South Carolina Sample Letter for Check Stipulations

Description

How to fill out Sample Letter For Check Stipulations?

US Legal Forms - one of several most significant libraries of legitimate forms in the States - provides a wide array of legitimate papers templates you are able to down load or print. Utilizing the website, you can find a huge number of forms for enterprise and individual functions, categorized by classes, claims, or search phrases.You can get the most up-to-date variations of forms such as the South Carolina Sample Letter for Check Stipulations in seconds.

If you already possess a subscription, log in and down load South Carolina Sample Letter for Check Stipulations through the US Legal Forms library. The Download key will appear on every single type you see. You have accessibility to all earlier acquired forms in the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed below are straightforward directions to obtain started out:

- Ensure you have picked out the proper type for your city/county. Click the Review key to check the form`s content. See the type information to ensure that you have chosen the appropriate type.

- In the event the type doesn`t suit your demands, take advantage of the Lookup field near the top of the screen to discover the one which does.

- If you are happy with the shape, verify your decision by clicking on the Get now key. Then, select the costs strategy you favor and offer your references to sign up on an bank account.

- Procedure the deal. Make use of your charge card or PayPal bank account to finish the deal.

- Select the formatting and down load the shape in your device.

- Make adjustments. Complete, modify and print and signal the acquired South Carolina Sample Letter for Check Stipulations.

Every single web template you added to your money does not have an expiration day and is your own property for a long time. So, if you would like down load or print yet another copy, just go to the My Forms segment and click on the type you want.

Obtain access to the South Carolina Sample Letter for Check Stipulations with US Legal Forms, the most comprehensive library of legitimate papers templates. Use a huge number of specialist and condition-distinct templates that fulfill your small business or individual demands and demands.

Form popularity

FAQ

An outstanding check is a financial instrument that has not yet been deposited or cashed by the recipient. An outstanding check is still a liability for the payor who issued the check. Checks that remain outstanding for long periods of time run the risk of becoming void.

An outstanding check is any check that has not cleared your bank for payment. This includes checks that are outstanding, written-off, stale-dated or returned by the post office. Common terms used include accounts payable, expense, drafts, and vendor payments.

Outstanding or unreleased checks ? outstanding checks have been issued by the business but not yet presented for payment by the payee. Unreleased checks have not yet issued to the payee but have already been deducted from the cash account in the books.

Deposits in transit are deposits that were made after the bank statement was issued, but have been recorded on the books. Outstanding checks are checks that have been written and recorded on the books, but have not yet been cashed or have not cleared the bank.

Employers are required to turn over unclaimed wages to the state under unclaimed property or escheat laws.

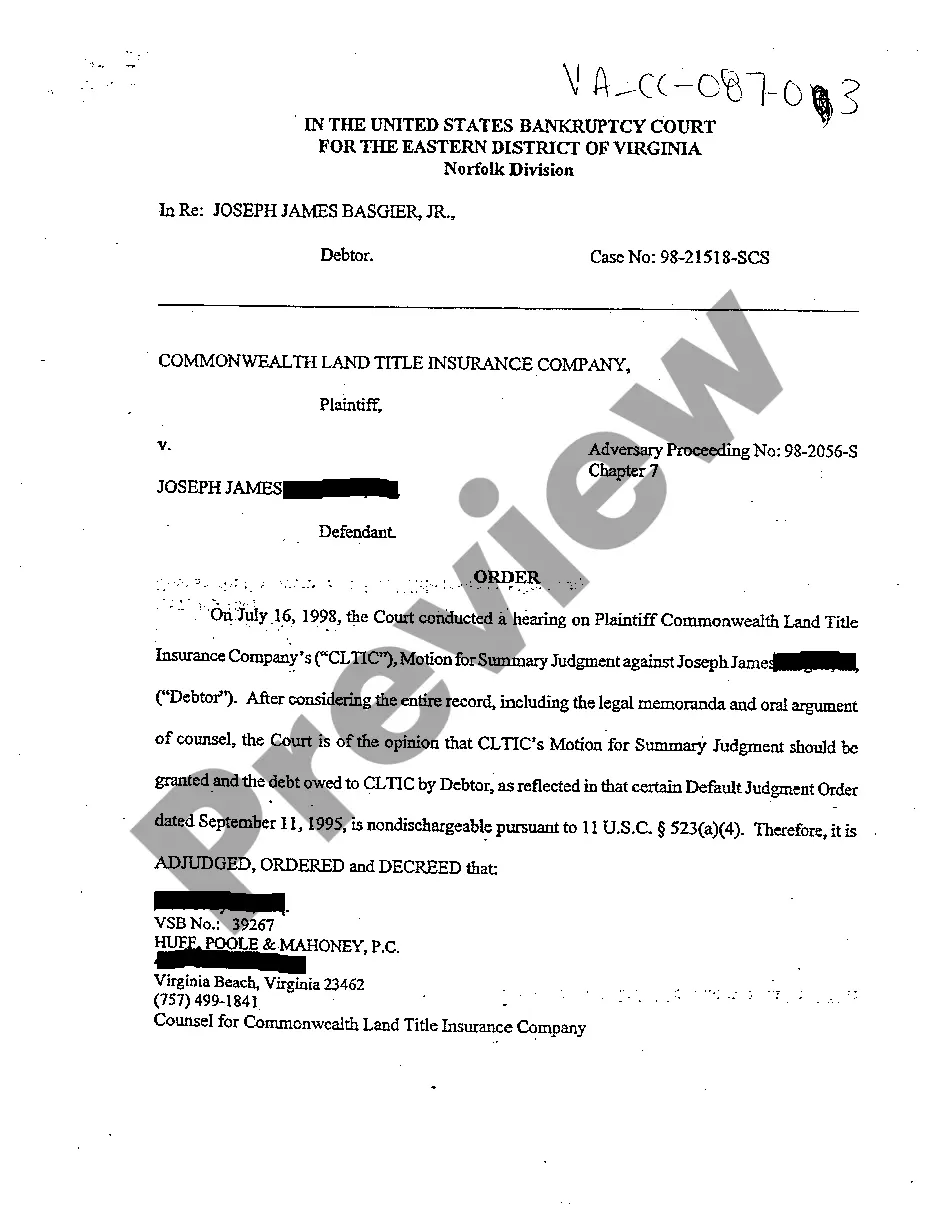

On [date], we received your check #[check number] in the amount of $[amount]. Your check was dated [date of check] and was drawn on the [name of bank]. The account was in the name of [name on account holder]. Your bank returned the check to us due to insufficient funds (or because the account was closed).