South Carolina Certificate of Value of Real Estate for Bond

Description

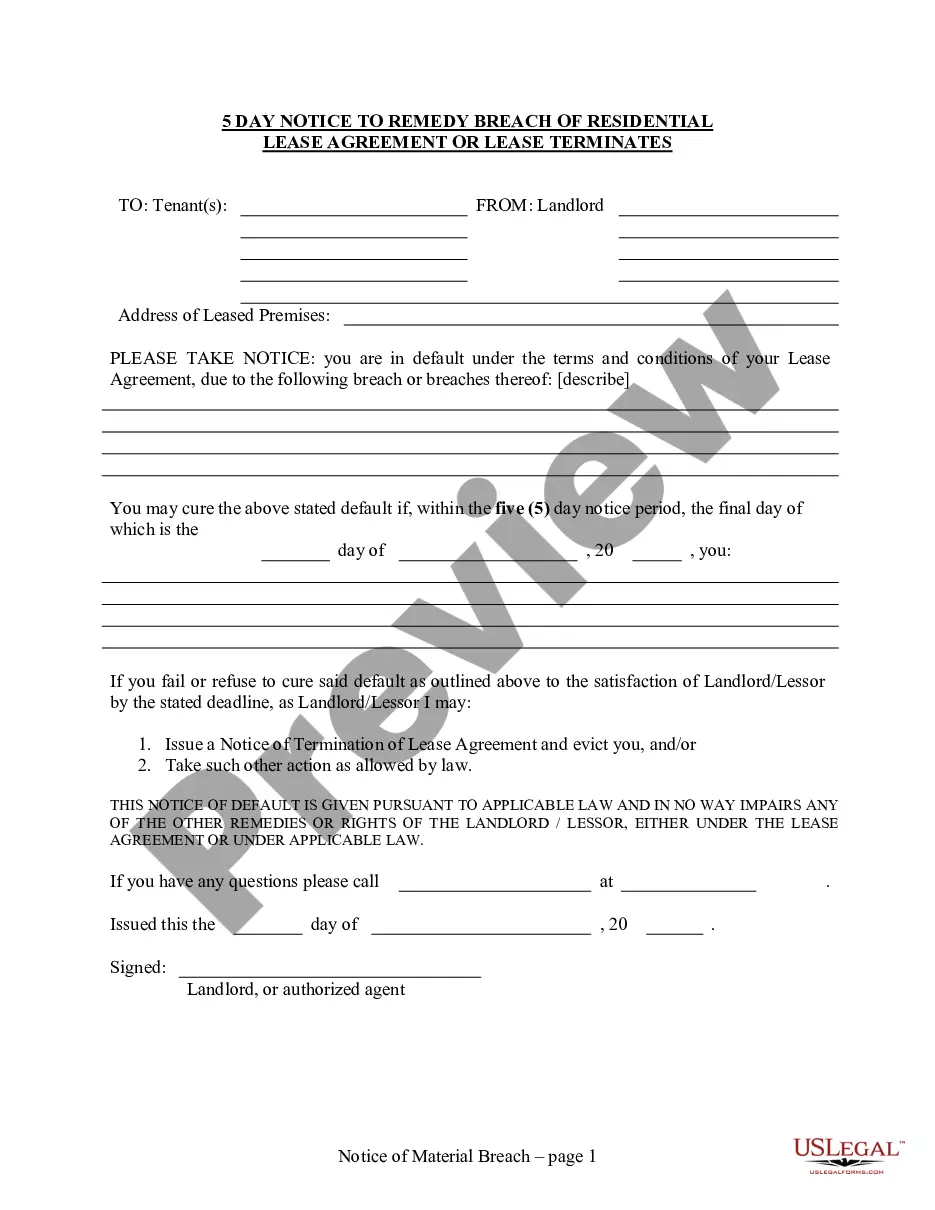

How to fill out South Carolina Certificate Of Value Of Real Estate For Bond?

