Oregon What To Do When Starting a New Business

Description

How to fill out What To Do When Starting A New Business?

Locating the appropriate genuine document template can be quite challenging. Of course, there are numerous templates available online, but how can you find the authentic form you require? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Oregon What To Do When Starting a New Business, suitable for both business and personal use. All forms are reviewed by professionals and comply with state and federal regulations.

If you are currently registered, Log In to your account and click on the Obtain button to access the Oregon What To Do When Starting a New Business. Use your account to browse the legal forms you have previously purchased. Visit the My documents section of your account for another copy of the document you need.

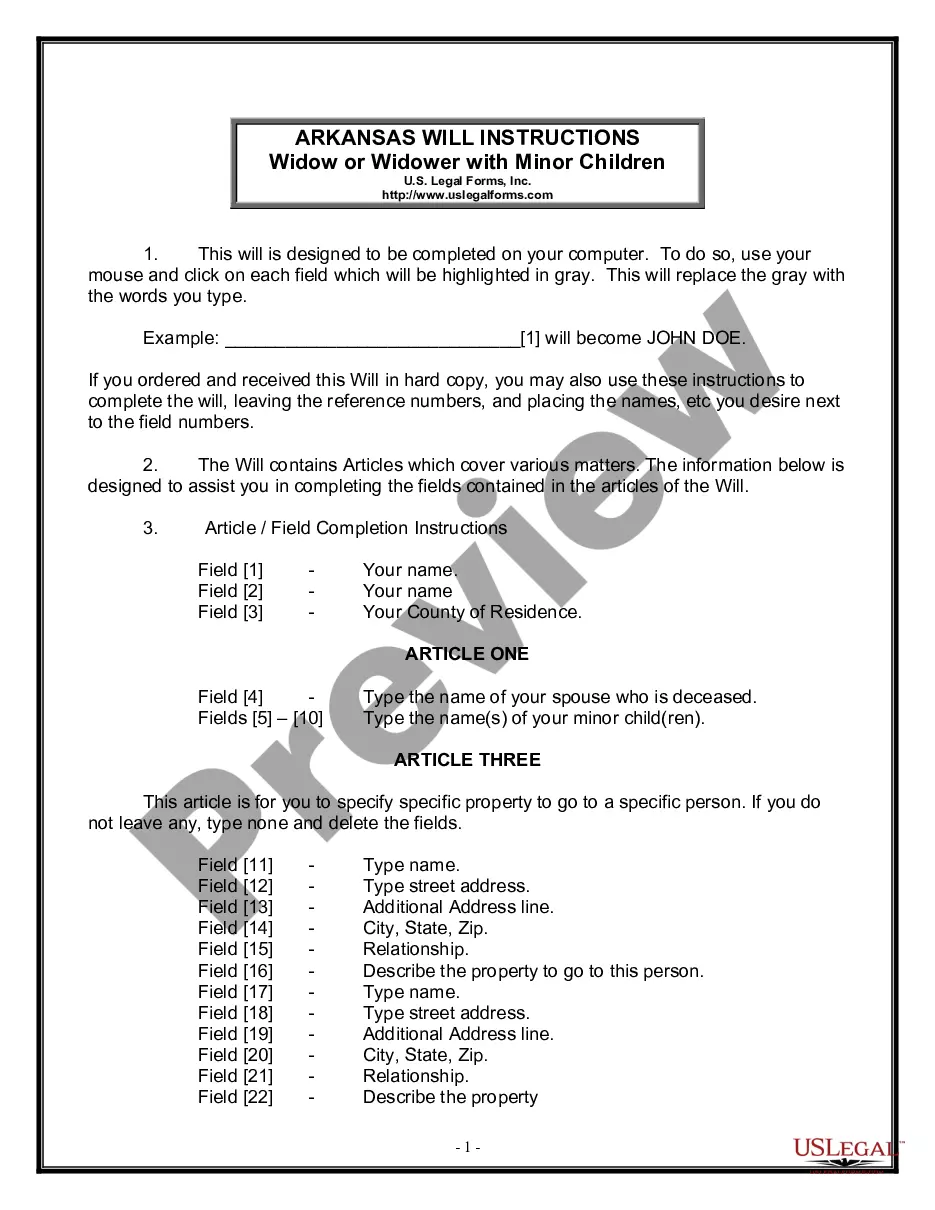

If you are a new user of US Legal Forms, here are simple instructions for you to follow: Firstly, ensure you have selected the correct form for your location/state. You can review the form using the Preview feature and read the form description to confirm it’s the right one for you.

US Legal Forms is indeed the largest collection of legal forms where you can find a wide range of document templates. Utilize this service to obtain professionally crafted paperwork that meets state requirements.

- If the form does not meet your requirements, use the Search box to find the appropriate form.

- Once you are confident the form is suitable, proceed with the Buy now button to purchase the form.

- Select the pricing plan you prefer and provide the necessary details.

- Create your account and make the payment for your order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the acquired Oregon What To Do When Starting a New Business.

Form popularity

FAQ

To Start a Business in Oregon, Follow These StepsChoose the Right Business Idea.Plan Your Oregon Business.Get Funding.Choose a Business Structure.Register Your Oregon Business.Set up Banking, Credit Cards, & Accounting.Get Insured.Obtain Permits & Licenses.More items...?

200b200bLicense RequirementsThe state of Oregon doesn't have a general business license. However, many occupations and business activities require special licenses, permits or certifications from state agencies or boards.

To Start a Business in Oregon, Follow These StepsChoose the Right Business Idea.Plan Your Oregon Business.Get Funding.Choose a Business Structure.Register Your Oregon Business.Set up Banking, Credit Cards, & Accounting.Get Insured.Obtain Permits & Licenses.More items...?

Conduct market research. Market research will tell you if there's an opportunity to turn your idea into a successful business.Write your business plan.Fund your business.Pick your business location.Choose a business structure.Choose your business name.Register your business.Get federal and state tax IDs.More items...

12 Things You Must Do Before Starting a BusinessIdentify a creative idea.Write a business plan.Choose a legal structure.Get your business registration, licenses and tax identification.Know your competition and the marketplace.Finance your business.Identify and secure a location.Get proper insurance.More items...

It will be necessary when you start dealing with things like insurance, and it is the only way for your business to be legally recognised. Keep in mind that you may need to register as an employer as soon as you start employing people, and the only way you can do this is if your business is already registered.

How to Start a Business. Ask Yourself if You're Ready. Determine What Type of Business to Start. Do Market Research. Set Realistic Goals and Expectations. Create a One-Page Business Plan. Get Feedback. Find a Way to Pay for Your Business. Pair Up With a Partner.Additional Resources to Start a Business.Conclusion.

Cost to Form an LLC in Oregon. The cost to start an Oregon limited liability company (LLC) is $100. This fee is paid to the Oregon Secretary of State when filing the LLC's Articles of Organization. Use our free Form an LLC in Oregon guide to do it yourself.

Yes, all businesses in Oregon must be registered, including those businesses operating as DBAs, assumed names, sole proprietorship, LLC, corporation, or limited partnership. The form can be filed on the Oregon Secretary of State website or mailed to the State's Corporation Division. The filing fee is $50.

Yes, all businesses in Oregon must be registered, including those businesses operating as DBAs, assumed names, sole proprietorship, LLC, corporation, or limited partnership. The form can be filed on the Oregon Secretary of State website or mailed to the State's Corporation Division. The filing fee is $50.