A license gives the permission of the owner to an individual or an entity to use real property for a specific purpose. A license is not an interest in land, but is a privilege to do something on the land of another person. Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another

Description

How to fill out License Agreement Allowing The Operation Of Washing, Drying, And Laundry Equipment On Real Property Of Another?

Selecting the most suitable valid document template can be challenging.

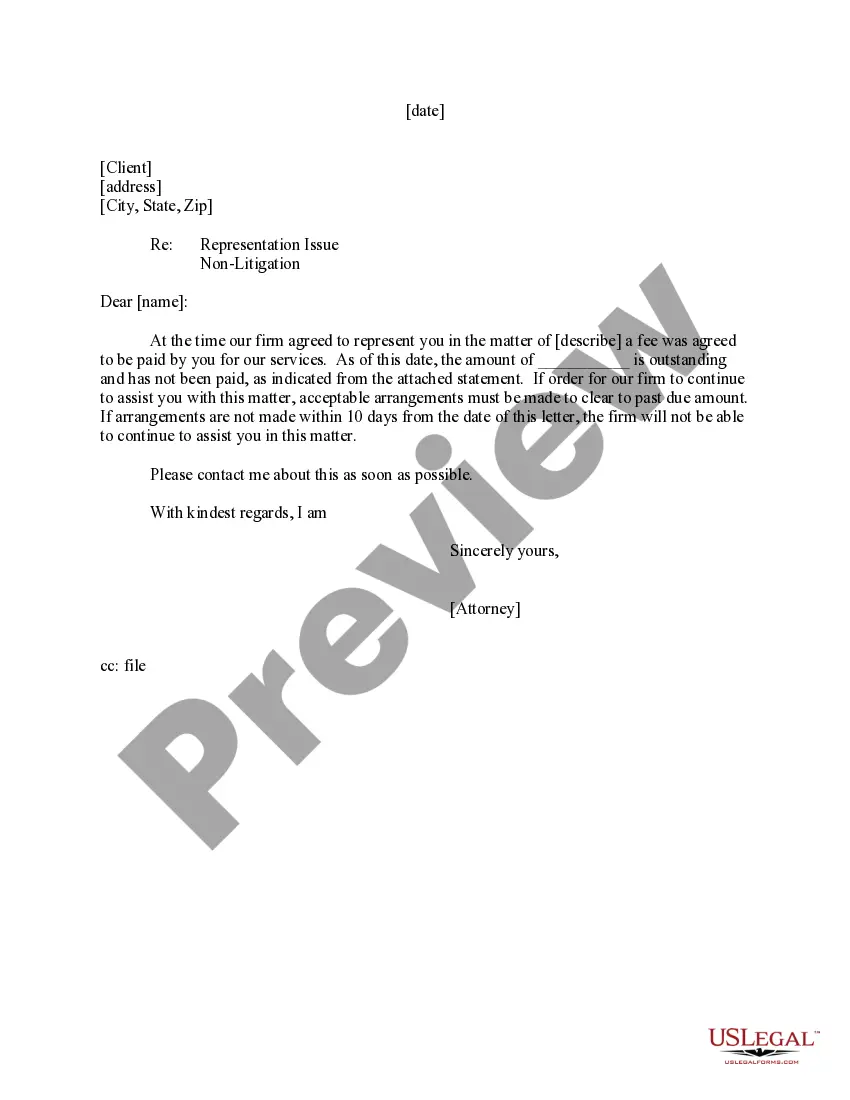

Certainly, there are numerous templates accessible on the internet, but how do you find the correct one you require? Utilize the US Legal Forms website.

The service provides thousands of templates, including the South Carolina License Agreement Authorizing the Use of Washing, Drying, and Laundry Equipment on Another's Real Estate, which you can use for business and personal purposes.

- All of the documents are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the South Carolina License Agreement Authorizing the Use of Washing, Drying, and Laundry Equipment on Another's Real Estate.

- Use your account to review the legal templates you have previously purchased.

- Navigate to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct template for your city/area. You can view the form using the Review button and read the form description to confirm it is the right one for your needs.

Form popularity

FAQ

Yes, maintenance services are generally taxable in South Carolina when they relate to tangible personal property. This includes services that maintain or repair equipment used in washing and drying operations. If you're planning to use a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, be sure to factor in these tax implications for compliance.

Most professional services in South Carolina, including legal and consulting services, are not subject to sales tax. However, some exceptions exist, particularly if the service involves tangible personal property. When engaging in a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, it's advisable to clarify whether your specific services will incur tax.

Certain items and services are exempt from sales tax in South Carolina. For example, grocery food, certain prescription medications, and some medical equipment fall into this category. However, businesses that use a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another should carefully review exemptions to ensure compliance and proper billing.

In South Carolina, various services are subject to sales tax, including those related to personal property and certain lease agreements. Notably, services such as repair and maintenance of tangible personal property are generally taxable. When forming a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, it's essential to consider how these tax regulations might apply.

Section 12-36-2120-83 in South Carolina addresses the specific conditions under which a license agreement allows the operation of washing, drying, and laundry equipment on real property owned by another party. This statute sets forth the legal framework for such agreements, outlining the responsibilities and rights of both property owners and equipment operators. Understanding this section is crucial for anyone looking to establish a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another.

In South Carolina, equipment rental generally falls under sales tax regulations. This includes rentals associated with laundry services; if you enter into a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, you may need to factor in applicable taxes. It's advisable to clarify these points to ensure compliance and proper financial planning.

Yes, malicious injury to property can be classified as a felony in South Carolina depending on the extent of the damage. This law is important for individuals and businesses operating under any agreements, including a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another. Understanding such legal implications can safeguard your operations from potential legal consequences.

SC Code 12 36 910 A outlines definitions related to the sales and use tax within South Carolina. This code is essential for businesses to understand, as it affects various transactions involving equipment and services, including those potentially governed by a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another. Staying informed ensures you operate within legal frameworks.

SC Code 12 36 920 addresses the taxation of certain services and property in South Carolina. This section specifies details related to the taxable nature of various transactions and services, potentially impacting operators of laundry equipment. If you are navigating the landscape of a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, familiarize yourself with these codes to ensure compliance.

Conditional discharge in South Carolina refers to a legal option for individuals convicted of certain minor offenses. Instead of serving jail time, the court may grant a chance to complete probation under specific conditions, leading to potential dismissal of charges. If you’re involved in operations under a South Carolina License Agreement Allowing the Operation of Washing, Drying, and Laundry Equipment on Real Property of Another, understanding your legal rights can be crucial.