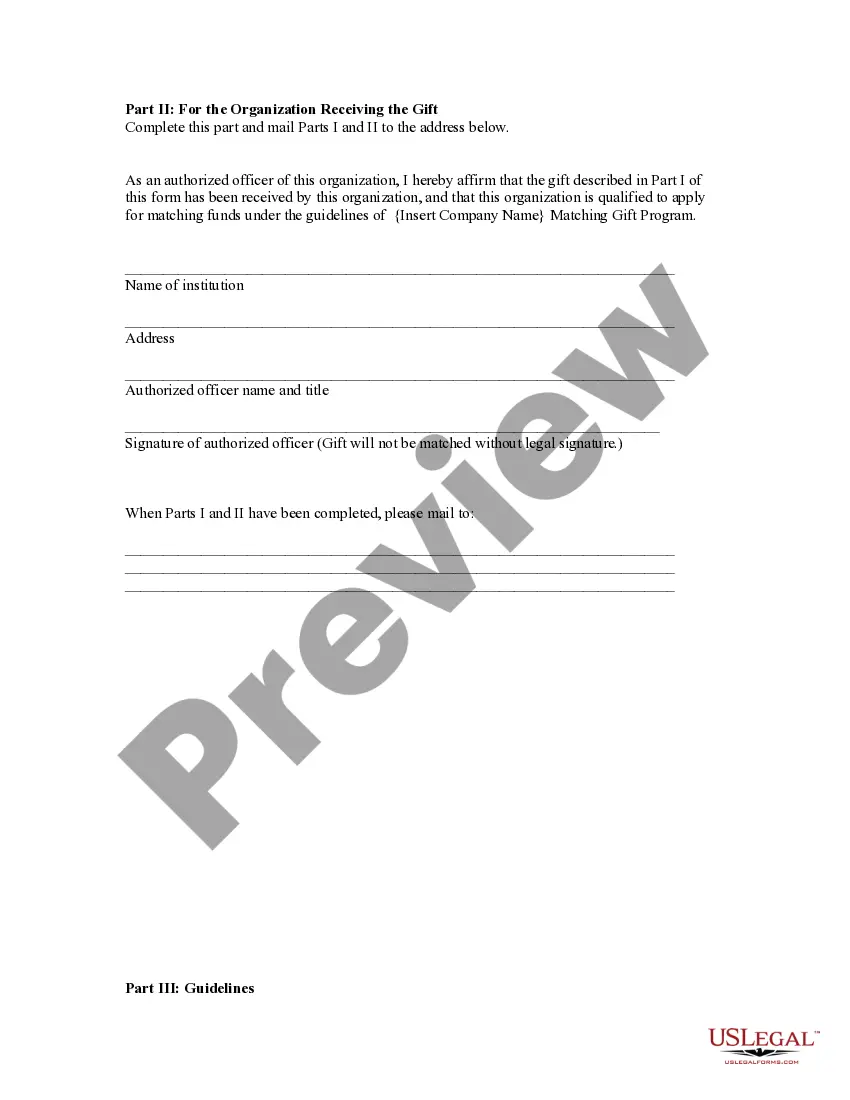

How to fill out Matching Gift Form?

It is feasible to spend hours online searching for the legal document template that fulfills the federal and state requirements you require.

US Legal Forms offers a wide array of legal forms that are reviewed by professionals.

You can download or print the South Carolina Matching Gift Form from our platform.

If available, utilize the Review button to preview the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the South Carolina Matching Gift Form.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of any purchased form, visit the My documents section and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/city.

- Read the form description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Nationwide: Gifts from eligible donors may be designated for a specific use, but the Foundation's matching gifts will be unrestricted for educational purposes.

