Missouri Purchasing Cost Estimate

Description

How to fill out Purchasing Cost Estimate?

Locating the appropriate authorized document format may be challenging.

Certainly, numerous templates are available online, but how can you acquire the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Missouri Purchasing Cost Estimate, which you can use for business and personal purposes.

If the form does not meet your needs, use the Search area to find the appropriate form.

- All forms are reviewed by experts and meet federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Missouri Purchasing Cost Estimate.

- Use your account to view the legal forms you have obtained previously.

- Visit the My documents section of your account to retrieve an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

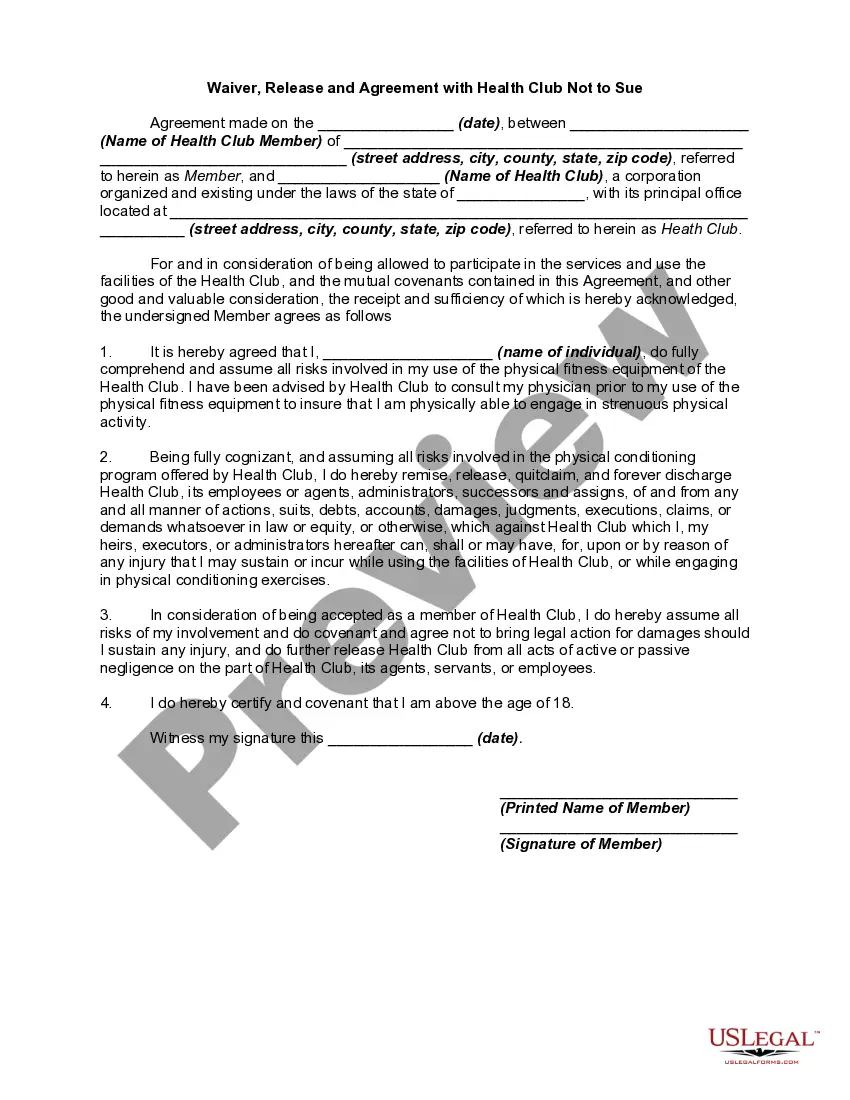

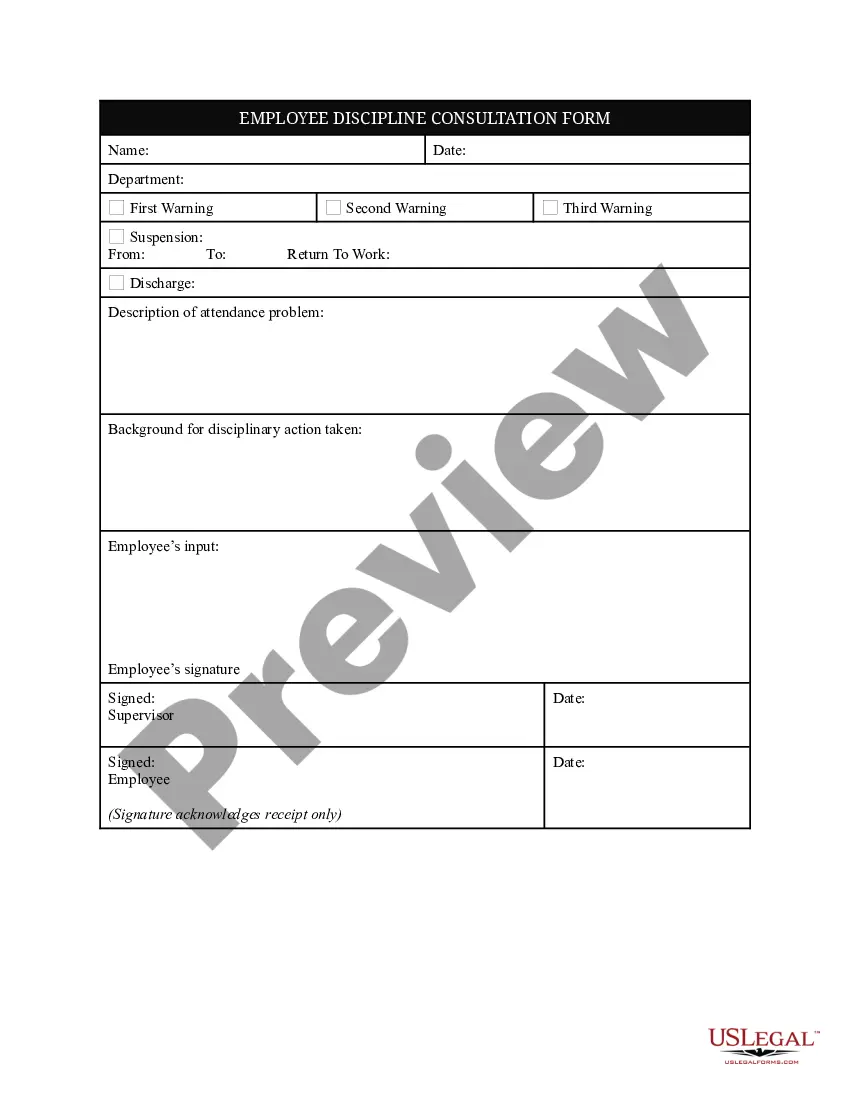

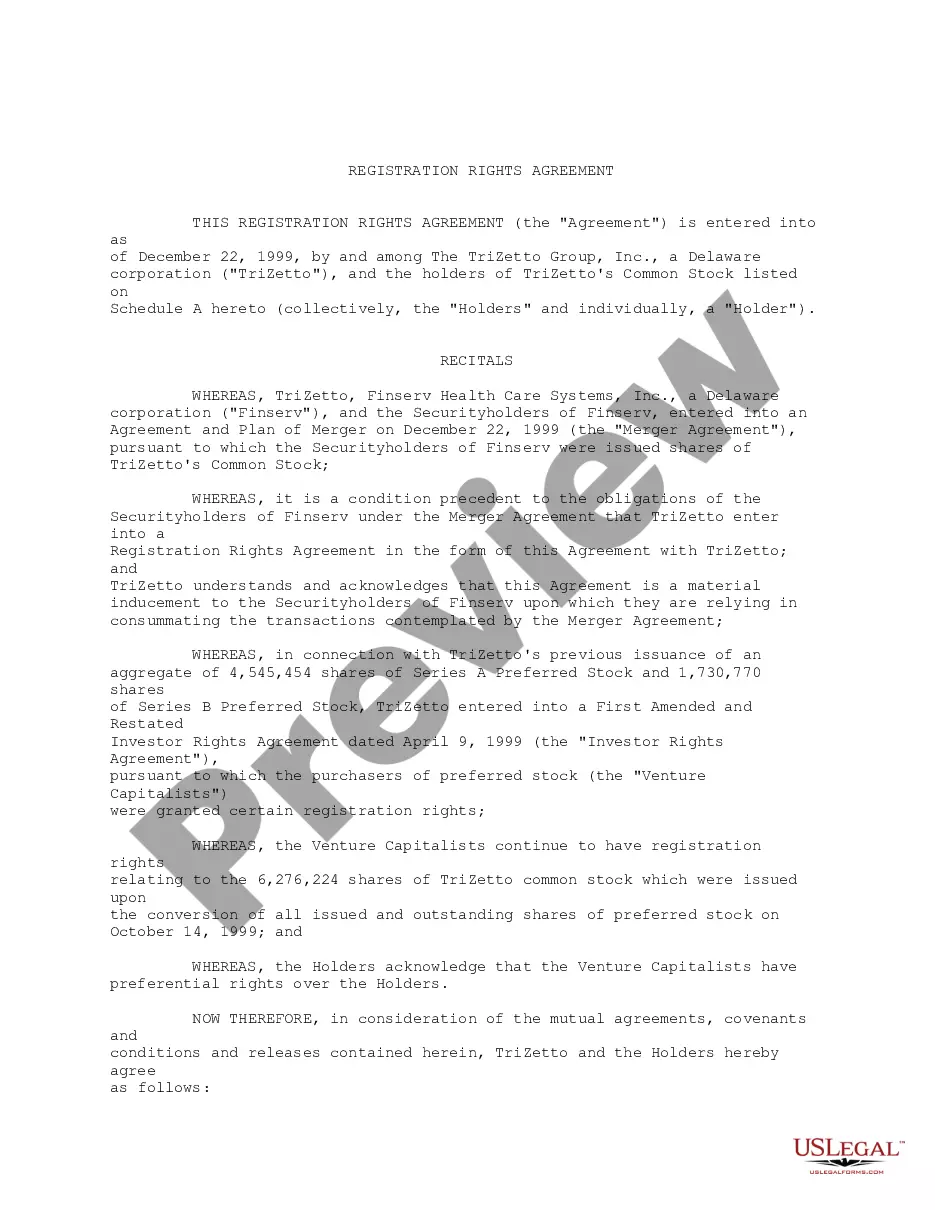

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview button and read the form details to confirm it is suitable for you.

Form popularity

FAQ

Filing the MO 941 form involves gathering all necessary payroll information for the reporting period. You will need to ensure that your employee wage details and tax withholdings are accurate. After completing the form, you can file it electronically through the Missouri Department of Revenue website or by mail. Using a Missouri Purchasing Cost Estimate can guide you in determining the expected amounts to report, making the filing process smoother.

