South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property

Description

How to fill out Agreement Appointing An Agent To Collect Payments Owed Pursuant To Leases Of Real Property?

If you need to summarize, procure, or print sanctioned document formats, utilize US Legal Forms, the premier assortment of legal forms available online.

Employ the site’s straightforward and user-friendly search to find the documents you need.

A range of templates for corporate and personal purposes are organized by categories and jurisdictions, or keywords.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of your legal document and download it to your device.

- Utilize US Legal Forms to discover the South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property with just a few clicks.

- If you’re already a US Legal Forms customer, Log In to your account and click the Download button to access the South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property.

- You can also access forms you previously purchased in the My documents tab of your account.

- If it is your first time using US Legal Forms, refer to the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/region.

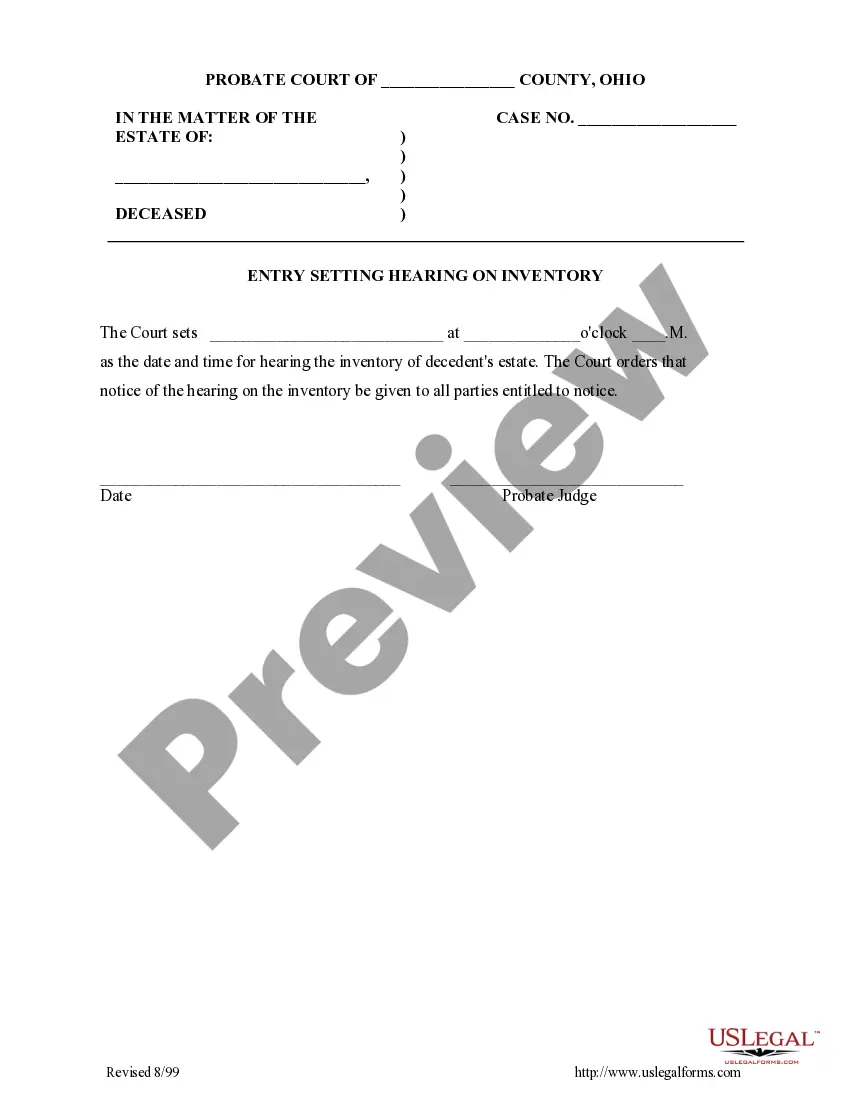

- Step 2. Use the Preview feature to review the form’s content. Don’t forget to read the description.

- Step 3. If you are not satisfied with the document, employ the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have identified the form you need, click the Get now button. Choose the payment plan you prefer and input your credentials to sign up for an account.

Form popularity

FAQ

To file a lien on property in South Carolina, you must complete a lien form that details the debt and property in question. Once filled, submit this form to the appropriate county clerk’s office for recording. The South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property can provide guidance and legal backing throughout this process, ensuring compliance with state regulations. Ensuring all information is accurate will facilitate smoother processing of the lien.

Filing a lien in South Carolina typically takes a few days to prepare and submit the necessary documents. Once you file the lien with the county, it can be recorded within a week. However, using the South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property might expedite this process, ensuring everything is correctly in order. Keep in mind, the actual time can vary depending on the county’s workload and procedures.

To put a lien on a property in South Carolina, you need to file a written notice with the appropriate county office. This notice should include specific details about the debt owed, as well as the property information. Utilizing a South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property can help streamline the process, ensuring you follow all legal requirements. It’s essential to understand that inaccurate filings can delay the collection process.

In South Carolina, landlords are responsible for maintaining safe and habitable living conditions for tenants, which includes addressing necessary repairs and ensuring that the property meets health and safety codes. They must also provide proper notice before entering the property, typically requiring a 24-hour notice unless there's an emergency. Furthermore, landlords must return security deposits within the stipulated timeframe after tenancy ends. Utilizing tools like the South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property can streamline rental management and payment collection.

In South Carolina, a 30-day notice is typically required for both landlords and tenants wishing to terminate a month-to-month lease. However, the specifics may vary based on the terms outlined in the lease agreement. For fixed-term leases, notice requirements may differ, depending on any specific terms indicated. To ensure compliance with these regulations, refer to the South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property for managing any required notices.

Yes, South Carolina is often regarded as a landlord-friendly state due to its laws which generally favor property owners. The state provides landlords with significant rights regarding lease enforcement and property management. However, it is vital for landlords to stay informed about tenant rights and local regulations to avoid potential legal complications. Using resources like the South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property can assist landlords in efficiently handling payment collections.

Breaking a lease in South Carolina typically requires valid grounds, such as a covered circumstance under state law or the lease agreement itself. Tenants should carefully review their lease for any early termination clauses that may specify the process and penalties involved. Additionally, it’s essential to communicate with the landlord to mitigate any potential disputes. To simplify this process, consider utilizing a South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property.

Section 44 33 34 of the South Carolina Code of Law deals with the regulations surrounding housing and health standards. This section ensures that rental properties meet safety and habitat standards for tenants. Being knowledgeable about this section can enhance your South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property, promoting healthier living conditions.

41 10 30 of the SC Code of Laws 1976 pertains to statutes regarding wage garnishment and employee rights. It protects employees in South Carolina against excessive deductions from their earnings. Understanding how this affects your financial agreements is key when crafting any South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property.

Section 40-57-350 of the SC Code of Laws focuses on the duties and responsibilities of real estate agents in South Carolina. It outlines necessary ethical obligations that ensure agents act in their clients' best interests. This section plays a critical role in executing a South Carolina Agreement Appointing an Agent to Collect Payments Owed Pursuant to Leases of Real Property responsibly.