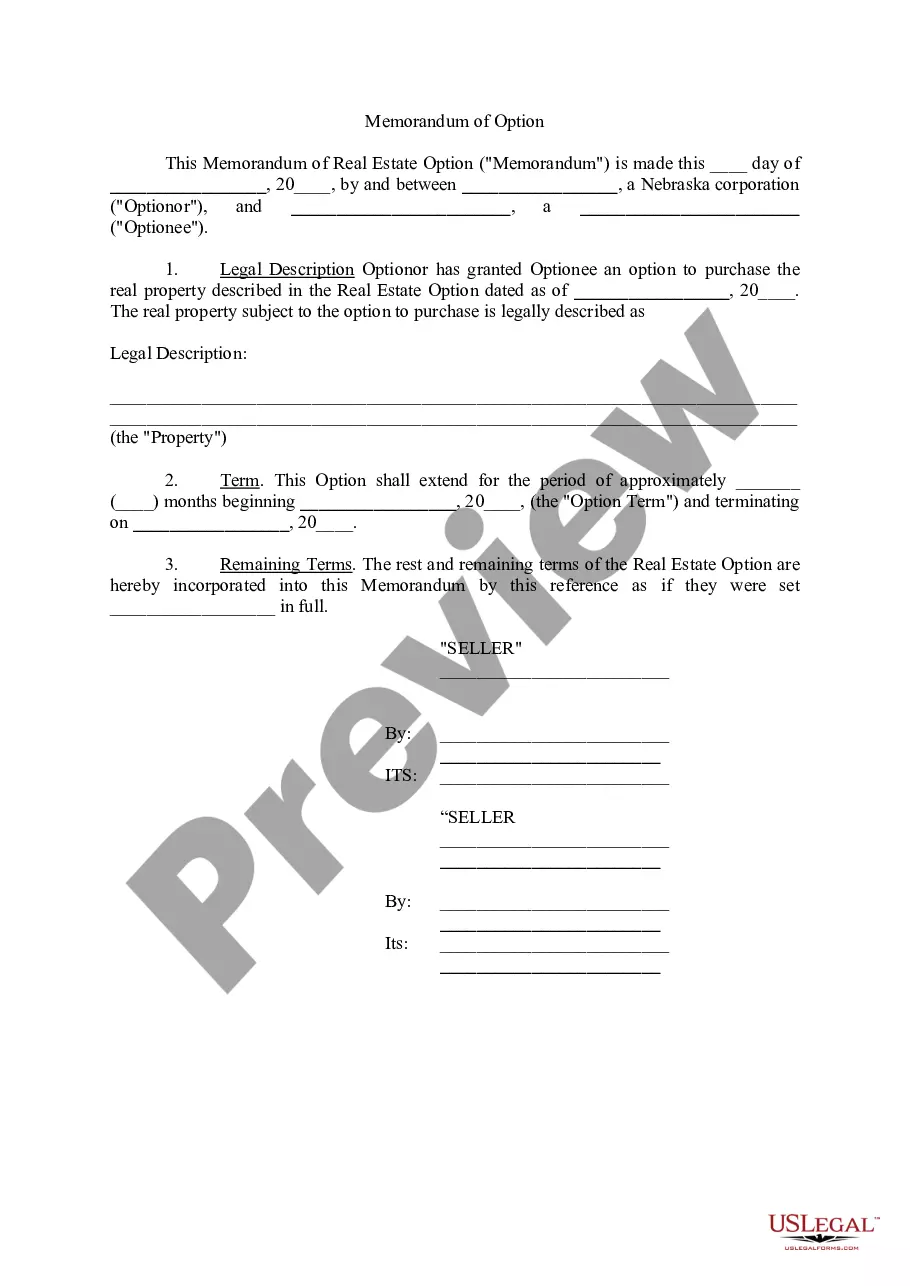

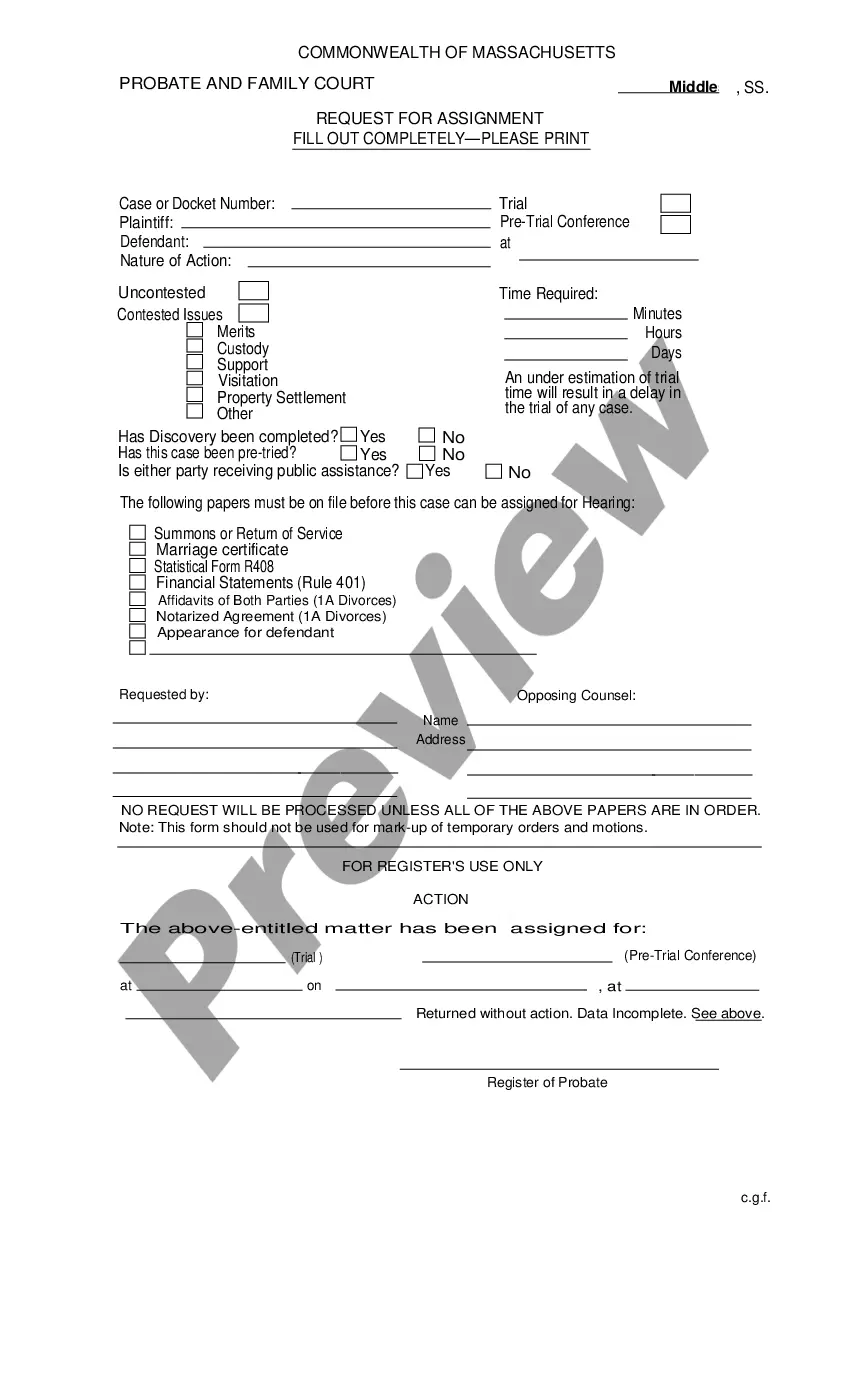

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

You may commit time on-line looking for the legal papers web template that fits the federal and state requirements you require. US Legal Forms supplies thousands of legal kinds which are analyzed by professionals. It is possible to down load or print out the South Carolina Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness from my services.

If you already have a US Legal Forms profile, you may log in and click the Down load switch. After that, you may comprehensive, modify, print out, or indication the South Carolina Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Each and every legal papers web template you get is yours forever. To have an additional version for any obtained form, visit the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site the first time, adhere to the basic directions beneath:

- First, make certain you have selected the right papers web template for that area/town of your choosing. Browse the form explanation to make sure you have selected the appropriate form. If offered, take advantage of the Preview switch to appear with the papers web template as well.

- If you would like locate an additional model of the form, take advantage of the Research field to get the web template that fits your needs and requirements.

- Once you have found the web template you want, click Purchase now to proceed.

- Select the prices prepare you want, key in your references, and sign up for a free account on US Legal Forms.

- Total the financial transaction. You should use your bank card or PayPal profile to cover the legal form.

- Select the structure of the papers and down load it in your system.

- Make modifications in your papers if required. You may comprehensive, modify and indication and print out South Carolina Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.

Down load and print out thousands of papers themes utilizing the US Legal Forms site, which offers the largest variety of legal kinds. Use skilled and condition-specific themes to deal with your organization or specific requirements.

Form popularity

FAQ

