South Carolina Vehicle Policy

Description

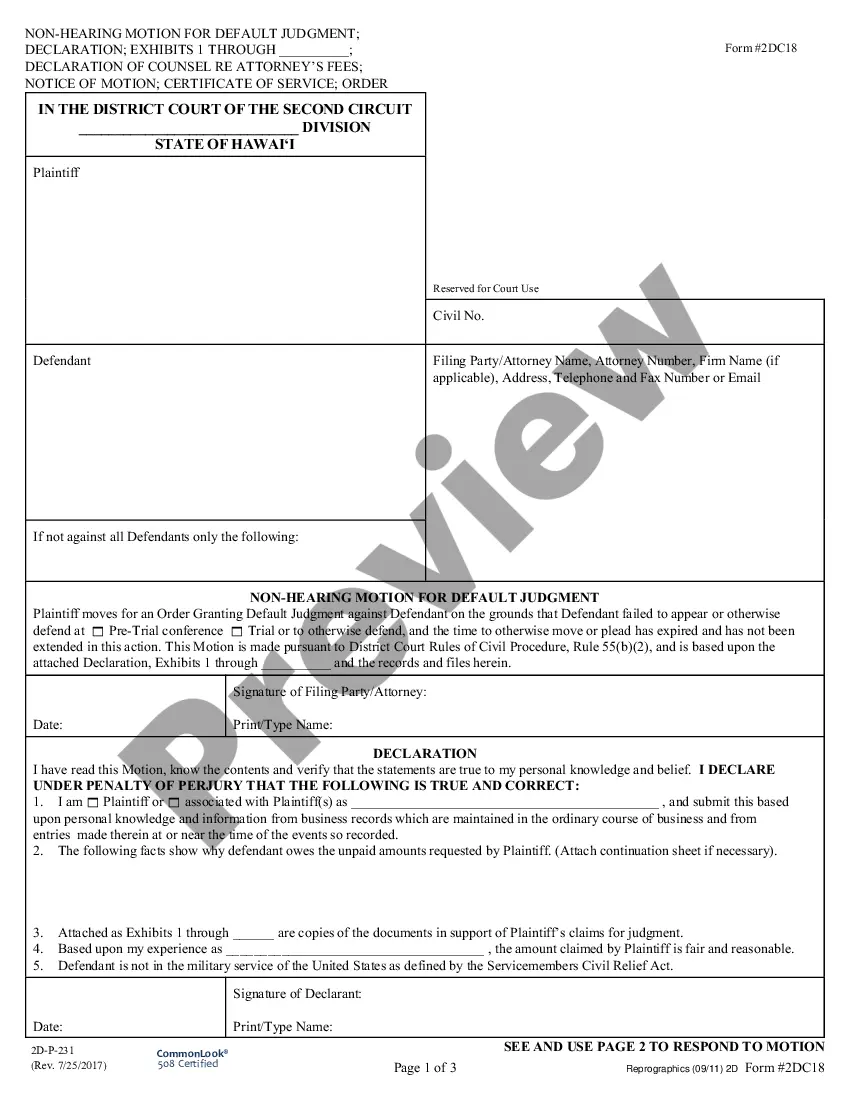

How to fill out Vehicle Policy?

If you need to thorough, obtain, or print legitimate document templates, utilize US Legal Forms, the largest array of legal forms that are accessible online.

Employ the site's straightforward and user-friendly search to locate the documents you need.

A selection of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Download now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the purchase.

- Use US Legal Forms to find the South Carolina Vehicle Policy in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the South Carolina Vehicle Policy.

- You can also retrieve forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for your correct city/state.

- Step 2. Utilize the Review function to examine the form's content. Do not forget to read the details.

- Step 3. If you are not happy with the template, use the Search field at the top of the page to find other variations of the legal form template.

Form popularity

FAQ

Compared to national averages, South Carolina is just a bit cheaper at $1,512 per year for full coverage and $558 per year for minimum coverage. However, the cost of your car insurance will typically vary based on rate factors like your motor vehicle record, age or ZIP code, among other variables.

For example, collision coverage (optional in South Carolina, though might be required under the terms of a vehicle lease or financing agreement) can pay for repairs to (or replacement of) your damaged vehicle after a car accident.

While different states mandate different types of insurance and there are several additional options (such as gap insurance) available, most basic auto policies consist of: bodily injury liability, personal injury protection, property damage liability, collision, comprehensive and uninsured/underinsured motorist.

Minimum Bodily Injury Liability Limits$15,000 for the death or injury of any one person. If one person is injured in the accident, your coverage pays up to $15,000. A total of $30,000 for the death or injury of more than one person in any one accident. If 2 or more people are injured, the coverage pays up to $30,000.

Full coverage insurance in South Carolina is usually defined as a policy that provides more than the state's minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage.

Minimum SC Car Insurance Coverage RequirementsProperty damage: $25,000 per accident. Bodily injury: $25,000 per person and $50,000 per accident. Uninsured motorist bodily injury: $25,000 per person and $50,000 per accident.

Unlike so-called no-fault states, South Carolina uses a fault-based system for dealing with car accidents, meaning the at-fault driver themselves can be held legally liable for any costs you incur.

South Carolina law requires that you purchase liability and uninsured motorist coverage to drive legally in the state. Auto insurance is divided into two basic coverages: liability and physical damage.

No, South Carolina does not have the no-fault law in effect. Instead, it follows an at fault model with comparative negligence. This means that so long as you are under 50% responsible for your accident, you can file a claim against the driver that caused your accident.

Report the accident to the police. In South Carolina, you must report the accident to the police if a crash results in injury or death. With that said, even if the vehicle damage and/or injuries appear to be minor, you should still call the police. Doing so will create a record.