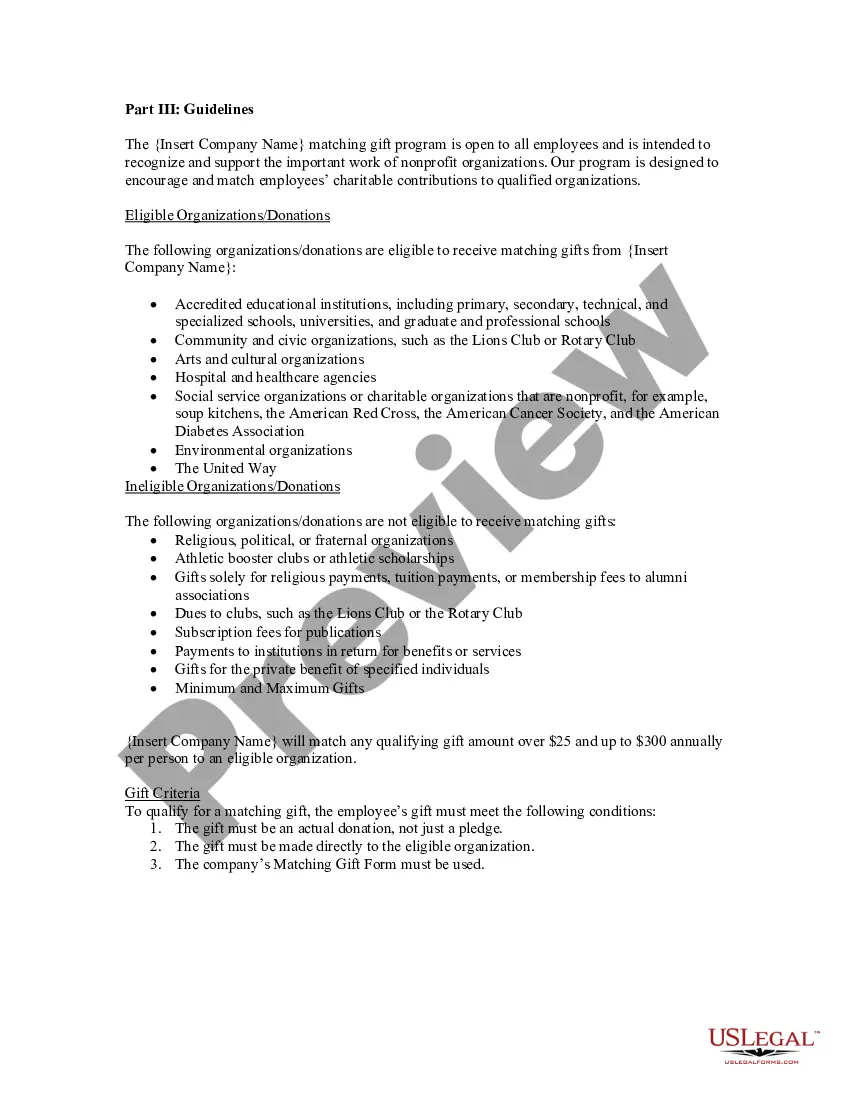

Matching gifts are a type of giving program that is set up by companies and corporations as an employee benefit. After an employee donates to a nonprofit, they can submit a matching gift request to their employer and the company will make an additional donation to that nonprofit.

Matching gift campaigns are a popular fundraising strategy used by charities to incentivize public donations with donations offered by one or more match donors. Types of Campaigns. The core of a matching gift campaign is that a match donor offers to make a donation in connection with donations made by the public.

Gifts to individuals are not tax-deductible. Tax-deductible gifts only apply to contributions you make to qualified organizations. Depending on how much money you are gifting to your adult child, you may have to pay a federal gift tax.

A challenge campaign is just what it sounds like: A 'challenge' is given to donors to raise a certain amount of money by a certain amount of time. If the challenge is complete, there is typically a matching donor(s) that will then match the gifts raised either dollar for dollar or at a certain percentage point.

Best Practices for Leveraging Matching Gift UpsellsProvide access to matching gift program data. One of the best ways to encourage matching gift upsells is by sharing company-specific matching gift details with donors.Incorporate suggested donation sizes.Look for software that automates the upsell process.

Question #3: How is the matching gift process structured?Make a donation to a nonprofit.See if either your employer or your spouse's employer has matching gift programs.Find the correct paperwork or the URL to submit a matching gift from the company and submit any necessary items.

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. When an employee makes a donation, they'll request the matching gift from their employer, who then makes their own donation.

You can only claim a tax deduction for gifts or donations to organisations that have the status of deductible gift recipients (DGRs). The person that makes the gift (the donor) is the person that can claim a deduction.

Since a matching gift is technically a donation, companies can deduct the matches they make from their reported income. Decreasing reported income means a company will not have to pay taxes on the donated money.