Missouri Job Expense Record

Description

How to fill out Job Expense Record?

In case you need to extensive, retrieve, or print legal document templates, utilize US Legal Forms, the premier collection of legal documents, available on the internet.

Utilize the site’s straightforward and user-friendly search to locate the documents you seek.

Various templates for business and personal purposes are categorized by groups and states, or by keywords.

Every legal document template you purchase is yours forever. You will have access to every document you've downloaded in your account. Click the My documents section and choose a document to print or download again.

Be proactive and download, and print the Missouri Job Expense Record with US Legal Forms. There are numerous professional and state-specific templates available for your business or personal needs.

- Employ US Legal Forms to find the Missouri Job Expense Record in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Missouri Job Expense Record.

- You can also access documents you previously downloaded via the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these instructions.

- Step 1. Ensure you have selected the form for the correct city/state.

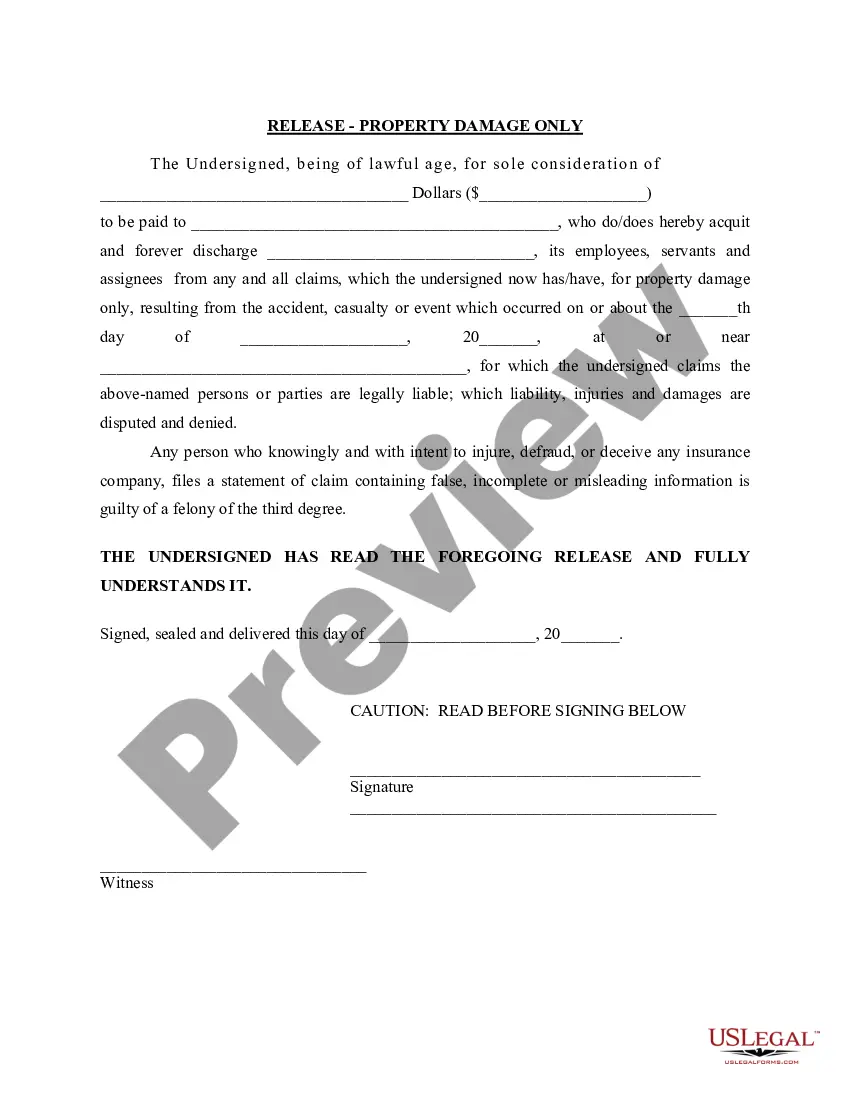

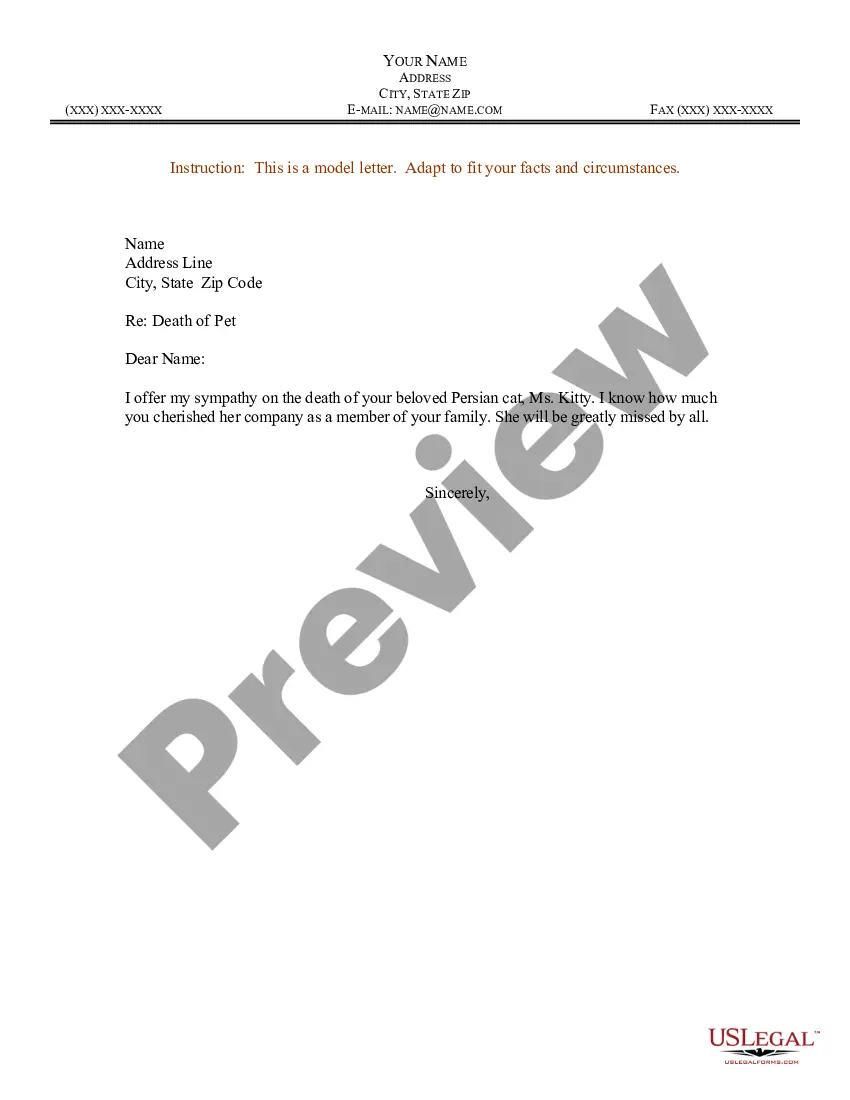

- Step 2. Utilize the Preview option to review the content of the form. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the document, use the Search box at the top of the screen to find additional templates of your legal document type.

- Step 4. Once you find the form you need, click the Get now button. Choose your preferred pricing plan and input your information to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it onto your device.

- Step 7. Complete, modify and print or sign the Missouri Job Expense Record.

Form popularity

FAQ

Remote work performed for a Missouri employer from a different state can complicate tax situations. However, generally, if you are considered a Missouri employee, your income remains taxable in Missouri regardless of your physical location. Consider maintaining a detailed Missouri Job Expense Record for any potential deductions related to your work environment and expenses incurred. For specific advice, consult a tax professional.

