This form assumes that the Beneficiary has the right to make such an assignment, which is not always the case. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust

Description

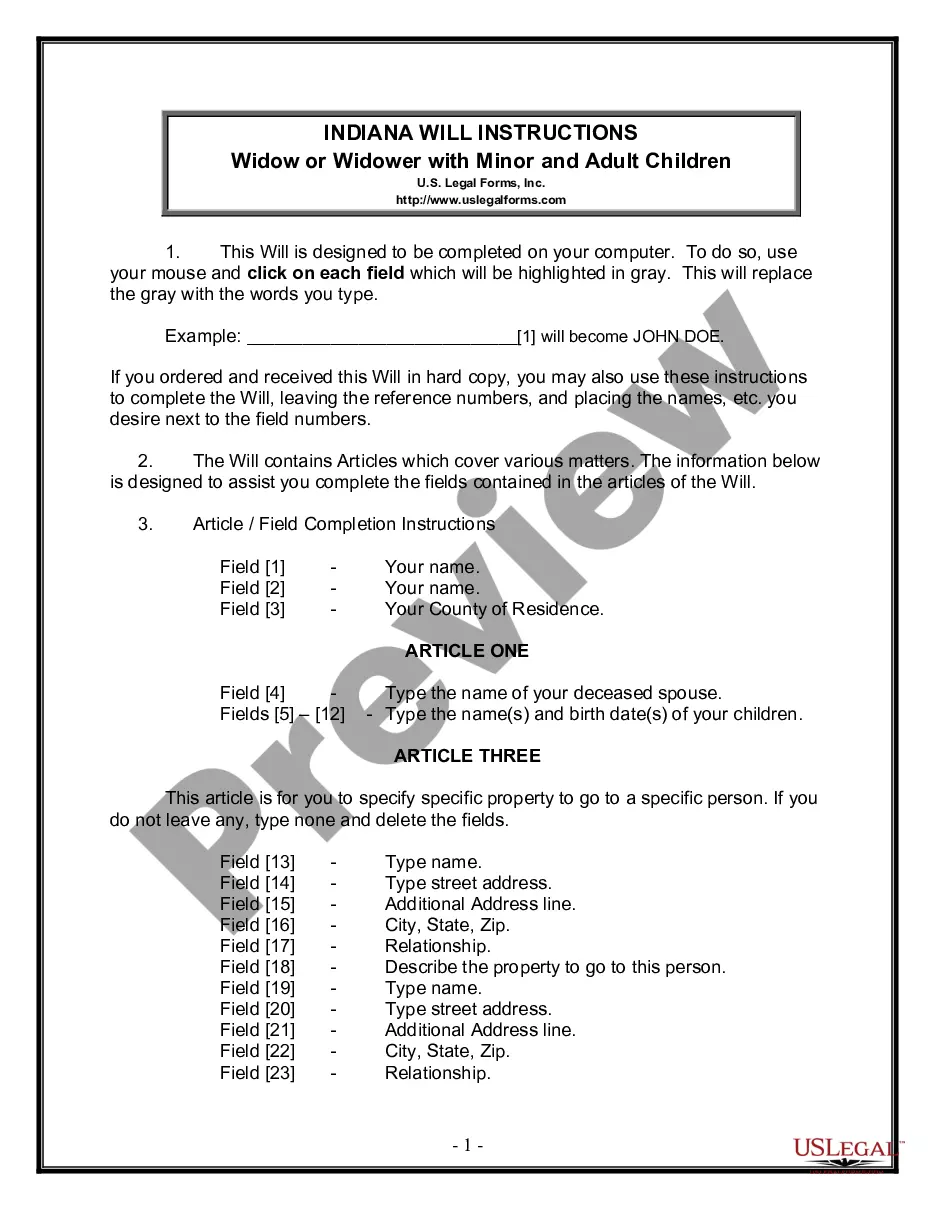

How to fill out Notice To Trustee Of Assignment By Beneficiary Of Interest In Trust?

Have you ever found yourself in a scenario where you need documents for either business or personal reasons almost constantly.

There are numerous valid document templates available online, but finding ones you can rely on isn’t simple.

US Legal Forms offers thousands of form templates, such as the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust, that are designed to comply with both federal and state regulations.

Select your preferred pricing plan, enter the required information to create your account, and complete your purchase using PayPal or a Credit Card.

Choose a convenient file format and download your copy. You can find all the document templates you’ve purchased in the My documents section. You may obtain an additional copy of the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust at any time. Simply access the required form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legitimate forms, to save time and prevent errors. The service provides professionally crafted legal document templates suitable for a variety of purposes. Create your account on US Legal Forms and start making your life easier.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it corresponds to the right city/county.

- Utilize the Review button to evaluate the form.

- Check the description to make sure you have chosen the correct template.

- If the form isn’t what you need, use the Search box to find a form that meets your needs and expectations.

- Once you locate the appropriate form, click Acquire now.

Form popularity

FAQ

Yes, it is entirely permissible to be both the trustee and the beneficiary of a trust. While this can streamline decision-making, it is crucial to handle this arrangement transparently to avoid conflicts of interest. Adherence to the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust remains pivotal to maintain proper governance and accountability.

Writing a letter to a trustee involves being clear and concise. Begin by addressing the trustee appropriately and stating your purpose in a straightforward manner. Include relevant details about the trust and any requests or questions, while also referencing the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust for specific obligations or actions needed.

Trustees generally have limited authority to add beneficiaries, as this must align with the trust’s terms. Depending on the trust document, adjustments may be possible if allowed by the original plan. Always consult legal guidance to navigate the provisions of the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust when considering changes.

A beneficiary can serve as a trustee, creating a dual role that helps align interests. This can enhance transparency, as the beneficiary will have a direct stake in the management of the trust. However, it is important to adhere to best practices and consider the implications of dual roles, especially regarding the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust.

Yes, a trustee and the sole beneficiary can indeed be the same person. This arrangement can simplify management and ensure that the beneficiary's needs are effectively met. However, it might lead to potential conflicts of interest, so clear documentation and adherence to the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust are essential.

A trustee can be an individual or an institution. Common choices include family members, friends, or a professional trust company. It's crucial to select someone trustworthy, responsible, and knowledgeable about managing the assets of the trust. Also, understanding the provisions of the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust should guide the selection.

One significant mistake parents often make is failing to communicate their intentions clearly with their children. It’s essential to explain how the trust works, the reasons behind it, and the responsibilities it entails. Moreover, they may overlook the importance of updating the trust as circumstances change. Keeping the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust current is vital for its effectiveness.

In South Carolina, a trust works by allowing a designated trustee to manage assets on behalf of the trust's beneficiaries according to the terms established in the trust document. The trust can be revocable or irrevocable, and it creates a legal separation between the assets and the grantor. Understanding the implications of the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust is critical for effective administration.

To assign a trustee, you must formally designate an individual or entity to take on this role within the trust agreement. This designation should include specific responsibilities and powers outlined in the trust document. When communicating changes such as the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust, clarity is key to prevent misunderstandings later.

In South Carolina, a certificate of trust is not generally required to be recorded. However, recording can provide an extra level of protection in certain situations. When dealing with matters related to the South Carolina Notice to Trustee of Assignment by Beneficiary of Interest in Trust, ensure that you have all the necessary documentation in order to avoid complications.