South Carolina Petition for Allowance of Claim

Description

How to fill out South Carolina Petition For Allowance Of Claim?

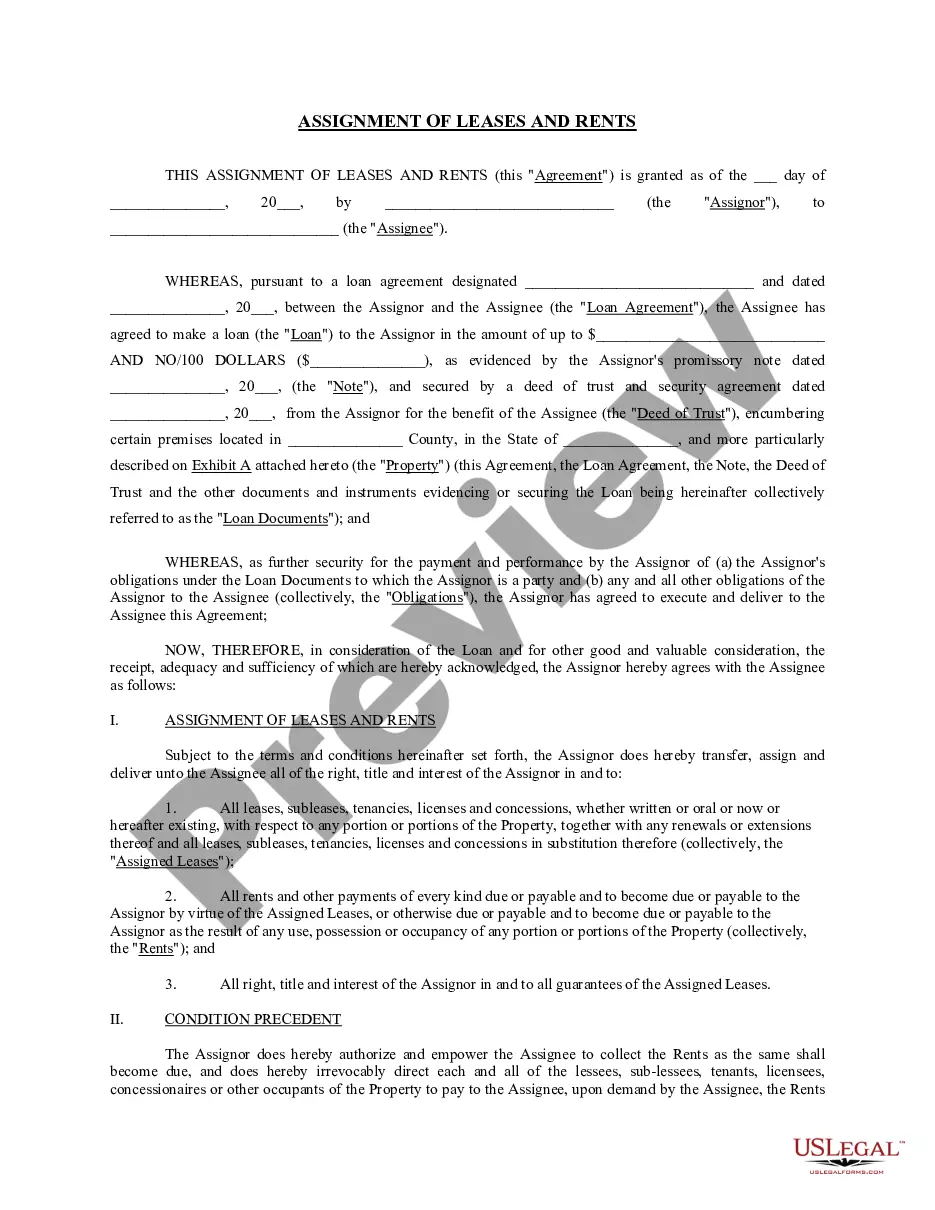

Preparing official paperwork can be a real stress unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are examined by our specialists. So if you need to prepare South Carolina Petition for Allowance of Claim, our service is the best place to download it.

Getting your South Carolina Petition for Allowance of Claim from our service is as simple as ABC. Previously registered users with a valid subscription need only sign in and click the Download button once they find the correct template. Later, if they need to, users can use the same blank from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few minutes. Here’s a brief guideline for you:

- Document compliance check. You should carefully examine the content of the form you want and ensure whether it suits your needs and complies with your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If you find any inconsistencies, browse the library through the Search tab on the top of the page until you find a suitable template, and click Buy Now when you see the one you need.

- Account creation and form purchase. Sign up for an account with US Legal Forms. After account verification, log in and select your preferred subscription plan. Make a payment to continue (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina Petition for Allowance of Claim and click Download to save it on your device. Print it to complete your papers manually, or use a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily whenever you need to, and keep your paperwork in order!

Form popularity

FAQ

The appointment of a witness, a witness's spouse, or a witness's issue is valid, if otherwise so, and the individual so appointed, in such case, is entitled by law to take or receive any commissions or other compensation on account thereof.

SECTION 62-2-101. Intestate estate. Any part of the estate of a decedent not effectively disposed of by his will passes to his heirs as prescribed in the following sections of this Code.

In South Carolina, to collect from the estate, a creditor must file their claim either before 60 days from the mailing of the Written Notice of Creditors (sent by the estate's personal representative) or 8 months from the first publication of the Notice of Creditors in the newspaper, whichever is later.

Current through 2023 Act No. 5. Section 62-2-202 - Probate estate (a) For purposes of this Part, probate estate means the decedent's property passing under the decedent's will plus the decedent's property passing by intestacy, reduced by funeral and administration expenses and enforceable claims.

In South Carolina, creditors must file any claims against the estate by the earlier of 1 year from the decedent's death, the deadline provided in the generally published notice (i.e., 8 months from publication), or the deadline provided in any direct notification (i.e., 60 days from notification).

Creditors must ?present? claims arising before the decedent's death within the earlier of one year after the decedent's death or eight months after the date of the first publication of the notice to creditors. S.C. Code Ann. § 62?3?803.

Any executor, devisee, legatee, guardian, attorney, or other person who fails to deliver to the judge of the probate court having jurisdiction to admit it to probate any last will and testament, including any codicil or codicils thereto, upon conviction must be punished as for a misdemeanor.

Exempt property. The surviving spouse of a decedent who was domiciled in this State is entitled from the estate to a value not exceeding twenty-five thousand dollars in excess of any security interests therein in household furniture, automobiles, furnishings, appliances, and personal effects.