South Carolina Fundraising Activity Approval Form

Description

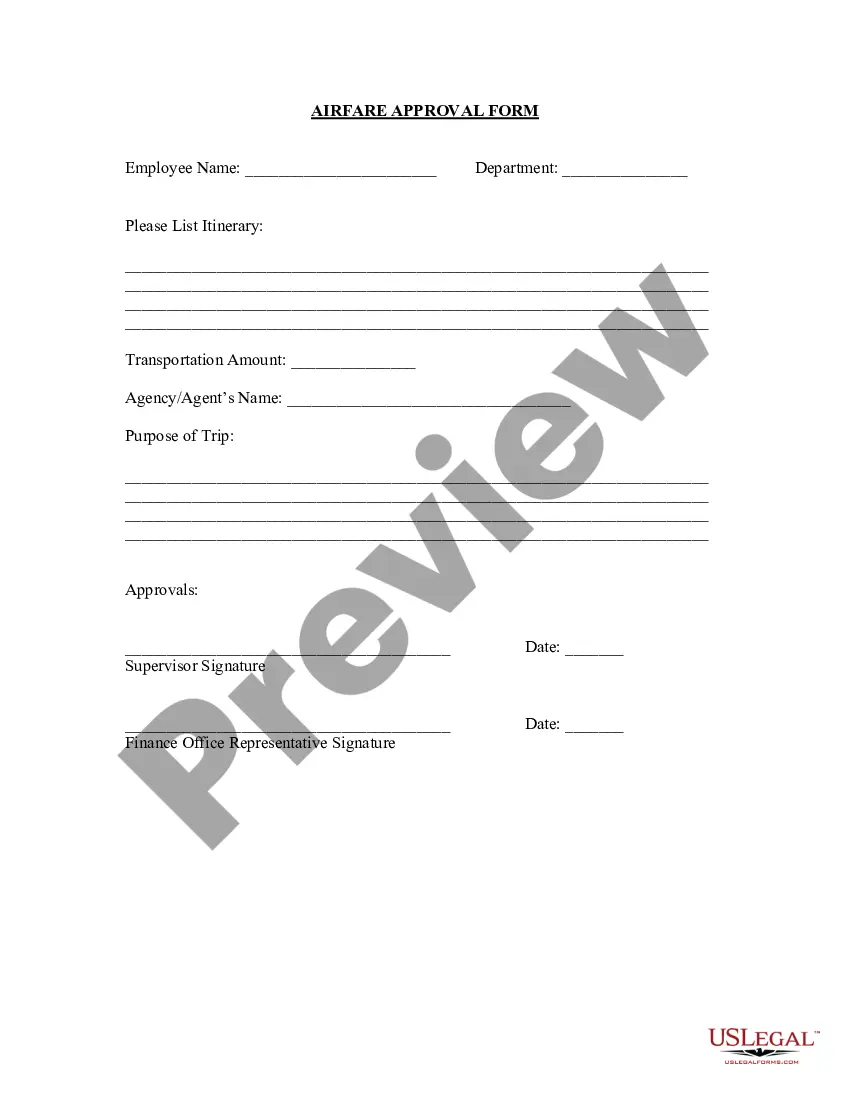

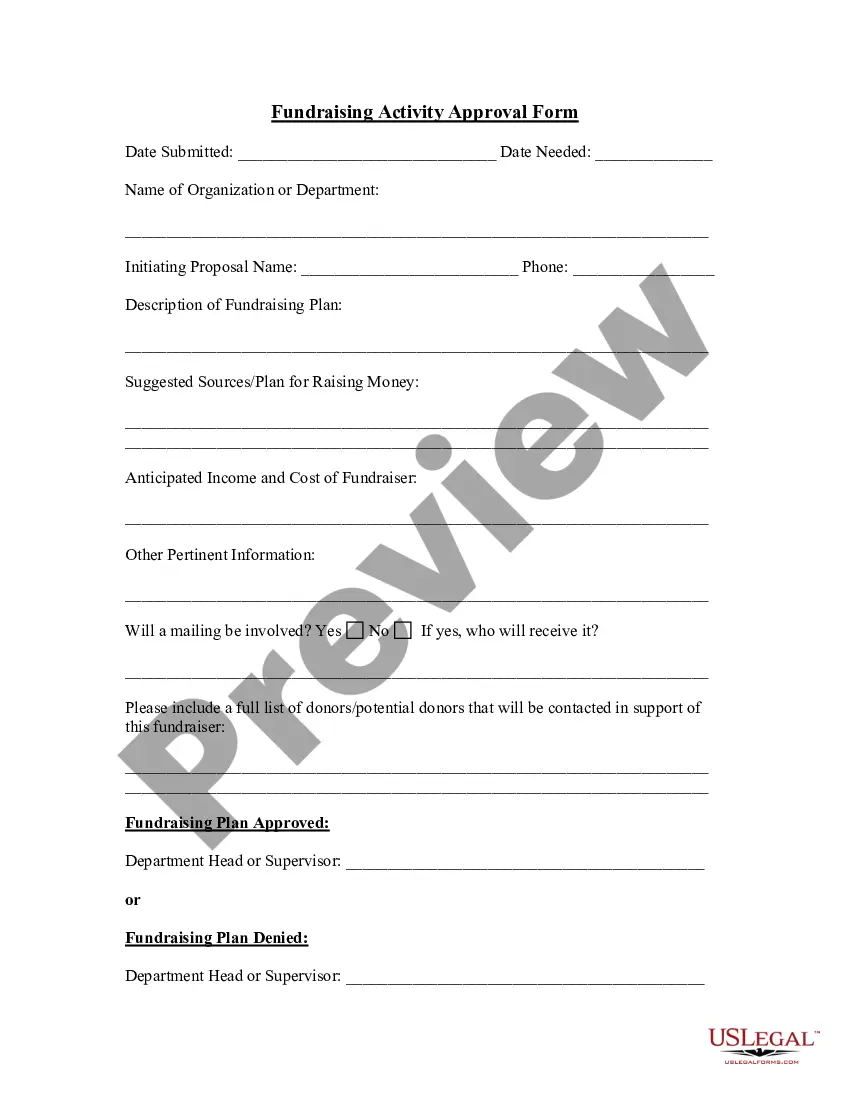

How to fill out Fundraising Activity Approval Form?

US Legal Forms - one of the most important collections of legal documents in the United States - provides a variety of legal form templates that you can obtain or print. By utilizing the website, you can access numerous forms for corporate and personal use, organized by categories, states, or keywords.

You can find the most recent types of forms, such as the South Carolina Fundraising Activity Approval Form, within minutes.

If you have a subscription, Log In and obtain the South Carolina Fundraising Activity Approval Form from the US Legal Forms collection. The Download button will appear on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Make changes. Complete, modify, and print/sign the downloaded South Carolina Fundraising Activity Approval Form.

Every template you added to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- If you wish to use US Legal Forms for the first time, here are some simple steps to help you begin.

- Ensure you have selected the appropriate form for your city/state. Click the Preview button to review the content of the form. Read the form description to confirm you have chosen the right one.

- If the form doesn't meet your needs, utilize the Search feature at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Then, select the pricing plan you wish and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

- Choose the format and download the form to your device.