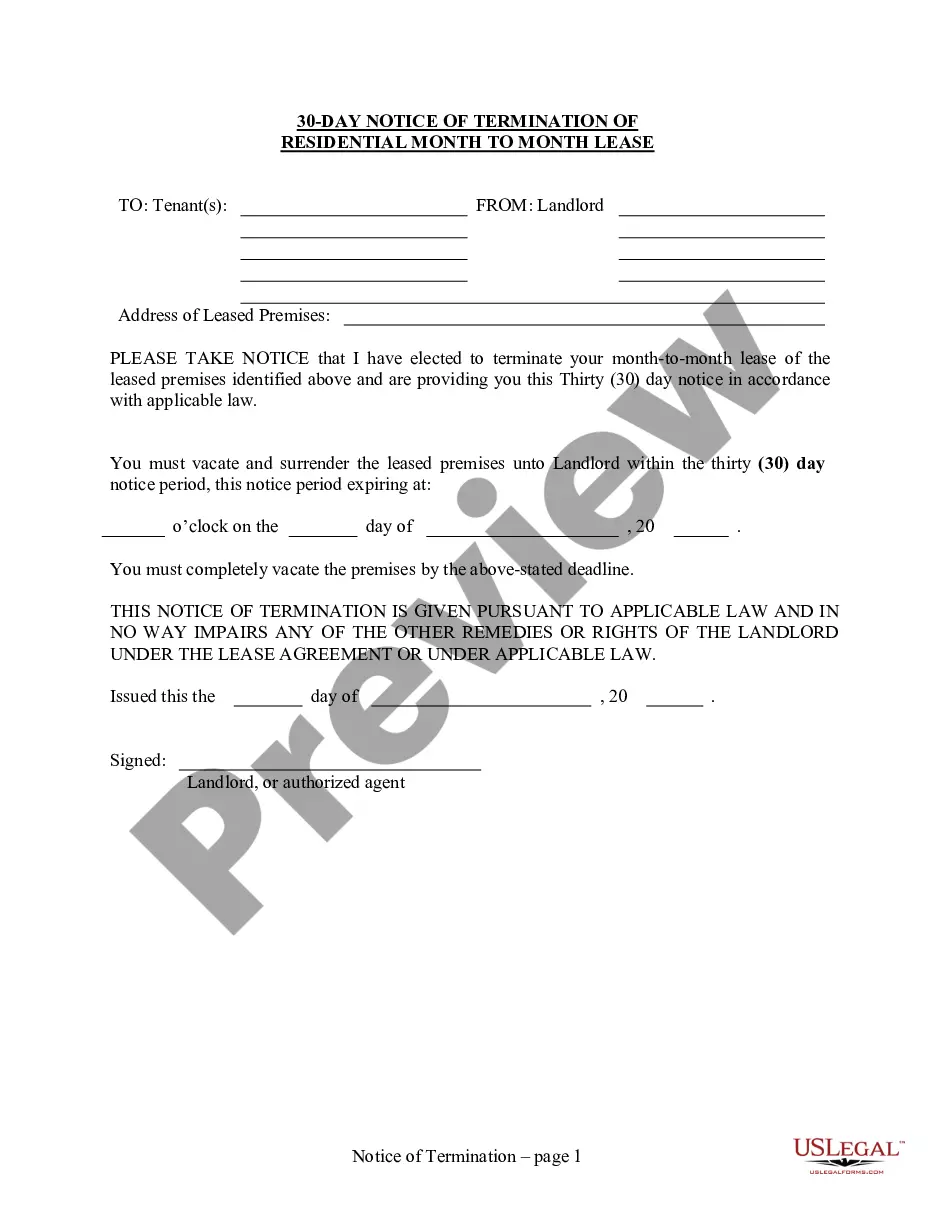

Handling official paperwork requires attention, precision, and using properly-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your South Carolina Certificate of Value of Real Estate for Bond template from our service, you can be sure it meets federal and state regulations.

Working with our service is simple and fast. To get the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guide for you to get your South Carolina Certificate of Value of Real Estate for Bond within minutes:

- Make sure to carefully examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Certificate of Value of Real Estate for Bond in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Create an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to prepare it electronically.

