South Carolina Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager

Description

How to fill out Resolution Of Meeting Of LLC Members To Accept Resignation Of Manager Of The Company And Appoint A New Manager?

If you require thorough, download, or printing lawful document templates, utilize US Legal Forms, the largest collection of lawful forms, which can be accessed online.

Take advantage of the site`s user-friendly and convenient search to find the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to locate the South Carolina Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager in just a few clicks.

Every legal document template you purchase is yours indefinitely.

You may access every form you downloaded within your account. Click the My documents section and choose a form to print or download again. Stay competitive and download, and print the South Carolina Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager with US Legal Forms. There are millions of professional and state-specific templates you can utilize for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to receive the South Carolina Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/country.

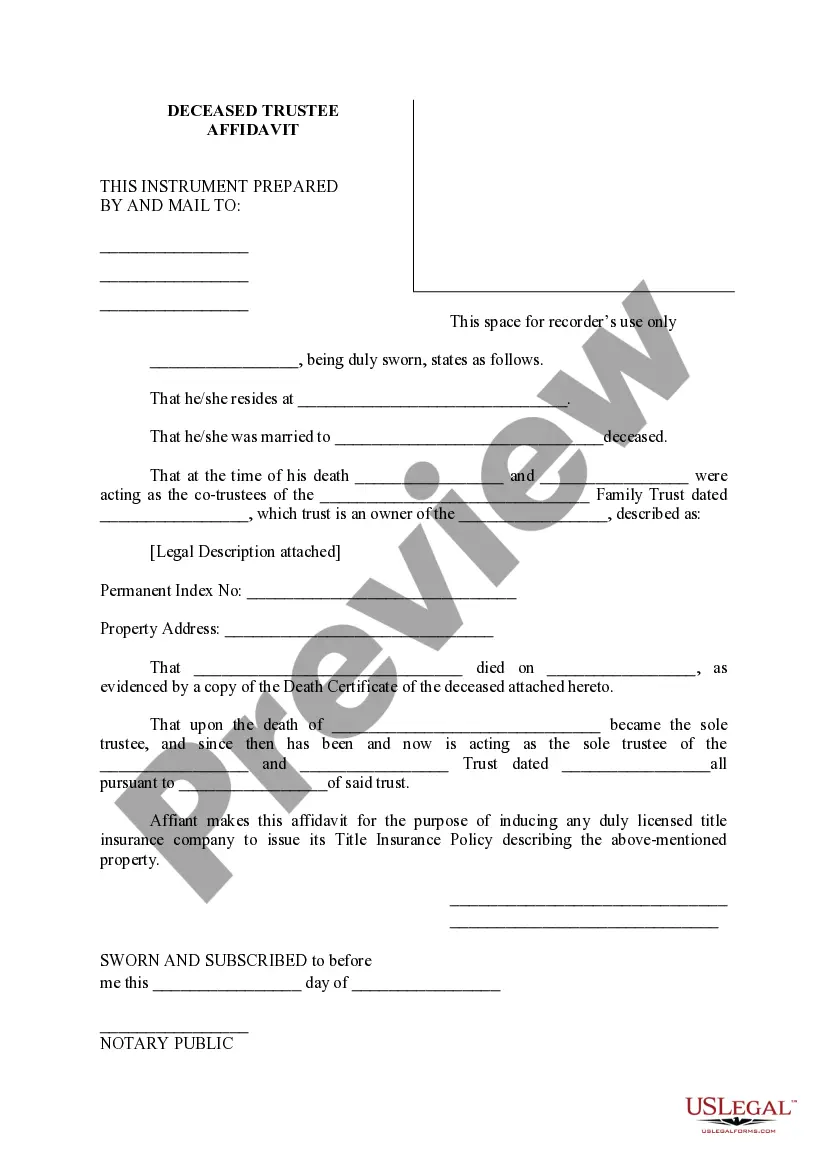

- Step 2. Use the Preview option to review the form’s content. Don’t forget to check the details.

- Step 3. If you are unhappy with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for the account.

- Step 5. Process the transaction. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the South Carolina Resolution of Meeting of LLC Members to Accept Resignation of Manager of the Company and Appoint a New Manager.

Form popularity

FAQ

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

An LLC Corporate Resolution Form is a document that describes the management and decision-making processes of the LLC. While LLCs are generally not required to draft a resolution form, it is highly beneficial and important for all businesses to draft corporate resolutions.

Notwithstanding any restriction upon the right of a member to withdraw, resign, or retire, a member may withdraw from a limited liability company at any time by giving written notice to the other members.

To dissolve an LLC in South Carolina, you are required to submit a complete Article of Dissolution to the Secretary of State. Before submitting the Article of Dissolution, one must follow the operating agreement. If you have an LLC in SC (domestic or foreign) you must have an operating agreement.

South Carolina requires business owners to submit their Articles of Termination by mail. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

The only way a member of an LLC may be removed is by submitting a written notice of withdrawal unless the articles of organization or the operating agreement for the LLC in question details a procedure for members to vote out others. The steps to follow are: Determine the procedure for withdrawing members.

If the operating agreement states it as a possibility, you may be able to sell your member shares. Typically, you must offer them to the remaining members for the right of first refusal before offering them outside of the LLC membership. Generally, all members must agree you may sell your shares.