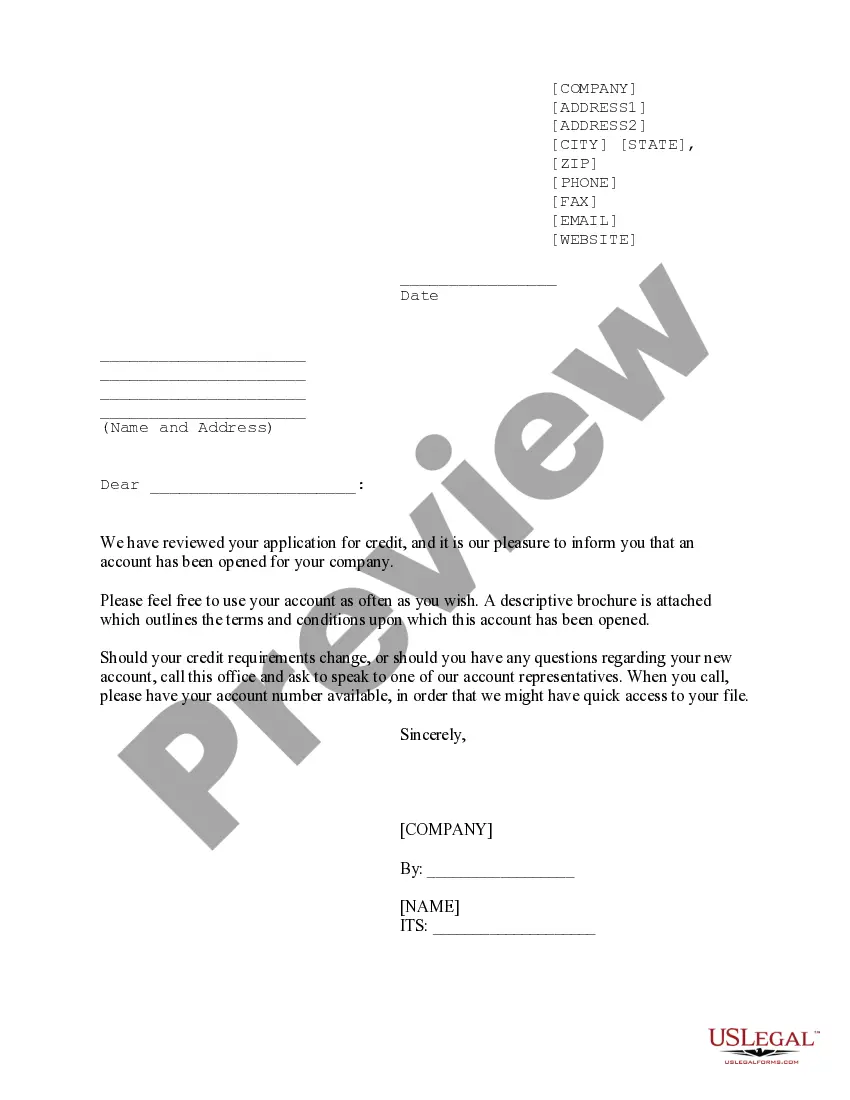

South Carolina Credit Approval Form

Description

How to fill out Credit Approval Form?

If you want to total, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Utilize the site's straightforward and useful search to find the documents you need. Various templates for business and personal use are categorized by groups and states, or keywords.

Use US Legal Forms to find the South Carolina Credit Approval Form with just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to each form you obtained in your account. Visit the My documents section and select a form to print or download again.

Stay competitive and download, and print the South Carolina Credit Approval Form using US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are currently a US Legal Forms member, Log In to your account and click on the Obtain option to access the South Carolina Credit Approval Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your correct city/state.

- Step 2. Use the Review option to check the form's content. Remember to review the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the page to find other versions of the legal form template.

- Step 4. Once you have located the form you need, select the Acquire now option. Choose the pricing plan you prefer and enter your credentials to register for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the South Carolina Credit Approval Form.

Form popularity

FAQ

The SC 1040 tax form is the individual income tax return that South Carolina residents must file annually. This form includes details about your income, deductions, credits, and overall tax liability. Filing this form accurately is crucial for proper tax management, and utilizing resources like the South Carolina Credit Approval Form can help you identify applicable credits and deductions to maximize your return.

Filling out the South Carolina W4 form involves providing your name, address, Social Security number, and claiming allowances. Be sure to carefully read through the instructions to understand how to calculate your allowances accurately. Integrating the South Carolina Credit Approval Form into your financial planning can streamline this process, ensuring you file correctly and efficiently.

You can claim a credit for taxes paid to another state on your South Carolina return if you are a resident of South Carolina and the same income is taxed in both South Carolina and another state. The credit is computed only on income that is required to be taxed in both states.

An Income Tax deduction of up to $15,000 is allowed against any South Carolina taxable income of a resident individual who is 65 or older by the end of the tax year. The following requirements apply to this deduction: a. Amounts deducted as retirement income (see above discussion) reduce this $15,000 deduction.

Page 1. FILING OF SC8453. PART II - DIRECT DEPOSIT OF REFUND. OR EFW PAYMENT OF TAX DUE.

South Carolina Income Taxes and SC State Tax Forms. South Carolina State Income Taxes for Tax Year 2021 (January 1 - Dec. 31, 2021) can be completed and e-Filed now along with a Federal or IRS Income Tax Return (or you can learn how to only prepare and file a SC state return).

The SCDOR will accept the federal 2848 for South Carolina purposes. Be sure to note any differences in the forms. Complete the form to be South Carolina specific, including references to South Carolina tax forms.

DEPARTMENT OF REVENUE. 2018. SC1040TC Worksheet. Credit for Taxes Paid to Another State. 1350.

If you elect to file as a full-year resident, file SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. You must complete SC1040TC and attach a copy of the other state's income tax return.

Qualifying taxpayers can take a credit against South Carolina Individual Income Tax, Corporate Income Tax, Bank Tax, or Insurance Premium Tax for creating new jobs in South Carolina. The credit is limited to 50% of the tax liability.