South Carolina Sample Letter for Applying Check to Accounts

Description

How to fill out Sample Letter For Applying Check To Accounts?

Discovering the right legitimate papers design might be a struggle. Naturally, there are a variety of templates available on the Internet, but how will you obtain the legitimate develop you need? Utilize the US Legal Forms site. The services delivers a huge number of templates, such as the South Carolina Sample Letter for Applying Check to Accounts, which can be used for company and private requires. All the types are inspected by experts and fulfill state and federal demands.

If you are currently signed up, log in to your accounts and then click the Download button to get the South Carolina Sample Letter for Applying Check to Accounts. Make use of accounts to look from the legitimate types you might have acquired in the past. Check out the My Forms tab of your accounts and get another duplicate in the papers you need.

If you are a brand new user of US Legal Forms, allow me to share straightforward directions that you should comply with:

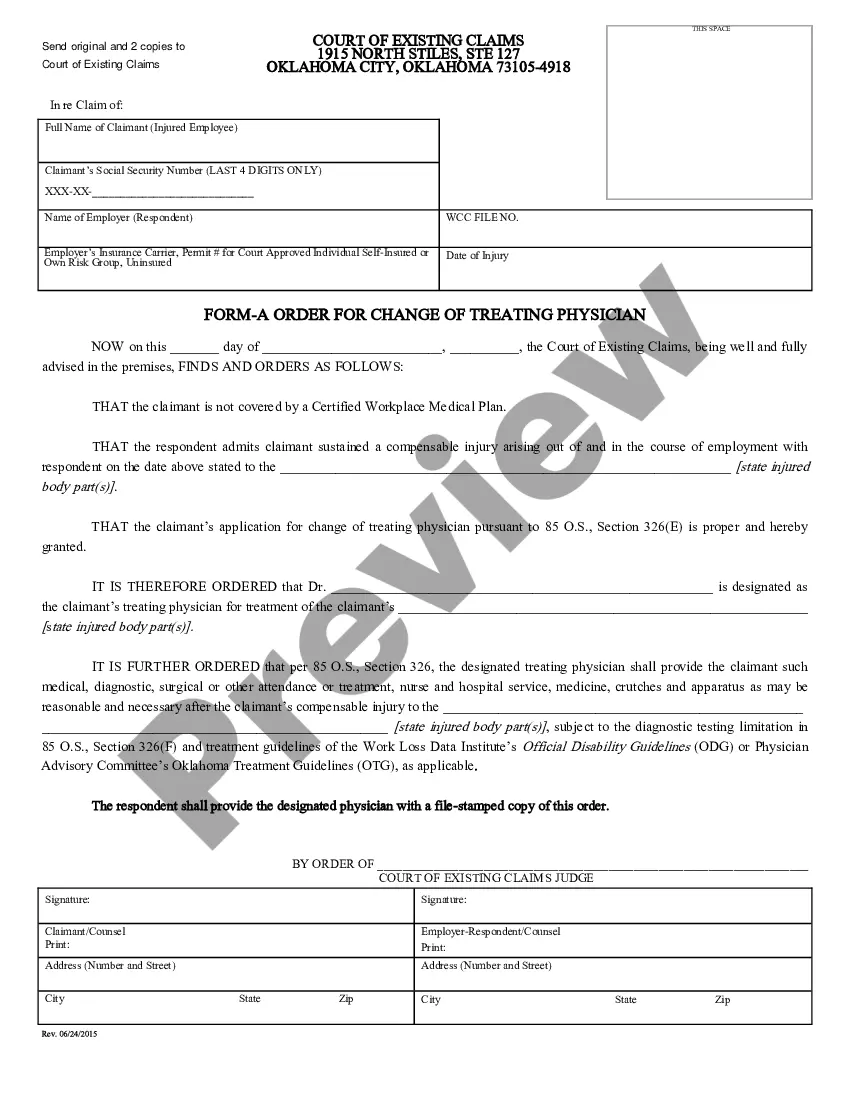

- First, ensure you have chosen the right develop for the city/region. You can look through the form making use of the Review button and look at the form information to make certain this is basically the best for you.

- In the event the develop does not fulfill your requirements, use the Seach field to find the correct develop.

- When you are certain the form would work, click the Buy now button to get the develop.

- Select the costs program you desire and enter in the necessary info. Make your accounts and purchase the order using your PayPal accounts or bank card.

- Choose the submit structure and down load the legitimate papers design to your device.

- Complete, change and printing and sign the attained South Carolina Sample Letter for Applying Check to Accounts.

US Legal Forms is the greatest collection of legitimate types that you can see numerous papers templates. Utilize the service to down load expertly-created papers that comply with express demands.

Form popularity

FAQ

Contact the customer Explain the situation to them. Ask the customer to pay with cash or credit card. If you can't reach the customer by phone, you can try sending a bounced check letter to customer. Tell the customer why you are contacting them.

I am writing to let you know that your [Check No. _______] in the amount of [$_____] has been returned to us by your bank marked ?Insufficient Funds.? You are a valued customer, and we understand that there may have been a minor error in your bookkeeping or a misunderstanding between you and your bank.

An outstanding check is any check that has not cleared your bank for payment. This includes checks that are outstanding, written-off, stale-dated or returned by the post office. Common terms used include accounts payable, expense, drafts, and vendor payments.

Generally, a returned check is one that a bank declines to honor ? typically because there's not enough money in the check writer's account to cover the amount of the payment. You might know this situation as a ?bounced check,? while the bank calls it ?nonsufficient funds,? or NSF.

Send certified mail. The check you wrote for $________, dated ______, which was made payable to _____________(write your/payee's name here), was returned by ______________ (write name of bank) because ____________(account was closed OR the account had insufficient funds).

On [date], we received your check #[check number] in the amount of $[amount]. Your check was dated [date of check] and was drawn on the [name of bank]. The account was in the name of [name on account holder]. Your bank returned the check to us due to insufficient funds (or because the account was closed).