All documents are created for multi-usage, like the South Carolina Certificate of Value of Real Estate for Bond you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

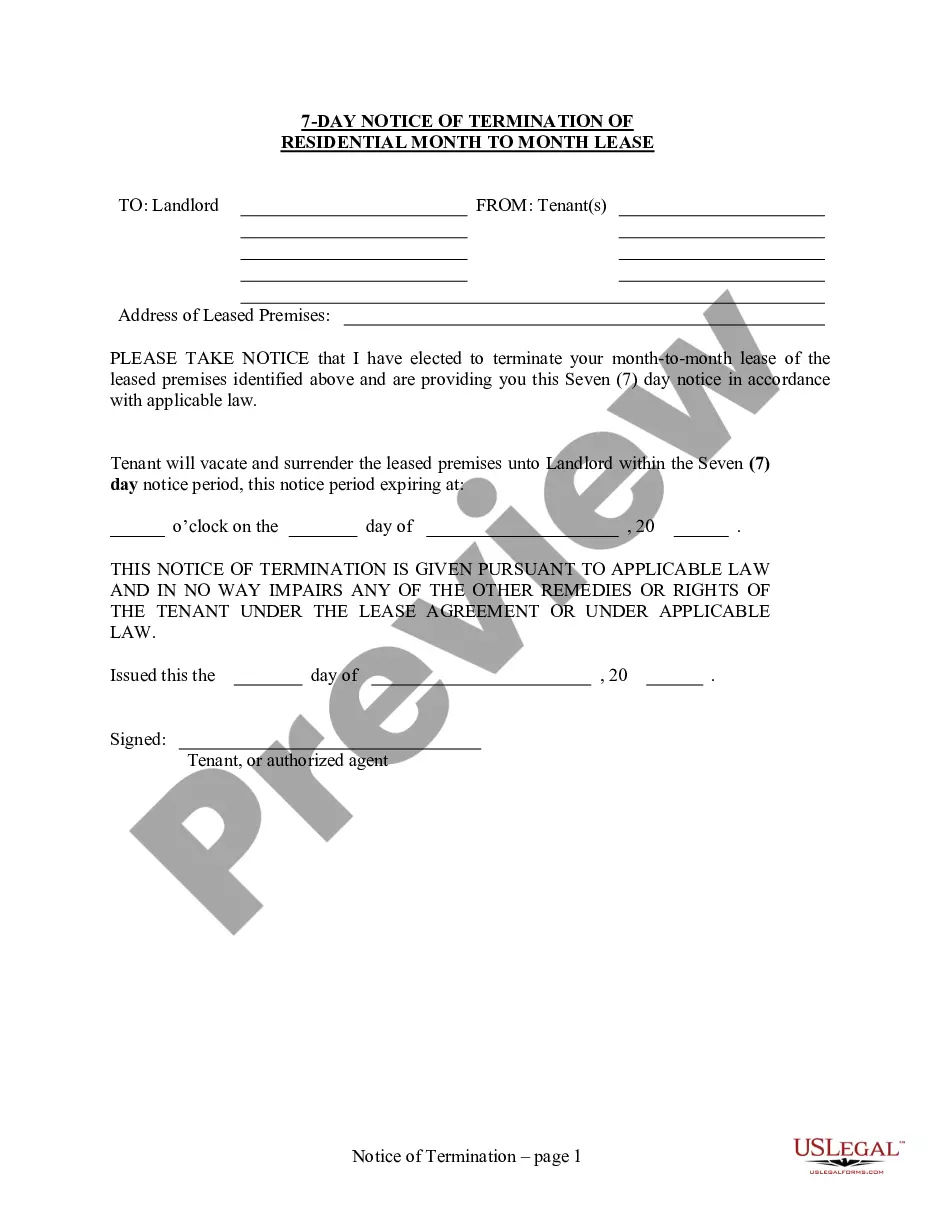

In South Carolina, the grantor must sign the deed in front of two witnesses and in the presence of an individual authorized by the state to administer an oath. Record the completed deed at the local county Recorder's office, along with an Affidavit of True Consideration (S.C. Code Ann.

The prior owner conveying the property is primarily responsible for payment, and the new owner is secondarily responsible. The deed-recording fee rate is $1.85 for each $500.00 of the real estate's value.

SECTION 12-24-70. Affidavits. (A)(1) The clerk of court or register of deeds shall require an affidavit showing the value of the realty to be filed with a deed. The affidavit required by this section must be signed by a responsible person connected with the transaction, and the affidavit must state that connection.

