South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement

Description

How to fill out Checklist Of Matters To Be Considered In Drafting Escrow Agreement?

Selecting the ideal legal document template might be challenging. Obviously, there are numerous themes accessible online, but how can you locate the legal document you require.

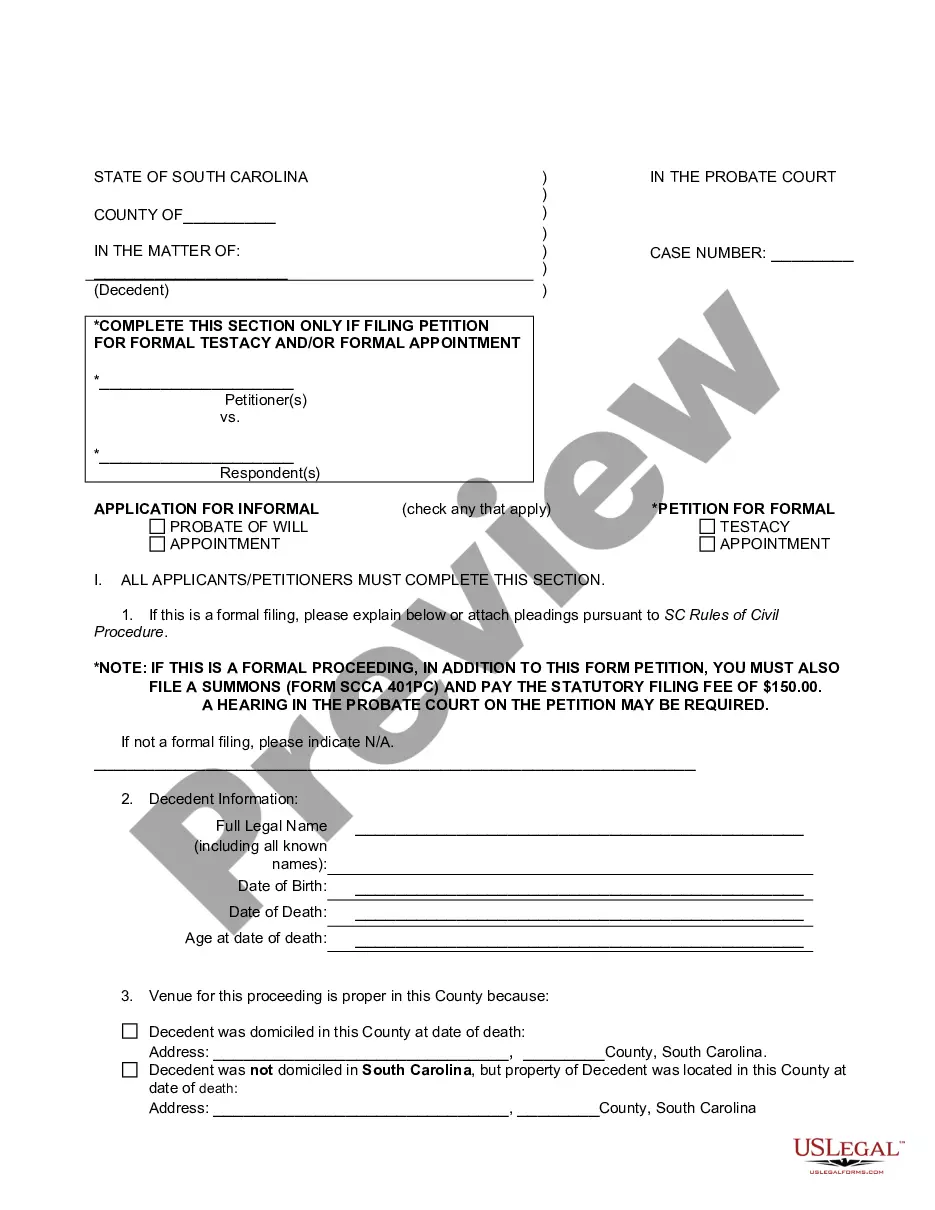

Utilize the US Legal Forms platform. The service offers a vast array of templates, including the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement, which can be used for both business and personal purposes.

All documents are reviewed by experts and comply with state and federal regulations.

Once you are confident the form is suitable, click the Buy now button to acquire the document. Choose the payment plan you desire and input the necessary information. Create your account and complete your purchase using your PayPal account or Visa or Mastercard. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement. US Legal Forms is truly the ultimate collection of legal templates where you can find a diverse range of document themes. Utilize the service to download well-crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement.

- Use your account to browse the legal forms you may have purchased previously.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your locality/state. You can review the form using the Preview button and read the form description to confirm it is suitable for you.

- If the form does not meet your requirements, utilize the Search field to find the appropriate document.

Form popularity

FAQ

The main elements of the escrow rule include the roles of the escrow agent, the conditions for releasing funds, and the rights and obligations of each party involved. The escrow agent acts as a neutral third party, holding the assets until the predetermined conditions are completed. Additionally, it is essential to detail instructions regarding disbursement and dispute resolution. Following the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement ensures clarity and compliance with legal standards.

The release conditions for an escrow agreement are critical aspects specified within the contract. Generally, these conditions outline when the escrow agent can release the funds or documents held in escrow. Commonly, they depend on the successful completion of a transaction or specific milestones being met. Understanding the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement helps ensure that both parties are clear on these conditions, reducing the possibility of disputes.

When reviewing an escrow agreement, focus on clarity in the terms and conditions outlined. Ensure the responsibilities of each party are well-defined and that there are clear criteria for releasing the funds. Additionally, consult the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement to confirm all essential elements are present. A clear agreement minimizes disputes and enhances trust between the parties involved.

To create an escrow agreement, start by identifying the parties involved and outlining the purpose of the agreement. Then, specify the terms for the escrow, such as the amount being held and the conditions for its release. Utilizing the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement can help ensure you cover all legal requirements. If you need assistance, platforms like US Legal Forms offer templates that simplify the drafting process.

An escrow agreement typically includes three main components: the parties involved, the terms for holding and releasing funds, and the conditions that must be met before the escrow is completed. You should review the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement to ensure all necessary elements are included. This checklist can guide you in structuring your agreement effectively. Overall, comprehensive coverage of these components protects the interests of all parties.

To draft an effective escrow agreement, start by identifying all parties involved and clearly articulating the terms and conditions of the escrow arrangement. Use the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement to ensure all crucial components are included. Consulting a platform like US Legal Forms can provide templates and assistance, making the drafting process more straightforward.

The standard escrow contract outlines the roles of the buyer, seller, and escrow agent, along with the conditions for releasing the escrowed funds or property. It is essential to incorporate the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement within this standard to address all necessary elements effectively. This contract serves as the backbone of any smooth and enforceable escrow transaction.

When reviewing an escrow agreement, focus on clarity in the terms, identification of parties, and specific conditions for the release of escrowed items. The South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement can guide you in ensuring that all important details are addressed. This will ultimately protect your interests and foster smooth transactions.

When creating a valid escrow, the agreement must have three essential requirements: a clear intention from all parties to create an escrow, delivery of the escrow item to a third party, and conditions under which the escrow agent will release the item to the rightful party. Following the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement can help ensure compliance with these requirements. Each step is crucial to prevent disputes and misunderstandings.

Typically, escrow agents cannot draft legal documents as their primary role is to facilitate the escrow process according to the terms set forth in the escrow agreement. However, they can provide templates and guidance based on the South Carolina Checklist of Matters to be Considered in Drafting Escrow Agreement. For tailored legal documents, it’s advisable to consult a qualified attorney to ensure compliance and protection under the law.