The Estate Settlement Timeline: While there is no specific deadline for this in South Carolina law, it is generally best to do so within a month to prevent unnecessary delays in the probate process.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In South Carolina, a judgment lien can be attached to real estate only.

Time for Presentment of Claims: Claims are barred against the estate unless presented within the earlier of the following: (1) one year after the decedent's death; or (2) the time provided in § 62-3-801(b) for creditors who are given actual notice, and within the eight months after the first publication.

SC Specifics In South Carolina, creditors must file any claims against the estate by the earlier of 1 year from the decedent's death, the deadline provided in the generally published notice (i.e., 8 months from publication), or the deadline provided in any direct notification (i.e., 60 days from notification).

SECTION 62-5-101. Definitions and use of terms. Unless otherwise apparent from the context, in this article: (1) "Adult" means an individual who has attained the age of eighteen or who, if under eighteen, is married or has been emancipated by a court of competent jurisdiction.

A will may refer to a written statement or list to dispose of items of tangible personal property not otherwise specifically disposed of by the will, other than money, evidences of indebtedness, documents of title (as defined in Section 36-1-201(15)), securities (as defined in Section 36-8-102(1)(A)), and property used ...

In South Carolina, the statute of limitations for most types of consumer and business debt is three years.

If you receive an inheritance that you do not need or want, or if you receive an inheritance that you would prefer someone else receive, you can make an ?assignment.? An assignment occurs when you transfer all or part of your inheritance to someone else.

Revocation or amendment of revocable trust. (a) Unless the terms of a trust expressly provide that the trust is irrevocable, the settlor may revoke or amend the trust.

SECTION 62-2-101. Intestate estate. Any part of the estate of a decedent not effectively disposed of by his will passes to his heirs as prescribed in the following sections of this Code.