This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

South Carolina Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

Finding the appropriate legal document template can be challenging. Clearly, there are numerous templates available online, but how do you find the legal form you require? Utilize the US Legal Forms website. The service provides thousands of templates, including the South Carolina Application for Release of Right to Redeem Property from IRS After Foreclosure, which you can utilize for both business and personal purposes. All of the forms are reviewed by experts and comply with federal and state regulations.

If you are already registered, sign in to your account and click on the Download button to retrieve the South Carolina Application for Release of Right to Redeem Property from IRS After Foreclosure. Use your account to browse through the legal forms you may have acquired previously. Navigate to the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have chosen the correct form for your area/county. You can review the form using the Preview button and examine the form outline to confirm it is suitable for you. If the form does not meet your needs, utilize the Search field to find the correct form. Once you are certain the form is appropriate, click on the Get Now button to acquire the form. Select the payment plan you want and enter the required information. Create your account and pay for your order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained South Carolina Application for Release of Right to Redeem Property from IRS After Foreclosure.

Make use of this platform to ensure you have access to all necessary legal documentation.

- US Legal Forms is the largest collection of legal forms where you can find various document templates.

- Utilize the service to obtain professionally crafted papers that comply with state regulations.

- Ensure you select the right form for your specific needs.

- Review your forms thoroughly before finalizing any downloads.

- Payment options include PayPal and credit cards for convenience.

- Always keep a copy of your completed documents for your records.

Form popularity

FAQ

If your real estate was seized and sold, you have redemption rights. You or anyone with an interest in the property may redeem your real estate within 180 days after the sale. This includes: your heirs, executors, administrators.

Generally, a Notice of Federal Tax Lien is active for ten years and thirty days from the date the tax liability is assessed. (See ?Self-Releasing Liens? section on page 4 of this publication.)

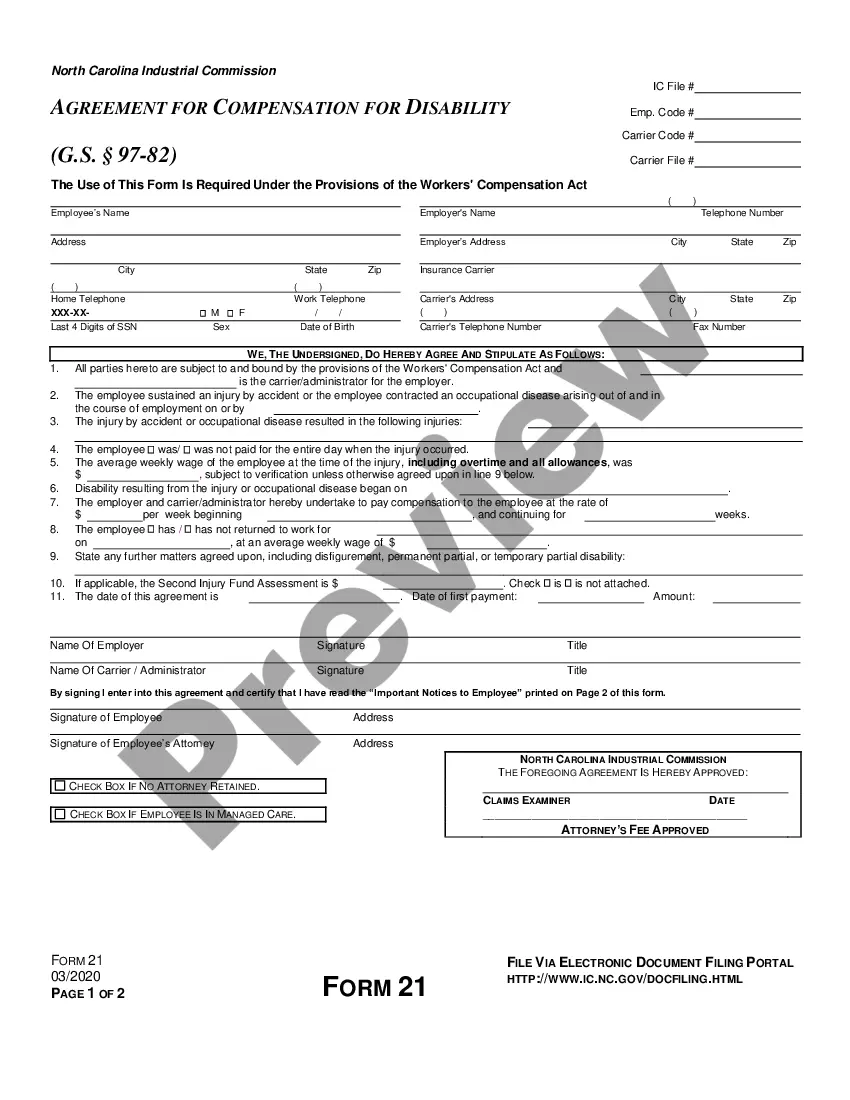

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

If you've paid your tax debt or fully paid your accepted Offer in Compromise and, if applicable, the outstanding amount of any related collateral agreement, and the lien was released, you can ask the IRS in writing to withdraw the lien.

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

If the Internal Revenue Service (IRS) has placed a tax lien on your property, once you've satisfied the debt, the IRS should notify you that the lien has been removed. To do so, the IRS should send you a ?Certificate of Release of Federal Tax Lien,? also known as Form 668(Z).

Help Resources. Centralized Lien Operation ? To resolve basic and routine lien issues: verify a lien, request lien payoff amount, or release a lien, call 800-913-6050 or e-fax 855-390-3530.

The removal of a lien on a motor vehicle or real property after the claim has been satisfied is referred to as a ?discharge of lien?.