Form popularity

FAQ

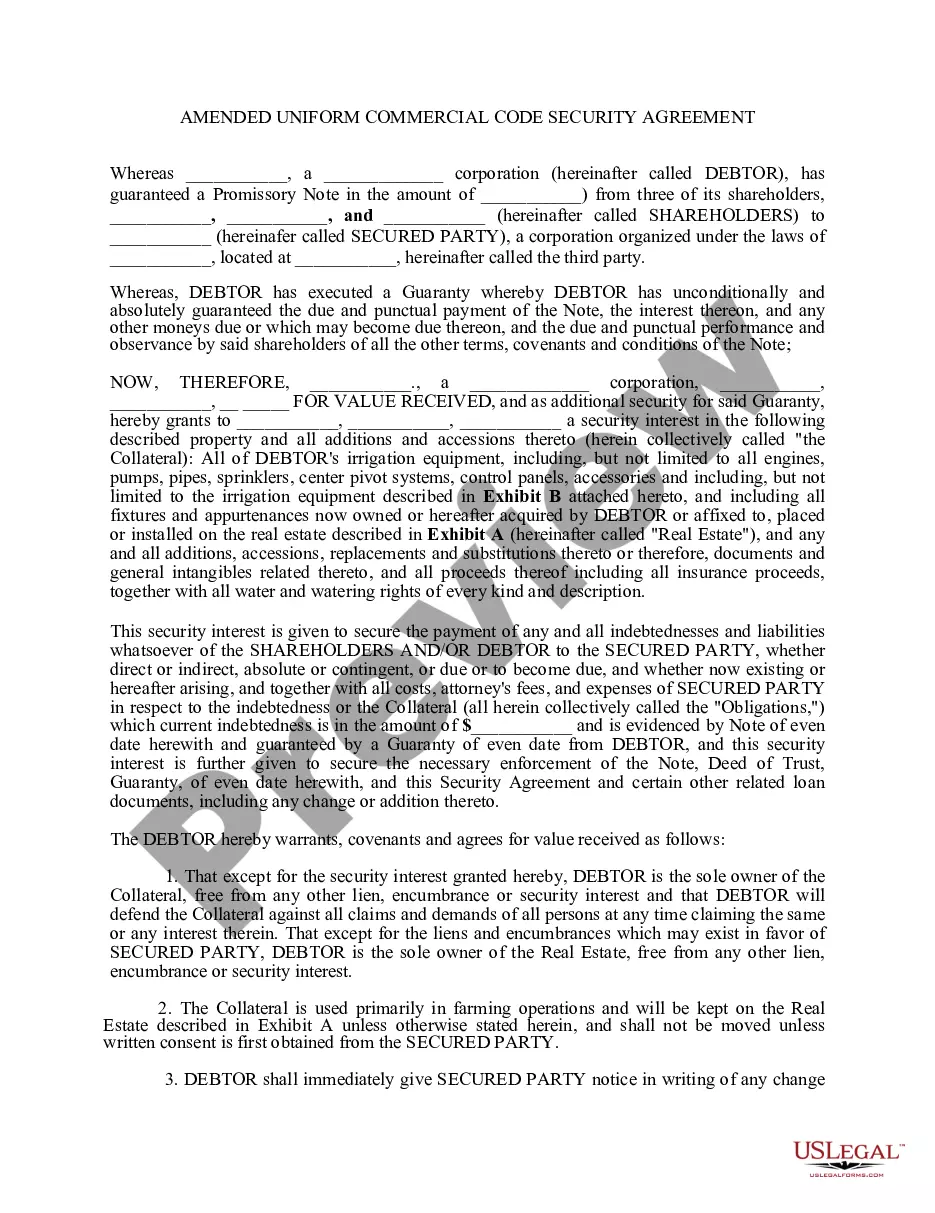

Doing business refers to the process of carrying on the normal activities of a business in another state on a regular basis or with substantial contacts not just an occasional shipment. If this is the case for your company, then you may need to foreign qualify within that state.