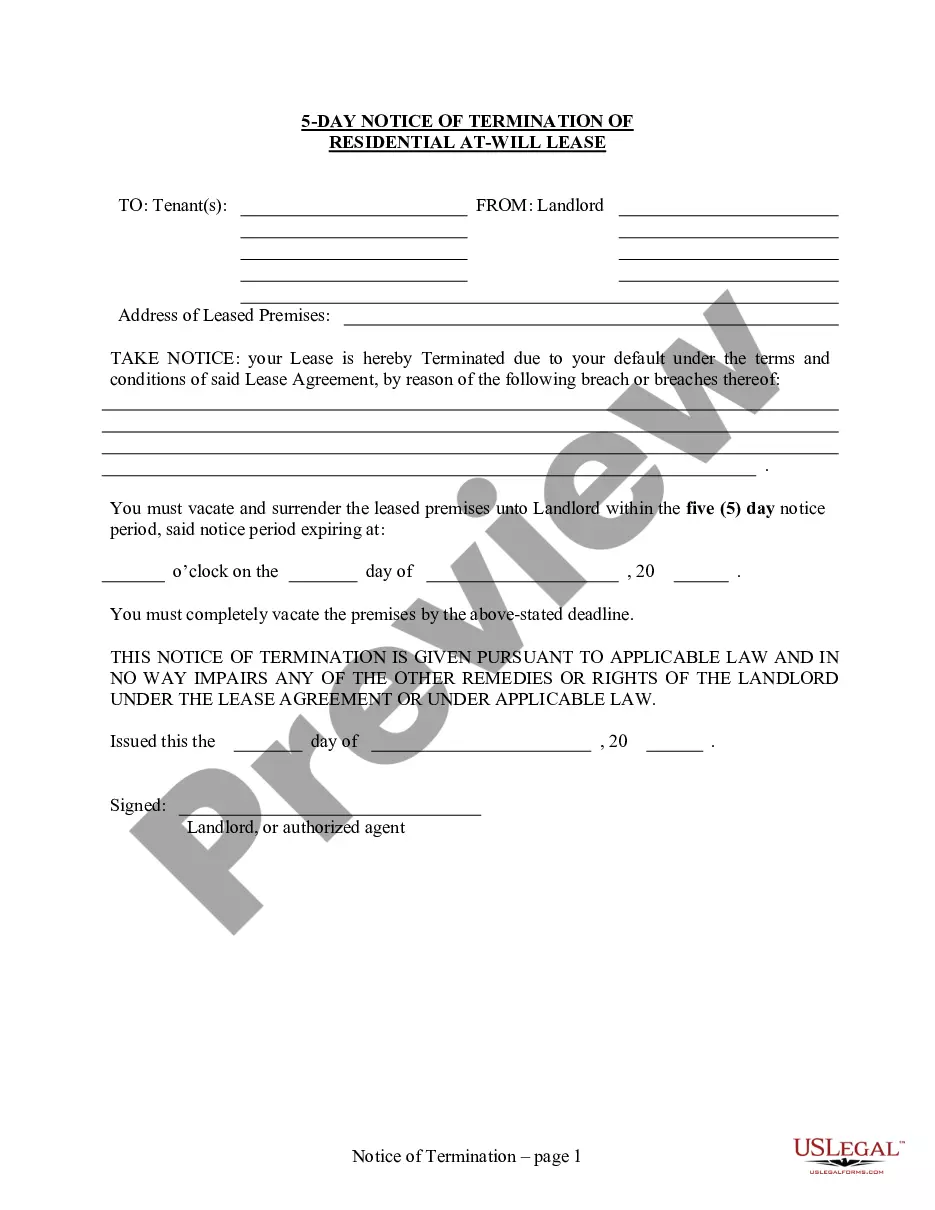

Although real estate transfer taxes are collected by your respective county, the rates remain constant throughout the state. The fees amount to $1.85 per $500, based on the amount that the property sold for. For example, if the property sold for $200,000, then $740 in real estate transfer taxes would be due.

In South Carolina, the formula for the transfer tax, mostly referred to as deed stamps, is $1.85 per $500 of consideration; this is the combined amount for city, county and state taxes. If the consideration is $100,000, the transfer tax is $370, and paid directly to the County Register of Deeds by the closing attorney.

For property valued between $100 and $500, the deed recording fee is at $1.85 of the realty's value. For property valued over $500, the rate is $1.85 per each $500 increment. A portion of the fee goes to the state, and the other goes to the county.

