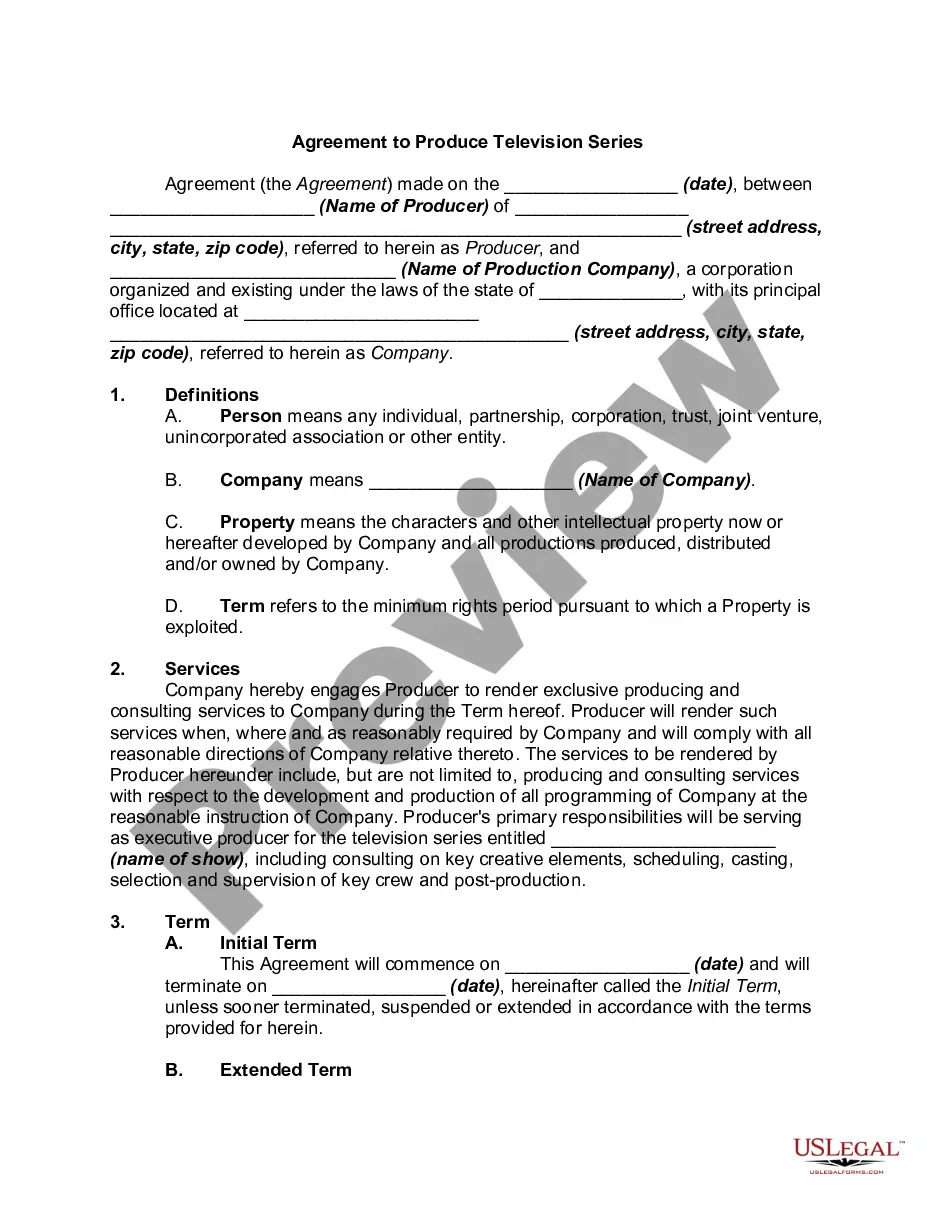

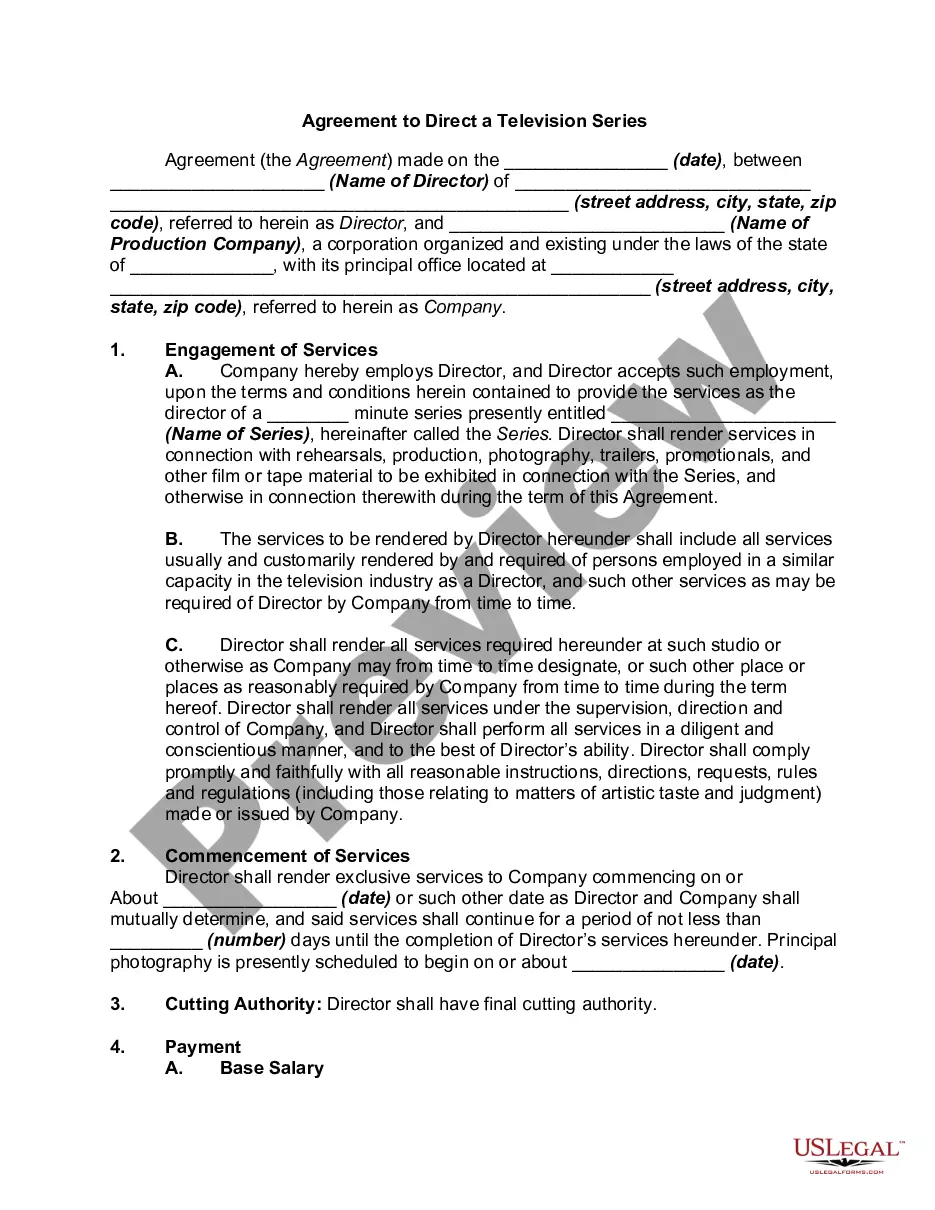

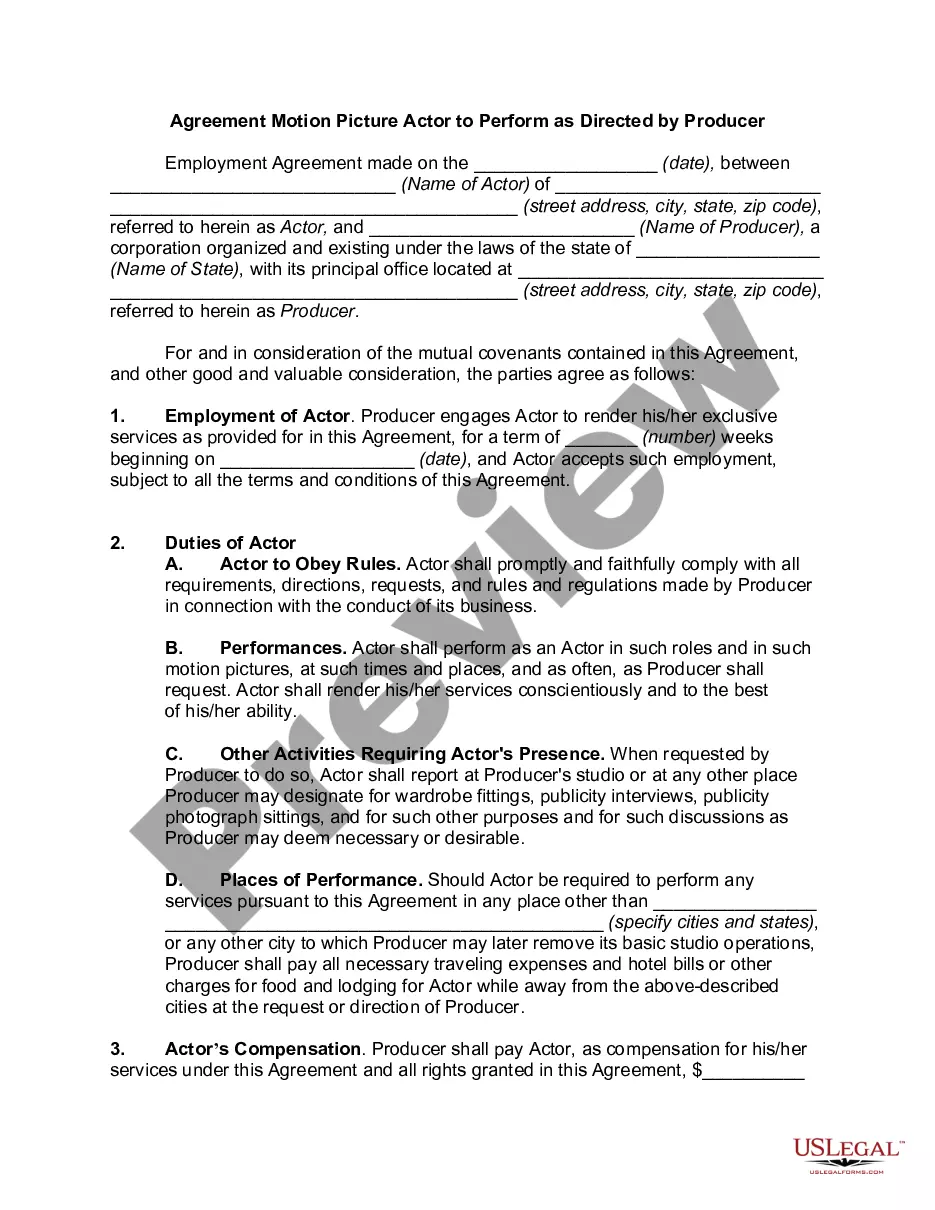

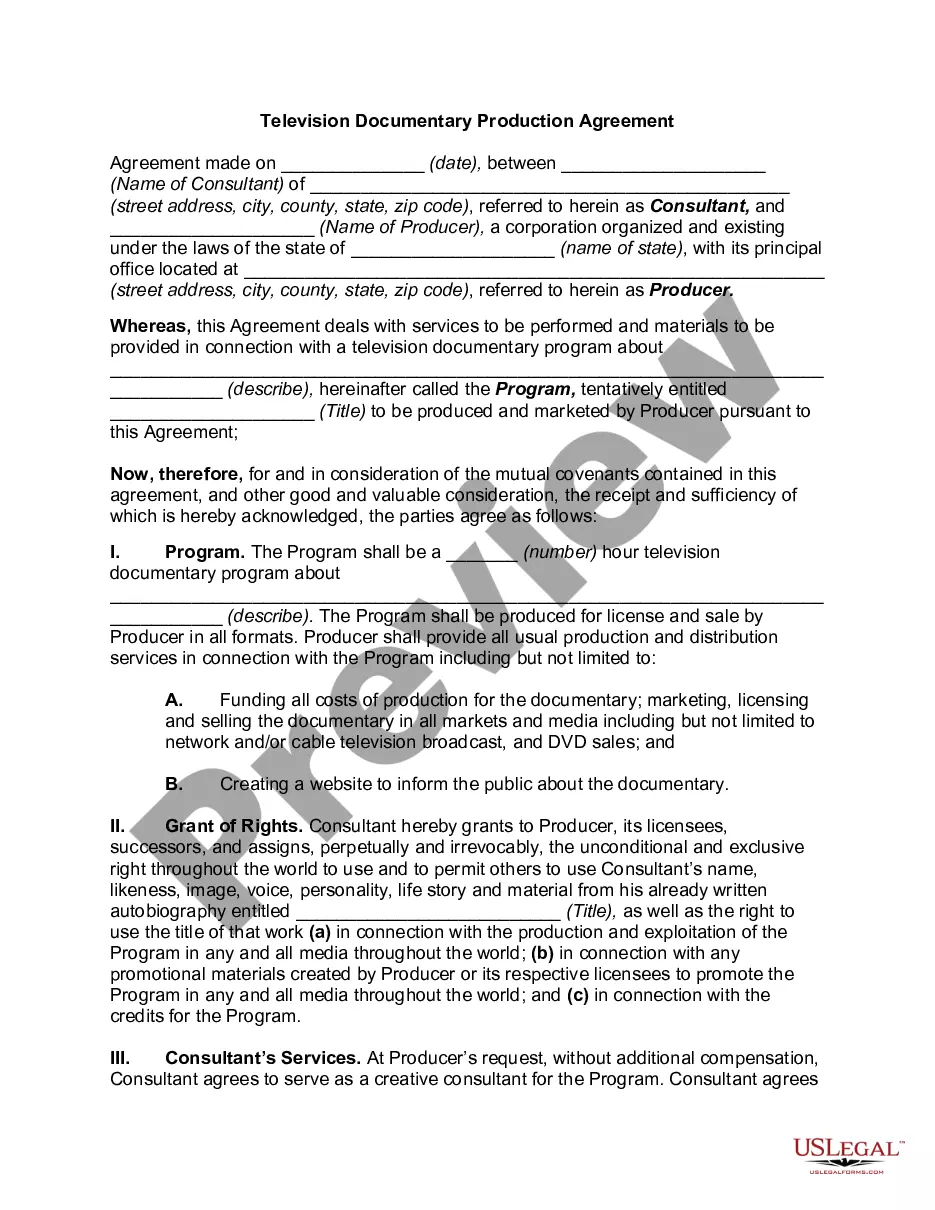

US Legal Forms - one of the largest libraries of lawful forms in the States - delivers a wide range of lawful record templates you can download or print out. Utilizing the web site, you can find a huge number of forms for organization and specific uses, sorted by categories, states, or key phrases.You will discover the newest variations of forms such as the South Carolina Agreement to Produce Motion Picture within minutes.