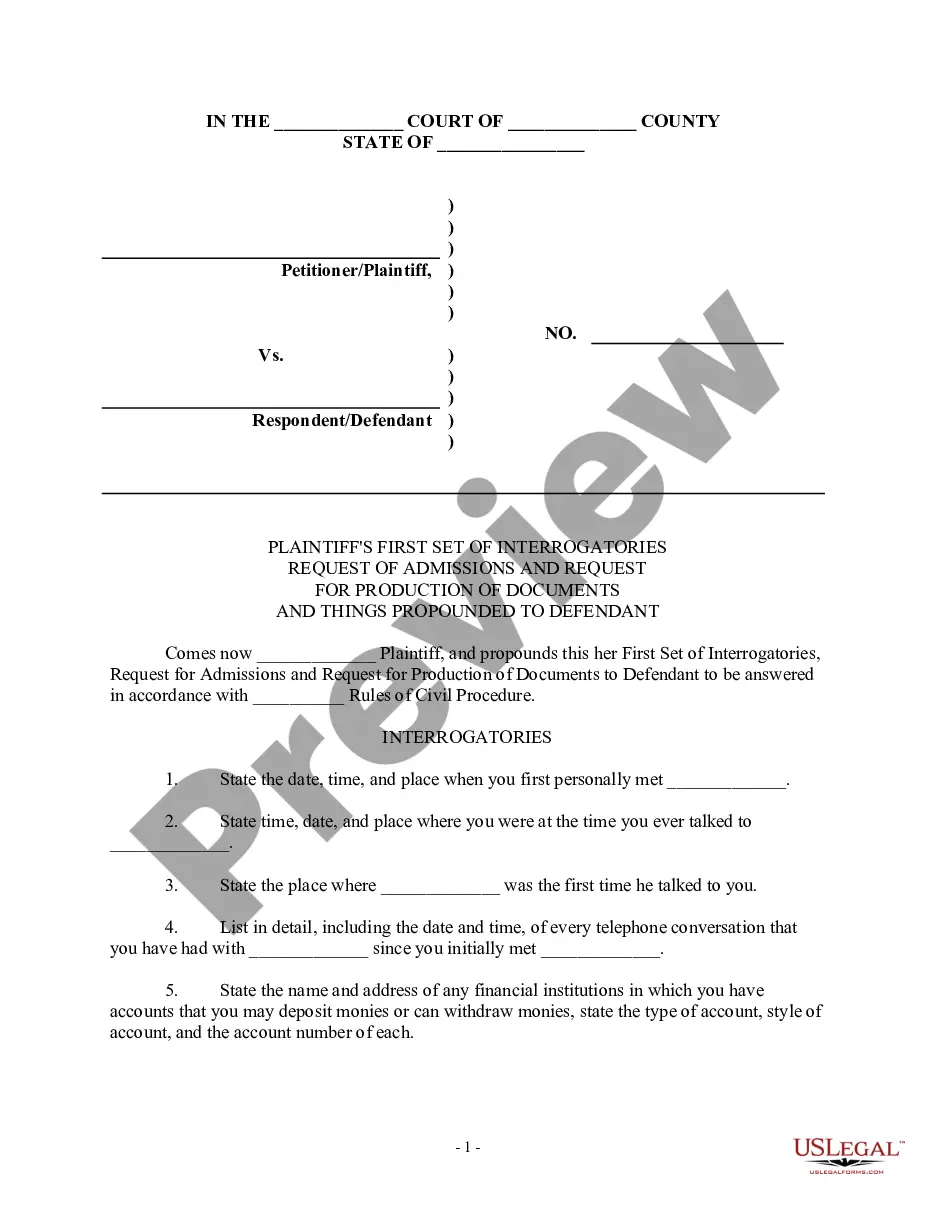

Most states regulate fundraising to protect the public, corporations and any potential donors from fraudulent solicitation. Many charitable organizations must register with the state, and individual fundraising professionals must hold a license before they may fundraise.

DBA stands for doing business as, and states like South Carolina allow some businesses to operate under a DBA or different name. You may also hear DBAs referred to as: South Carolina Assumed Business Name. South Carolina Alternate Name. South Carolina Business Name.

A 501(c)(3) eligible nonprofit board of directors in South Carolina MUST: Have at least three board members that are not related to each other. Elect the following members: president, treasurer, and secretary.

It must not engage in misleading or deceptive conduct or unconscionable conduct; and. if its fundraising activities also involve supplying goods or services, it must not make false or misleading representations or engage in unconscionable conduct in relation to the supply of those goods or services.

Generally, if you plan to do business in the state of South Carolina and are incorporated elsewhere, you will need to obtain South Carolina Foreign Qualification. Doing business is typically defined by activities such as maintaining a physical office or having employees in the state.

There are no restrictions on what projects, life events, or causes you can fundraise for. As long as you can create a page and ask people to donate, the possibilities are endless! If you want direction on where to get started, we've got a list of 18 personal fundraising causes.

What is the Unified Registration Statement? The Unified Registration Statement (URS) represents an effort to consolidate the information and data requirements of all states that require registration of nonprofit organizations performing charitable solicitations within their jurisdictions.

Since there is no definition of doing business, each business is evaluated on a case-by-case basis. However, in general, you will need to form a foreign LLC in South Carolina if your business pursues any of the following activities: Having a commercial domicile in the state.

Generally speaking, South Carolina does not require the registration of a DBA.