South Carolina Credit Agreement

Description

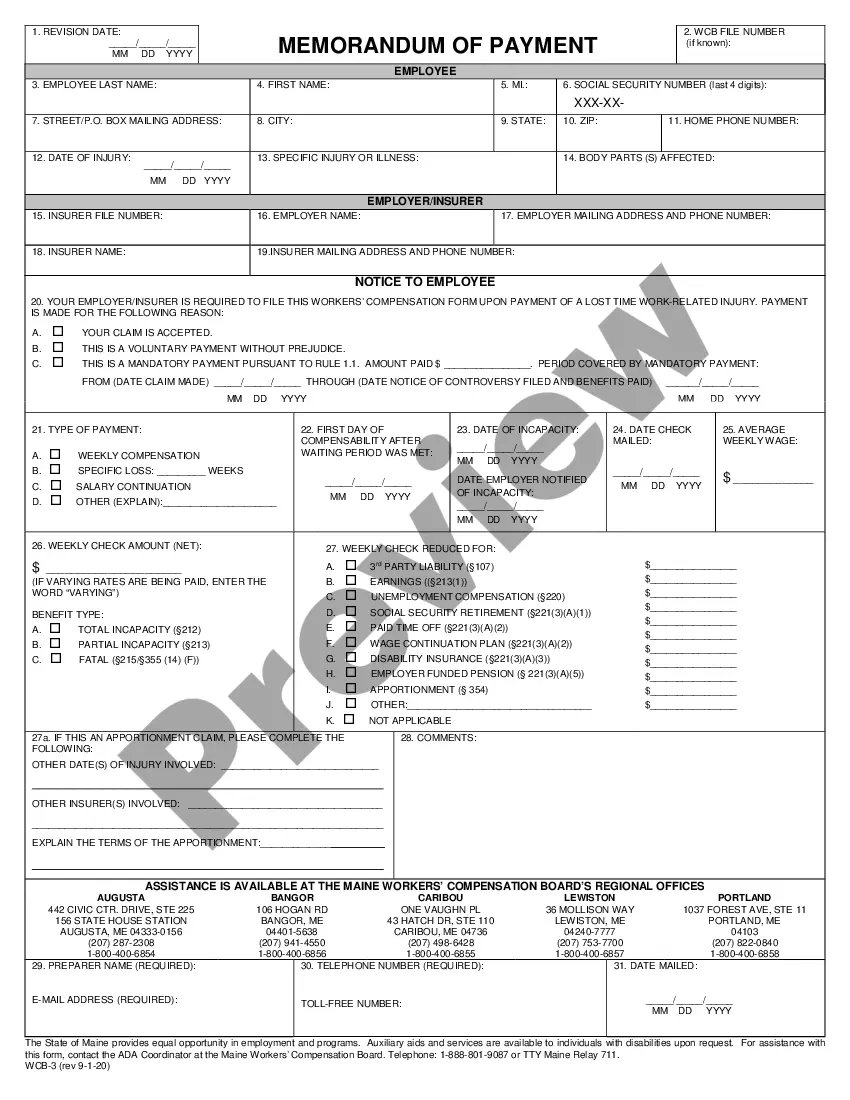

How to fill out Credit Agreement?

You may spend hours online searching for the legal document template that complies with the state and federal standards you require.

US Legal Forms offers numerous legal forms that are vetted by professionals.

You can obtain or print the South Carolina Credit Agreement from my service.

If available, use the Preview button to view the document template as well. If you're looking for another version of the form, utilize the Lookup field to find the template that fits your needs and specifications. Once you’ve located the template you need, click Buy now to proceed. Select the pricing plan you want, enter your details, and register for an account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to your document if necessary. You can fill out, modify, sign, and print the South Carolina Credit Agreement. Download and print thousands of document templates using the US Legal Forms site, which offers the largest collection of legal forms. Take advantage of professional and state-specific templates to address your business or personal needs.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can fill out, modify, print, or sign the South Carolina Credit Agreement.

- Each legal document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click on the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your choice.

- Review the form details to ensure you have chosen the right form.

Form popularity

FAQ

Interest Rates Laws in South Carolina Code SectionSouth Carolina Code of Laws 34-31-20: Legal Rate of InterestLegal Maximum Rate of Interest8.75% (§34-31-20)Penalty for Usury (Unlawful Interest Rate)Usury penalty laws repealed June 25, 1982, but old law may apply to transactions before then (formerly §34-31-50)2 more rows

In South Carolina mortgage debt has a statute of limitations of 20 years. This is quite long compared to consumer debt such as credit card debt, which has a statute of limitations of 3 years. Medical debt also holds a statute of limitations of 3 years, while auto loan debt is 6, and state tax debt is 10.

Summary Court in South Carolina is also known as Magistrate Court - the Judge is called a Magistrate. Credit card companies, finance companies and other debt collectors (called "creditors") can file lawsuits to collect debt from you in these courts if the amount is less than $7500.

Some states offer more protection for debtors. In South Carolina, your employer can't fire you for an attempted garnishment that results from "consumer debt." (S.C. Code Ann.

Once you sign a contract, you have an obligation to pay. Although some people think so, there is no three-day right to rescind automobile sales. No such automatic rescission rights exist.

Residents of South Carolina fall under the Federal Debt Collections Protection Act, which prohibits collection agencies from harassing borrowers or using unfair or misleading tactics to collect debts.

Setoff Debt & GEAR? South Carolina law requires the SCDOR to assist qualifying entities in collecting debts through two collection programs: Setoff Debt and GEAR. Setoff Debt allows the SCDOR to assist in collecting debts owed to claimant agencies by garnishing South Carolina Individual Income Tax refunds.

The Right to Cure Act is a product of the South Carolina Legislature, which decided that some construction lawsuits might be avoided if the homeowner was first required to give the contractor notice of the alleged defect and to give that contractor the right to fix, or ?cure? the problem.