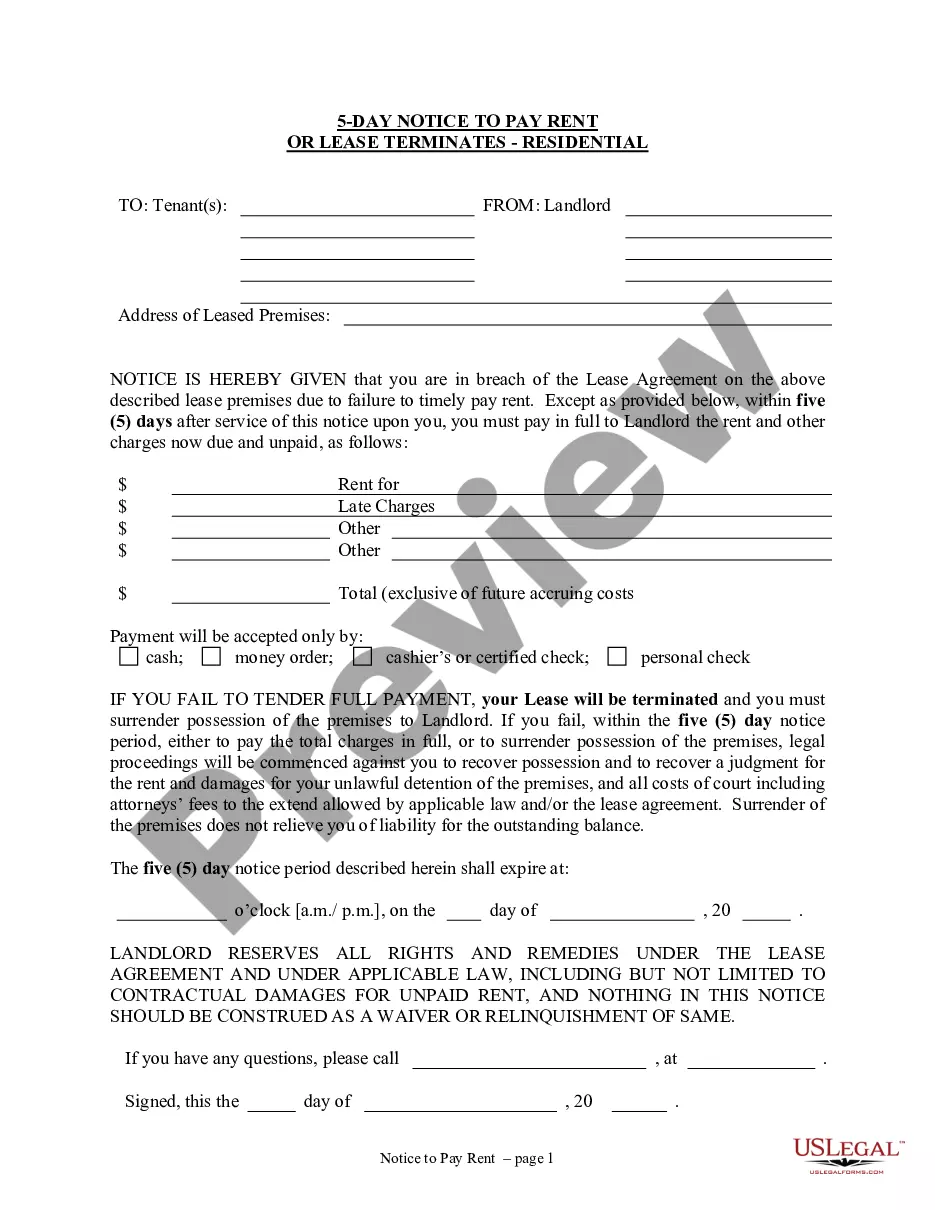

A mortgage bond is an investment traded by the lender to another party. The investment is backed by a grouping of mortgages. A mortgage loan is a secured contract made between a lender and a borrower on a property. The borrower must repay the borrowed amount of money plus interest over a period of time.

To obtain a title agency bond, apply online through our application tool. Your application will be processed, and we will contact you within a short amount of time with a quote on your bond. Call us at (877)-514-5146 anytime if you have any questions about your bond.