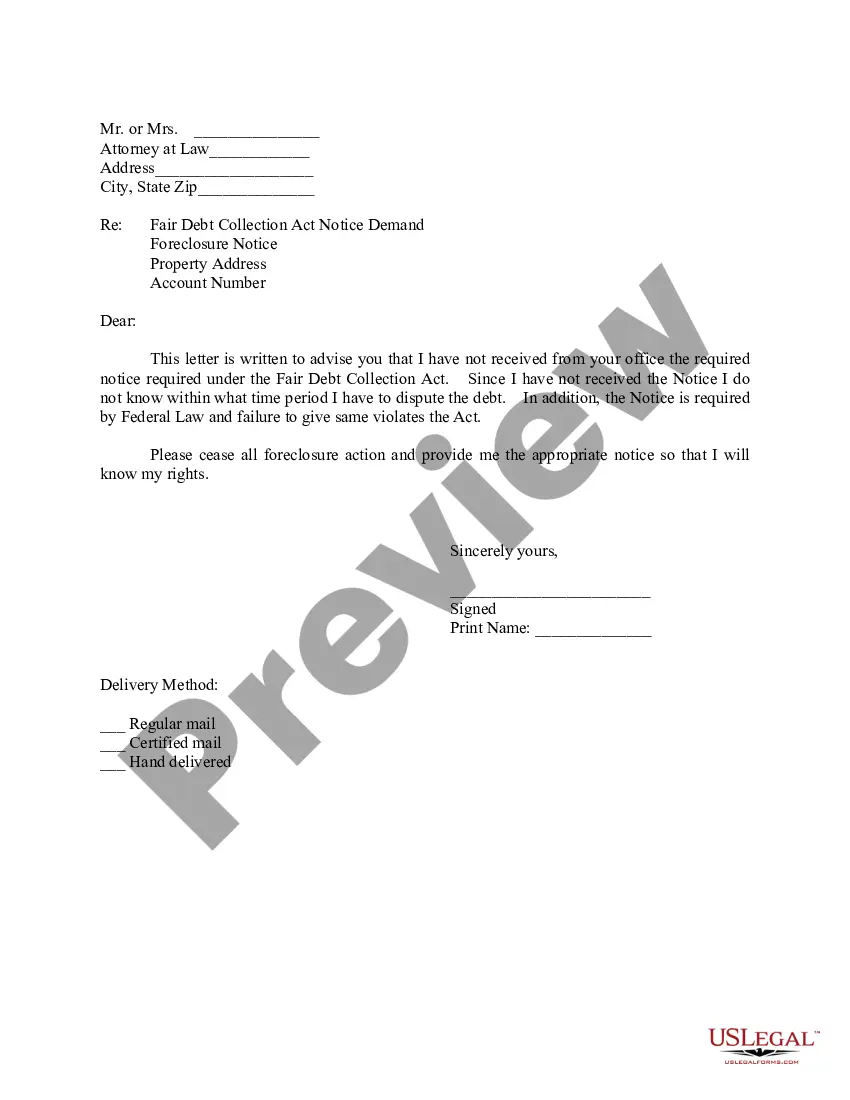

South Carolina Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure

Description

How to fill out Letter To Foreclosure Attorney To Provide Verification Of Debt And Cease Foreclosure?

US Legal Forms - one of many largest libraries of legitimate varieties in the United States - gives an array of legitimate document themes it is possible to acquire or produce. While using web site, you can find a huge number of varieties for organization and person purposes, categorized by categories, says, or keywords and phrases.You will find the newest types of varieties just like the South Carolina Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure within minutes.

If you already have a membership, log in and acquire South Carolina Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure in the US Legal Forms local library. The Down load option will appear on every kind you view. You have access to all earlier delivered electronically varieties inside the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the very first time, allow me to share basic recommendations to help you get started out:

- Make sure you have chosen the proper kind to your area/region. Click the Review option to review the form`s content. Read the kind outline to ensure that you have chosen the correct kind.

- When the kind doesn`t match your demands, take advantage of the Look for discipline towards the top of the screen to discover the one that does.

- When you are satisfied with the form, confirm your option by clicking the Buy now option. Then, pick the pricing program you prefer and offer your accreditations to sign up for the accounts.

- Procedure the transaction. Make use of your Visa or Mastercard or PayPal accounts to complete the transaction.

- Choose the formatting and acquire the form on your gadget.

- Make modifications. Fill up, modify and produce and sign the delivered electronically South Carolina Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure.

Each and every design you included with your bank account lacks an expiry date and is your own for a long time. So, in order to acquire or produce one more version, just check out the My Forms portion and click on around the kind you require.

Get access to the South Carolina Letter to Foreclosure Attorney to Provide Verification of Debt and Cease Foreclosure with US Legal Forms, one of the most comprehensive local library of legitimate document themes. Use a huge number of specialist and condition-distinct themes that satisfy your business or person needs and demands.

Form popularity

FAQ

If the collection agency failed to validate the debt, it is not allowed to continue collecting the debt. It can't sue you or list the debt on your credit report. Why request validation, even if you're ready to pay and you know it's your debt? Simple.

However, they're required to send a debt validation letter within five days of first contacting you. If you don't receive a debt validation letter within 10 days of initial contact, you can submit a complaint to the Consumer Financial Protection Bureau.

If the collection agency failed to validate the debt, it is not allowed to continue collecting the debt. It can't sue you or list the debt on your credit report. Why request validation, even if you're ready to pay and you know it's your debt? Simple.

In this article, ?debt validation letter? means the initial notice a debt collector must send you under federal law, and ?debt verification letter? means a letter you send to the debt collector to request more information and/or to dispute the debt.

Debt collectors are legally obligated to send you a debt validation letter. If you don't receive a debt validation letter, or it lacks detail, you can make a debt verification request. You can file a complaint with the Consumer Federal Protection Bureau or the Federal Trade Commission.

In your dispute, say that you were never notified of the debt. The credit bureaus will then have to remove the negative mark on your report until they can either verify the debt or determine that you don't actually owe the amount in question. You can dispute incorrect information either with a letter or online.

Legally, a debt collector has to send you a debt verification letter within five days of their first contact with you. And if not, you should ask for one. Why? Because it helps you determine if the debt is actually yours and if there's anything fishy going on behind the scenes.

While debt validation requests can be a useful tool, they are not effective at resolving the issue. In most cases, creditors and collection agencies are able to provide the necessary documentation to prove the validity of the debt.

I am requesting that you provide verification of this debt. Please send the following information: The name and address of the original creditor, the account number, and the amount owed. Verification that there is a valid basis for claiming I am required to pay the current amount owed.