Yes, Missouri does have a system for estimated tax payments, which applies to both individuals and businesses that expect to owe a certain amount in state taxes. This system allows taxpayers to spread their taxation over the year. A Missouri Purchasing Cost Estimate can help you assess whether you need to make these payments based on your projected income and tax liability.

To make estimated tax payments to Missouri, you can use the Missouri Department of Revenue’s online portal for convenience. Payments can be made electronically, or you can send checks by mail. Consider incorporating the Missouri Purchasing Cost Estimate to determine the amount needed for each payment period, ensuring you stay on track and avoid penalties.

Yes, trusts in Missouri are required to make estimated tax payments under certain conditions. This applies primarily to trusts that have taxable income exceeding the threshold set by the state. Utilizing a Missouri Purchasing Cost Estimate can assist trustees in determining the required estimated payments needed to avoid penalties and ensure compliance with Missouri tax laws.

The new tax law in Missouri includes updates aimed at simplifying the tax filing process and adjusting tax rates for various income brackets. These changes may impact your overall tax obligations and the Missouri Purchasing Cost Estimate you'll need to calculate. To stay compliant, make sure you review these updates and consult with tax professionals if needed to navigate your personal or business tax situation effectively.

Yes, Missouri does require Pass-Through Entities (PTE) to make estimated tax payments when certain taxable income levels are reached. These payments help ensure compliance with state tax obligations throughout the year. Utilizing a Missouri Purchasing Cost Estimate can clarify your tax liabilities as a PTE and guide you on how to calculate the proper payment amounts.

Yes, Missouri requires estimated tax payments for individuals and businesses whose tax liability meets certain thresholds. These payments help taxpayers break their total tax burden into manageable portions throughout the year. If you’re unsure about your estimated tax status, consider using a Missouri Purchasing Cost Estimate to calculate your potential tax liability more accurately. This proactive approach can assist you in avoiding underpayment penalties.

To fill out a 53/1 form in Missouri, begin by gathering your financial information relevant to the form. This includes your identification details and the Missouri Purchasing Cost Estimate. Next, carefully complete each section of the form, ensuring accuracy in your figures. Finally, review the completed form for errors before submission, making sure you meet all deadlines to avoid penalties.

In Missouri, the sales tax on a $30,000 car typically amounts to around $1,800, based on the average state tax rate of 6%. However, local taxes may also apply, potentially increasing this figure. To get a precise Missouri purchasing cost estimate, you should consider both state and local tax rates where you live. For personalized guidance, consider using resources like USLegalForms to navigate your purchasing needs.

Economic nexus in Missouri refers to a business's obligation to collect sales tax based on its activity within the state, rather than physical presence. This concept has become increasingly important for online sales and services. Understanding economic nexus can influence your Missouri Purchasing Cost Estimate, particularly if you're evaluating business investments or transactions.