South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift

Description

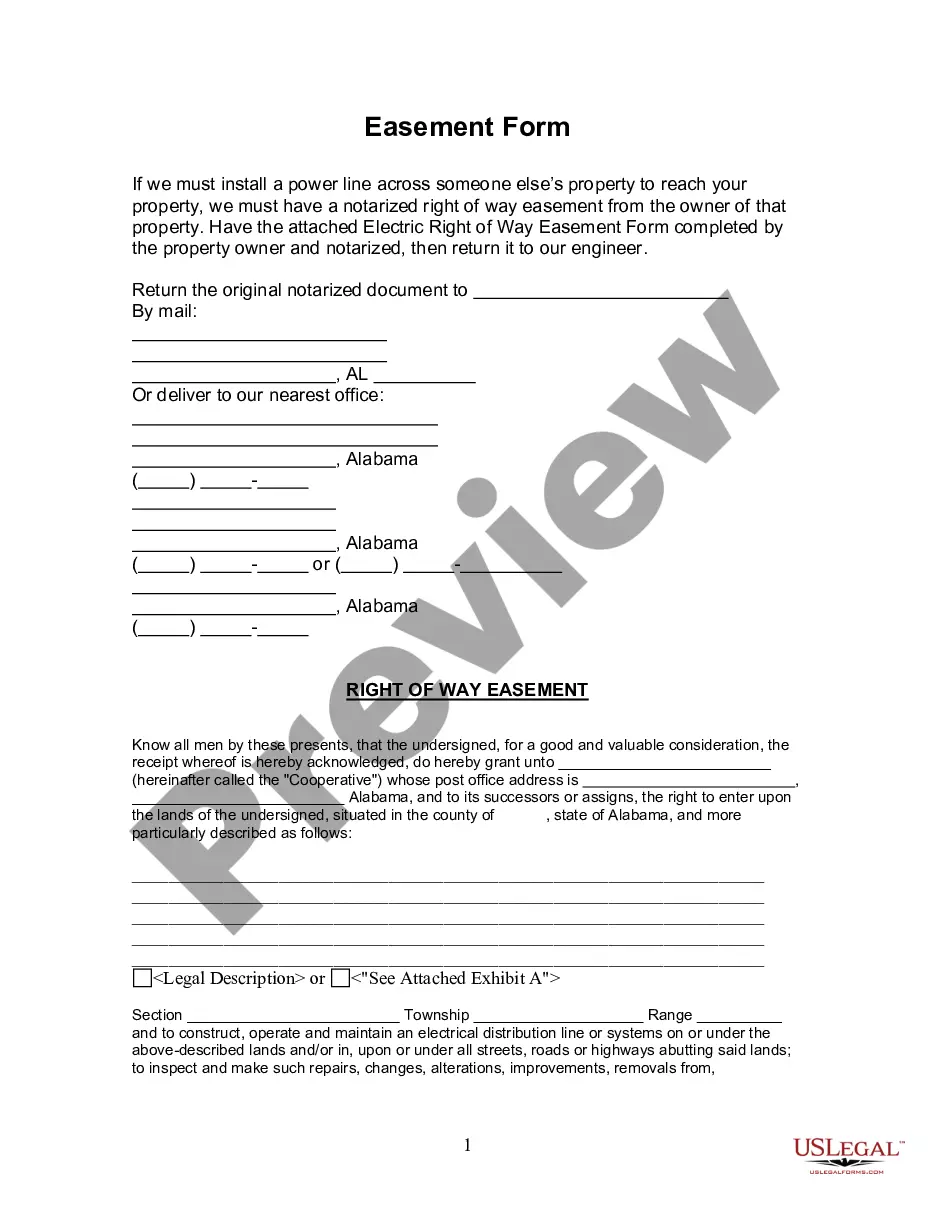

How to fill out Acknowledgment By Charitable Or Educational Institution Of Receipt Of Gift?

Selecting the appropriate legal document format can be a challenge. Naturally, there are numerous online templates available on the web, but how can you find the legal form you require? Utilize the US Legal Forms website. The service offers a vast array of templates, such as the South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift, suitable for both business and personal needs. Each of the forms is reviewed by professionals and meets state and federal regulations.