Complete Forms MO-1040 and MO-A, pages 1 and 2, using corrected figures. Attach all schedules along with a copy of your federal changes and your Federal Form 1040X. If you are due a refund, mail to: Department of Revenue, P.O. Box 500, Jefferson City, MO 65106-0500.

Yes, you'll need to attach a copy of your Federal Tax Return with your Missouri Tax Return.

Businesses filing a composite return on behalf of their nonresident partners or shareholders should use Form MO-1040. Attach a schedule listing the name, address, identification number, and amount of each nonresident partner or shareholder's income from Missouri sources to Form MO-1040.

MO-1040 Fillable Calculating Document. Individual Income Tax Return - Fillable and Calculating Form (NOTE: For optimal functionality, save the form to your computer BEFORE completing or printing and utilize Adobe Reader.) 2019. 5/3/2021. MO-1040 Fillable Calculating Document.

What documents do I need to file my taxes?Social Security documents.Income statements such as W-2s and MISC-1099s.Tax forms that report other types of income, such as Schedule K-1 for trusts, partnership and S corporations.Tax deduction records.Expense receipts.

This is your Missouri resident credit. Enter the amount on Form MO-1040, Line 29Y and 29S. (If you have multiple credits, add the amounts on Line 11 from each MO-CR). Your total credit cannot exceed the tax paid or the percent of tax due to Missouri on that part of your income. Information to complete Form MO-CR.

Only the credits issued by the Department of Economic Development (DED) will have a benefit number. The number is located on your Certificate of Eligibility Schedule (Certificate). Alpha Code: This is the three character code located on the back of the form.

Include only Missouri withholding as shown on your Forms W-2, 1099, or 1099-R. Do not include withholding for federal taxes, local taxes, city earnings taxes, other state's withholding, or payments submitted with Form MO-2NR or Form MO-2ENT. Attach a copy of all Forms W-2 and 1099.

12/7/2020. MO-TC Document. Miscellaneous Income Tax Credits.