South Carolina Sample Letter for Incorporation Documents

Description

How to fill out Sample Letter For Incorporation Documents?

Discovering the right legitimate papers template could be a have difficulties. Naturally, there are a lot of layouts available online, but how can you obtain the legitimate form you will need? Make use of the US Legal Forms internet site. The support provides a huge number of layouts, for example the South Carolina Sample Letter for Incorporation Documents, that you can use for company and private needs. All the types are inspected by experts and satisfy federal and state specifications.

If you are already listed, log in to your account and click the Acquire switch to have the South Carolina Sample Letter for Incorporation Documents. Utilize your account to look through the legitimate types you may have ordered formerly. Visit the My Forms tab of your respective account and obtain yet another backup of the papers you will need.

If you are a brand new end user of US Legal Forms, here are simple guidelines that you should comply with:

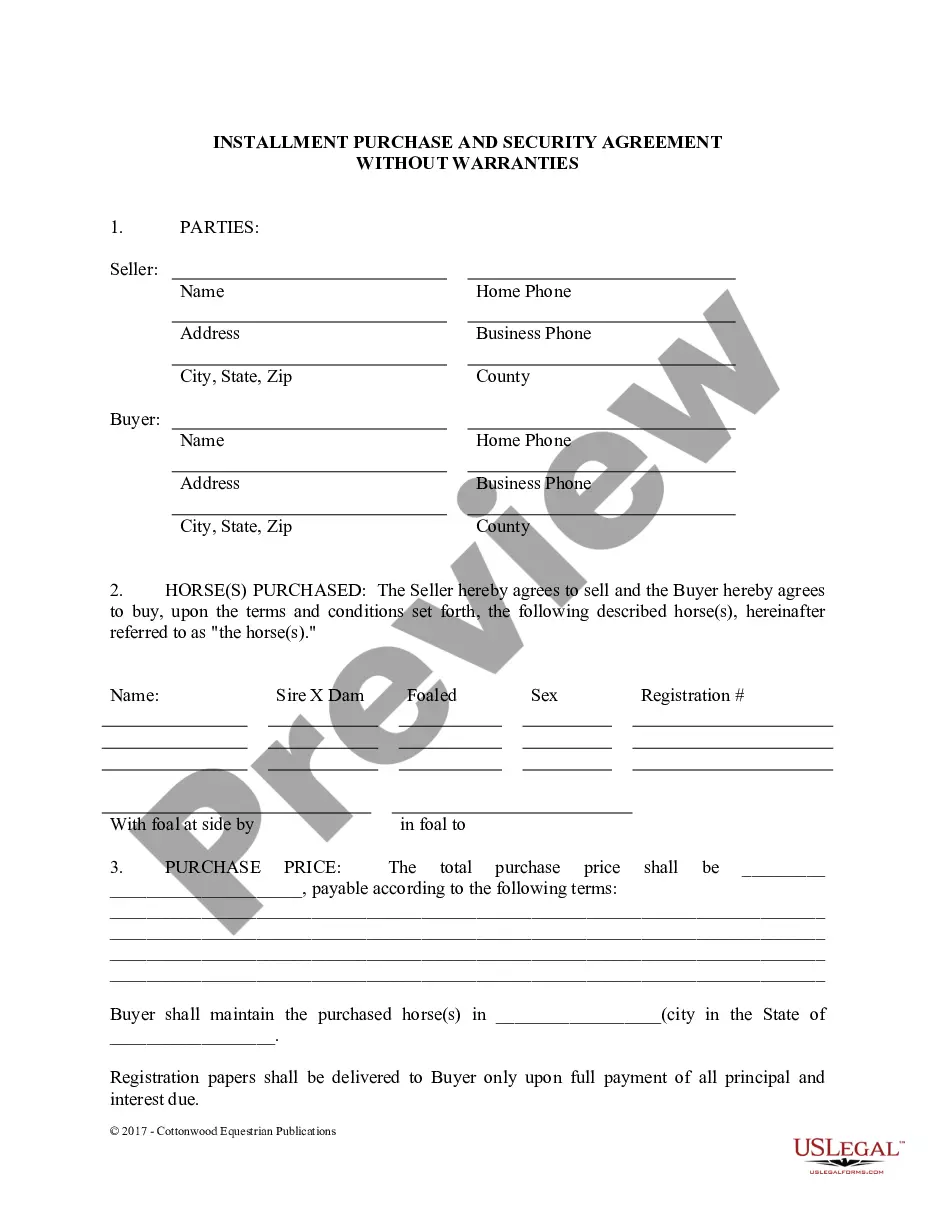

- Initially, make sure you have selected the correct form for your personal metropolis/state. It is possible to look over the shape using the Review switch and look at the shape description to make certain this is the right one for you.

- In case the form is not going to satisfy your needs, use the Seach industry to find the proper form.

- Once you are certain that the shape is acceptable, click on the Acquire now switch to have the form.

- Choose the costs plan you want and enter the necessary details. Make your account and buy an order using your PayPal account or Visa or Mastercard.

- Select the data file formatting and download the legitimate papers template to your gadget.

- Total, change and produce and indicator the obtained South Carolina Sample Letter for Incorporation Documents.

US Legal Forms may be the biggest catalogue of legitimate types for which you can see a variety of papers layouts. Make use of the service to download expertly-produced documents that comply with state specifications.

Form popularity

FAQ

~1-2 business days online. Choose a Corporate Structure. Incorporating means starting a corporation. ... Check Name Availability. ... Appoint a Registered Agent. ... File South Carolina Articles of Incorporation. ... File Initial Report. ... Establish Bylaws & Corporate Records. ... Appoint Initial Directors. ... Hold Organizational Meeting.

An attorney licensed to practice law in South Carolina must sign articles of incorporation for a business corporation.

South Carolina Annual Report Information. Businesses and nonprofits are required to file annual reports to stay in good standing with the secretary of state. Annual reports are required in most states. Due dates and fees vary by state and type of entity.

So for most people who own an LLC in South Carolina, there are no state-required annual South Carolina LLC fees. If you hired a Registered Agent service, you'll have an annual subscription fee to pay each year. This is usually about $125 per year. Some LLCs may need a business license in South Carolina.

LLC taxes and fees The following are taxation requirements and ongoing fees for South Carolina LLCs: Annual report. South Carolina does not require LLCs to file an annual report.

Businesses that are incorporated in another state will typically apply for a South Carolina certificate of authority. Doing so registers the business as a foreign entity and eliminates the need to incorporate a new entity. Operating without a certificate of authority may result in penalties or fines.

CL-1 The Initial Annual Report of Corporations. This form is filed with the South Carolina Department of Revenue. $25.00.

LLC filing form (Articles of Organization) in South Carolina Online: The LLC filing fee is $125 and your LLC will be approved in 1-2 business days, however, most filings are approved the same business day. By mail: The LLC filing fee is $110 and your LLC will be approved in 3-4 business days (plus mail time).