If you are already registered, Log In to your account and click on the Obtain button to access the South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift. Use your account to browse the legal forms you have previously purchased. Go to the My documents section of your account to retrieve another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions to follow: First, ensure you have chosen the correct form for your city/state. You can examine the form using the Preview feature and read the form description to confirm it is suitable for you. If the form does not meet your requirements, use the Search area to find the appropriate form. Once you are confident that the form is correct, click on the Get now button to acquire the form. Choose the pricing plan you need and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Select the document format and download the legal document format to your device. Fill out, modify, print, and sign the obtained South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift.

Take advantage of US Legal Forms to access a comprehensive selection of legal forms that meet your needs.

- US Legal Forms is the largest repository of legal forms where you can find a variety of document templates.

- Utilize the service to obtain well-crafted documents that adhere to state regulations.

- Ensure you have selected the correct document format.

- Review the form description carefully to ensure it meets your requirements.

- Use the search function to find suitable forms if necessary.

- Complete the payment process securely to obtain your documents.

Form popularity

FAQ

A contemporaneous written acknowledgment of a charitable gift must include the donor's name, the amount of the gift, and a statement indicating whether any goods or services were exchanged. This South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift should be provided within a reasonable time frame, typically by the end of the tax year. By ensuring these elements are present, organizations can maintain compliance and foster donor trust.

A short donation message could read, 'Thank you for your generous support! Your gift of $250 makes a significant impact on our programs.' Such a message can be included in a card or email. It’s essential to follow up with a more formal South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift for tax documentation, ensuring the donor feels appreciated and informed.

An example of a written acknowledgment for charitable contributions could be a letter stating, 'We acknowledge receipt of your generous donation of $1,000 made on January 1, 2023. Thank you for supporting our mission at Organization Name. This South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift serves as your official receipt for tax purposes.' This formality assures the donor that their contribution is recognized.

To write a letter acknowledging a donation, start with a warm greeting and express gratitude for the donor's support. Next, include specific details about the donation, such as the amount and designation of the gift. Finally, mention how this contribution will impact your organization, reinforcing the importance of the South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift for tax purposes and donor appreciation.

A written acknowledgment of charitable contributions typically includes the name of the donor, the amount donated, and a statement indicating that no goods or services were provided in exchange for the gift. For instance, a South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift might state, 'Thank you for your generous donation of $500. Your support helps us achieve our mission.' This format ensures clarity and meets IRS requirements.

Gift law in South Carolina outlines the rules and regulations surrounding the giving of gifts. Generally, gifts made to individuals are not subject to taxation, but there are limits to consider, especially for large donations. If you donate to a charitable or educational institution, obtaining a South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift can provide you with necessary documentation for tax purposes. This ensures your generosity is recognized and recorded appropriately.

In South Carolina, the order of inheritance follows a specific legal hierarchy. If someone passes away without a will, the estate typically goes to the surviving spouse and children first. If there are no children, the estate may pass to parents or siblings. Understanding how inheritance works can help you plan your estate, and using a South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift can clarify gifts made during your lifetime.

Yes, you can gift a car to your daughter in South Carolina. To do so, you must complete the necessary paperwork, including a title transfer, to ensure proper ownership. Additionally, consider obtaining a South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift to document the transaction if it's part of a charitable contribution. This will help clarify the nature of the gift and may benefit you during tax season.

In South Carolina, a donation receipt is typically required for tax purposes. When you make a gift to a charitable or educational institution, they should provide you with a South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift. This document serves as proof of your contribution and can help you claim deductions on your taxes. It's essential to keep this receipt for your records.

For a Qualified Charitable Distribution (QCD), you need to provide documentation that confirms the donation was made directly from an IRA to a qualified charity. This includes the South Carolina Acknowledgment by Charitable or Educational Institution of Receipt of Gift, which verifies the amount and recipient of the donation. It is also helpful to maintain records of the transaction for tax reporting purposes. US Legal Forms can guide you in creating the appropriate acknowledgment and documentation.