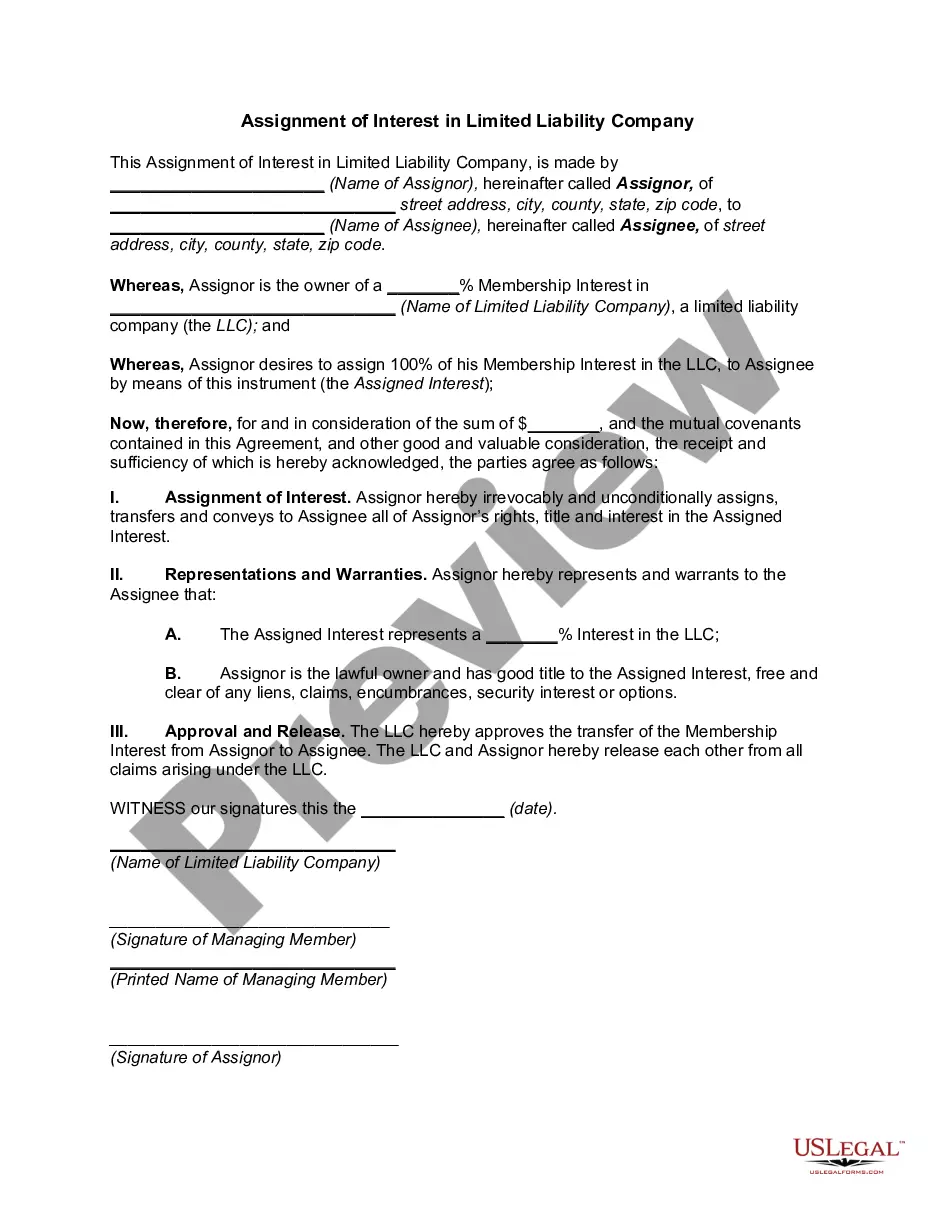

If you need to full, acquire, or print legitimate record layouts, use US Legal Forms, the greatest assortment of legitimate varieties, that can be found on the Internet. Take advantage of the site`s simple and easy handy search to find the paperwork you will need. A variety of layouts for enterprise and individual purposes are categorized by classes and says, or keywords and phrases. Use US Legal Forms to find the South Carolina Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company in a number of clicks.

Should you be currently a US Legal Forms consumer, log in for your account and click the Download key to obtain the South Carolina Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company. Also you can gain access to varieties you formerly downloaded inside the My Forms tab of the account.

If you are using US Legal Forms for the first time, refer to the instructions below:

- Step 1. Make sure you have selected the shape for your correct city/country.

- Step 2. Utilize the Preview method to look through the form`s content. Don`t overlook to read the explanation.

- Step 3. Should you be unsatisfied using the form, utilize the Research industry towards the top of the screen to discover other variations from the legitimate form format.

- Step 4. After you have identified the shape you will need, click on the Get now key. Opt for the pricing plan you choose and add your references to register for the account.

- Step 5. Process the purchase. You can utilize your credit card or PayPal account to finish the purchase.

- Step 6. Pick the structure from the legitimate form and acquire it in your device.

- Step 7. Total, revise and print or indication the South Carolina Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company.

Each legitimate record format you get is the one you have permanently. You might have acces to every form you downloaded with your acccount. Click the My Forms area and choose a form to print or acquire once more.

Contend and acquire, and print the South Carolina Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company with US Legal Forms. There are millions of professional and state-particular varieties you can use to your enterprise or individual needs.