Tennessee Guaranty of Payment of Open Account

Description

How to fill out Guaranty Of Payment Of Open Account?

Are you in a situation where you require documents for either commercial or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers a vast array of form templates, such as the Tennessee Guaranty of Payment of Open Account, which can be crafted to meet state and federal regulations.

Once you locate the correct form, click on Acquire now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for your order using PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Tennessee Guaranty of Payment of Open Account at any time, if necessary. Just navigate to the needed form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and prevent mistakes. The service provides properly crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life a bit simpler.

- If you are already familiar with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Tennessee Guaranty of Payment of Open Account template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it pertains to the correct city/county.

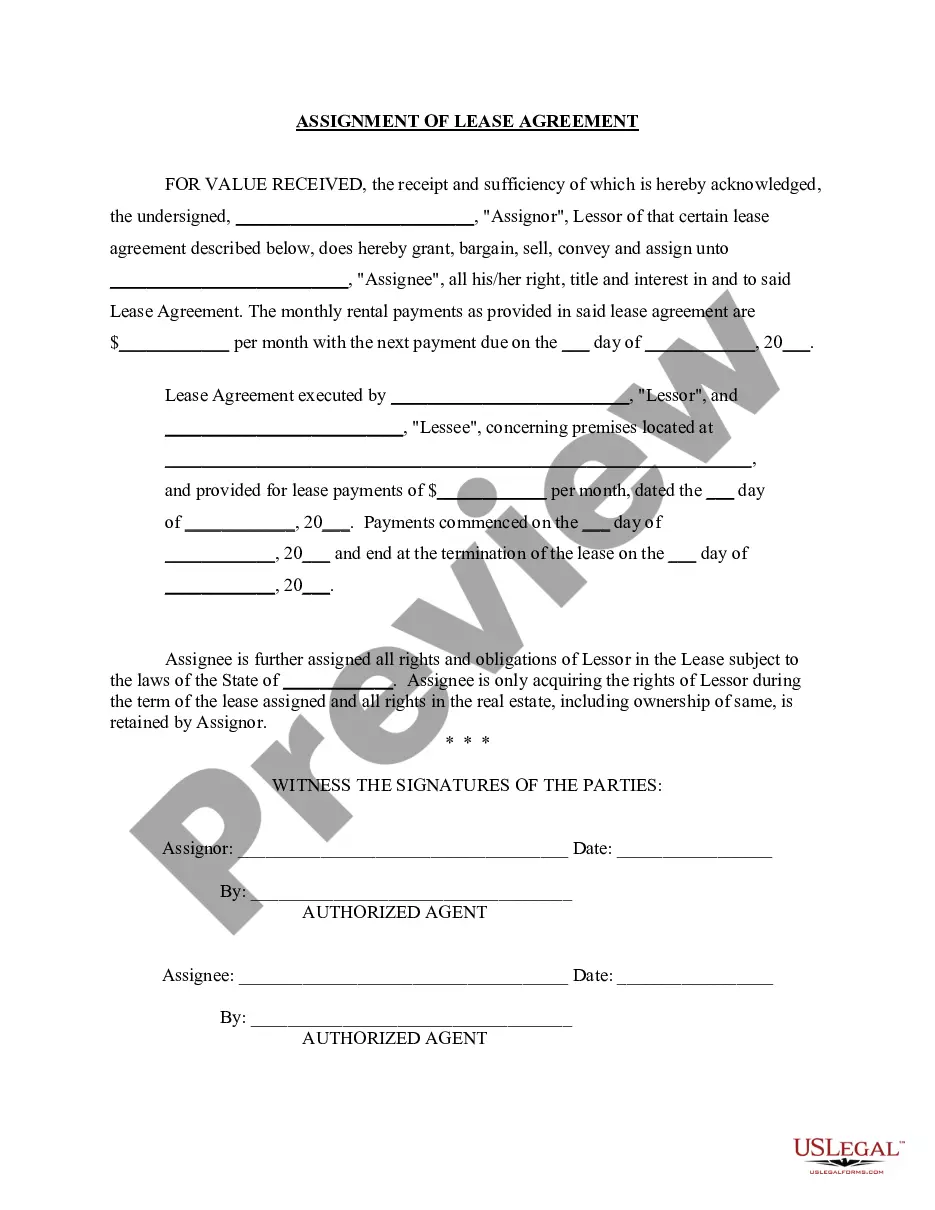

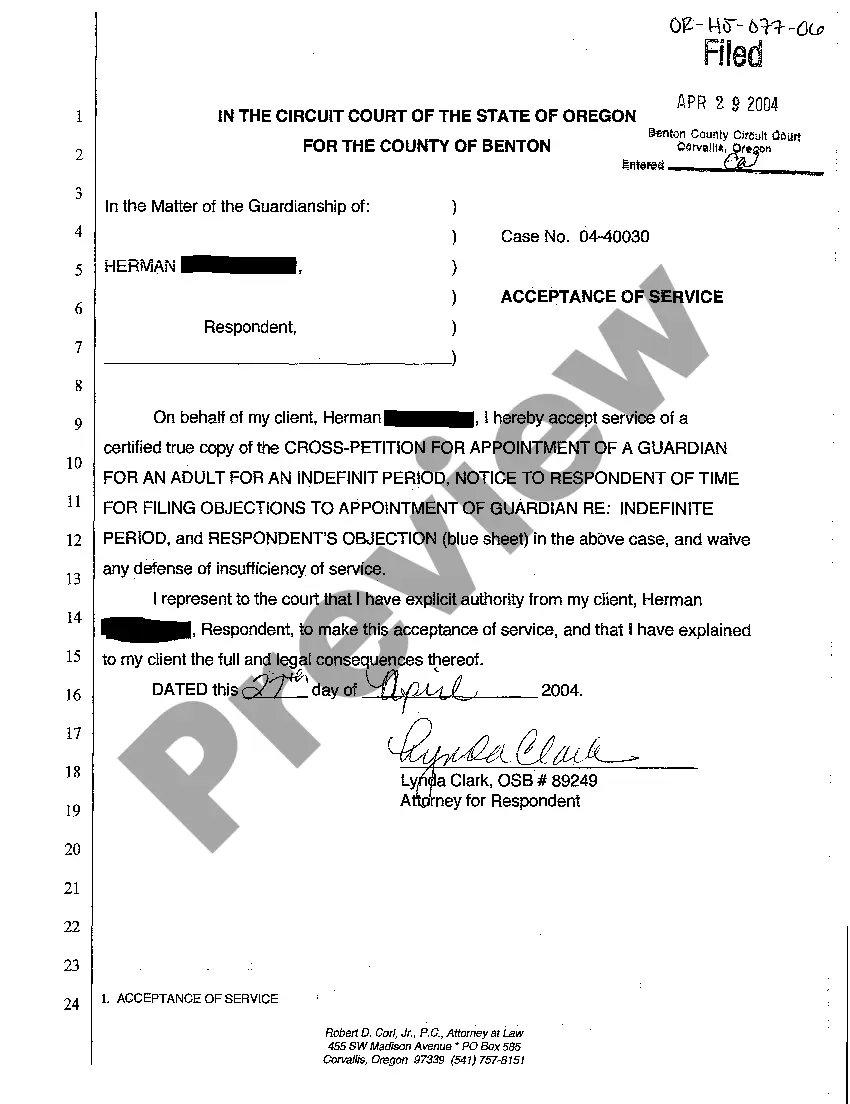

- Use the Preview button to review the form.

- Check the description to confirm that you have chosen the correct form.

- If the form is not what you need, utilize the Lookup field to find the form that suits your needs and specifications.

Form popularity

FAQ

No, you do not need an LLC to become a contractor in Tennessee; however, choosing to form one offers important benefits. Operating as an LLC can provide limited liability protection and can help separate your personal assets from your business liabilities. Incorporating the concept of Tennessee Guaranty of Payment of Open Account can also enhance your credibility, as it shows you take your financial obligations seriously.

Getting a contractor's license in Tennessee involves submitting an application along with proof of experience and passing a qualifying exam. Additionally, you must provide financial statements and comply with the regulations set by the Tennessee Board for Licensing Contractors. Knowing the Tennessee Guaranty of Payment of Open Account can further strengthen your application, as it demonstrates financial responsibility and stability.

To obtain a contractor's license in Tennessee, you must meet specific financial requirements, including demonstrating a minimum net worth. Typically, you need to provide proof of a certain amount of working capital and financial stability, ensuring that you can sustain your business. Understanding the Tennessee Guaranty of Payment of Open Account can help you secure additional financial backing by involving a guarantor.

