South Carolina Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

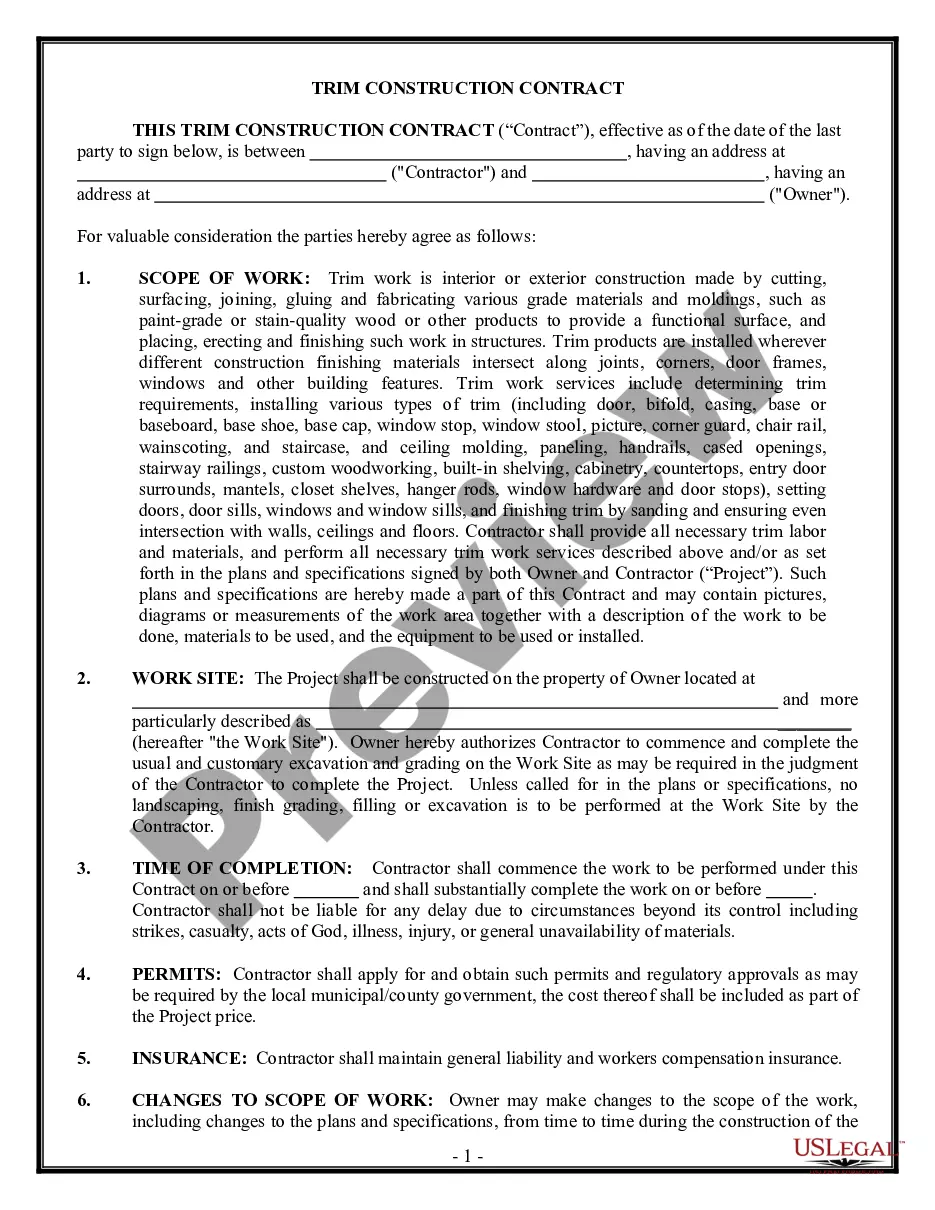

How to fill out Sample Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

Have you been in a situation in which you need to have documents for both company or specific reasons nearly every time? There are plenty of authorized record web templates available on the net, but finding versions you can rely on is not simple. US Legal Forms offers a large number of kind web templates, just like the South Carolina Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure, that happen to be created to satisfy state and federal demands.

Should you be already familiar with US Legal Forms web site and have your account, just log in. Afterward, you are able to obtain the South Carolina Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure web template.

Unless you offer an account and need to start using US Legal Forms, abide by these steps:

- Get the kind you will need and make sure it is for the right area/area.

- Make use of the Review option to analyze the shape.

- Look at the explanation to ensure that you have chosen the correct kind.

- If the kind is not what you are trying to find, make use of the Look for industry to find the kind that suits you and demands.

- Whenever you discover the right kind, click Purchase now.

- Select the prices program you desire, submit the specified information and facts to produce your account, and buy an order with your PayPal or credit card.

- Pick a handy data file formatting and obtain your duplicate.

Locate all the record web templates you have bought in the My Forms food selection. You can get a further duplicate of South Carolina Sample Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure whenever, if necessary. Just select the necessary kind to obtain or print the record web template.

Use US Legal Forms, probably the most substantial collection of authorized types, in order to save time as well as prevent faults. The services offers appropriately manufactured authorized record web templates that you can use for an array of reasons. Create your account on US Legal Forms and start producing your life easier.

Form popularity

FAQ

In this article, ?debt validation letter? means the initial notice a debt collector must send you under federal law, and ?debt verification letter? means a letter you send to the debt collector to request more information and/or to dispute the debt.

If the collection agency failed to validate the debt, it is not allowed to continue collecting the debt. It can't sue you or list the debt on your credit report. Why request validation, even if you're ready to pay and you know it's your debt? Simple.

Debt validation, or "debt verification", refers to a consumer's right to challenge a debt and/or receive written verification of a debt from a debt collector.

Collectors who don't send these letters could get in trouble with the Federal Trade Commission (FTC) if you file a complaint against them. To formally request debt validation, start by sending a letter via certified mail to the debt collector ? LendingTree's debt validation letter template can help you get started.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

State the amount of the debt when you obtained it, and when that was. If there have been any additional interest, fees or charges added since the last billing statement from the original creditor, provide an itemization showing the dates and amount of each added amount.

Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it thinks you owe, (2) the name of the creditor, and (3) how to dispute the debt in writing.