If you currently have a registration, log in and download South Carolina Agreement to Produce Motion Picture in the US Legal Forms local library. The Acquire switch will show up on each type you see. You get access to all formerly downloaded forms within the My Forms tab of the profile.

If you want to use US Legal Forms initially, listed here are simple directions to obtain started:

- Be sure you have chosen the correct type for your city/area. Click the Preview switch to examine the form`s content material. Browse the type explanation to ensure that you have chosen the right type.

- In case the type does not satisfy your specifications, make use of the Look for industry near the top of the display screen to obtain the one which does.

- In case you are happy with the shape, confirm your selection by simply clicking the Acquire now switch. Then, pick the rates strategy you like and supply your accreditations to sign up to have an profile.

- Approach the purchase. Make use of credit card or PayPal profile to perform the purchase.

- Choose the format and download the shape on your system.

- Make changes. Fill up, revise and print out and indication the downloaded South Carolina Agreement to Produce Motion Picture.

Every single web template you put into your account does not have an expiry day and is also your own property forever. So, if you wish to download or print out an additional backup, just go to the My Forms portion and click on the type you require.

Gain access to the South Carolina Agreement to Produce Motion Picture with US Legal Forms, the most comprehensive local library of lawful record templates. Use a huge number of skilled and express-distinct templates that satisfy your company or specific requirements and specifications.