A guaranty agreement is a legal document that ensures one party will fulfill the financial obligations of another if they fail to do so. In the context of Tennessee Guaranty of Payment of Open Account, this agreement protects businesses by allowing them to seek payment from a guarantor when a primary debtor defaults. This arrangement not only provides security to creditors but also establishes trust between parties involved.

In Tennessee, builders are generally liable for their work for a duration of four years from the completion date. This time period allows homeowners to address any defects or issues that arise. Being aware of the Tennessee Guaranty of Payment of Open Account can help builders understand their financial obligations and encourage prompt resolutions to disputes. Staying informed leads to better outcomes.

In Tennessee, homeowners can perform repairs up to $25,000 without requiring a contractor license, whereas contractors must have a license for work exceeding this amount. This is vital for staying compliant with state regulations. The Tennessee Guaranty of Payment of Open Account plays a significant role in ensuring that payment obligations are met regardless of whether a license is required. It’s beneficial to understand these laws and stay informed.

A personal guarantee in Tennessee signifies that the contractor is personally liable for the debts incurred while operating their business. This is crucial for establishing trust with clients and financial institutions. Comprehending the Tennessee Guaranty of Payment of Open Account can help ensure that contractors meet their payment obligations, showcasing financial responsibility. It may serve as a strong selling point when seeking contracts.

Yes, a contractor can face criminal charges in Tennessee for various reasons, including fraud or failing to comply with state laws. This underscores the importance of maintaining transparency and adherence to regulations. Understanding the Tennessee Guaranty of Payment of Open Account can provide contractors clarity on their financial responsibilities and protect them from potential legal issues. Staying informed is always a wise choice.

In Tennessee, a contractor's liability for their work often extends for a period of four years starting from the date of completion. This means that if there are issues with the work performed, you can seek remedies within this timeframe. It is essential to understand the implications of the Tennessee Guaranty of Payment of Open Account, as it outlines payment obligations and keeps everyone accountable. Being informed can save you significant stress later on.

In Tennessee, the monetary limit for a contractor's license varies based on the classification of the license. Generally, contractors can work on projects up to $3 million without needing a license. However, for larger projects, you will need to adhere to the legal requirements under the Tennessee Guaranty of Payment of Open Account. It is crucial to ensure compliance to avoid financial and legal issues.