South Carolina UCC Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina UCC Financing Statement?

If you’re searching for a way to properly prepare the South Carolina UCC Financing Statement without hiring a legal professional, then you’re just in the right place. US Legal Forms has proven itself as the most extensive and reliable library of official templates for every individual and business scenario. Every piece of documentation you find on our online service is drafted in accordance with federal and state regulations, so you can be sure that your documents are in order.

Adhere to these straightforward guidelines on how to acquire the ready-to-use South Carolina UCC Financing Statement:

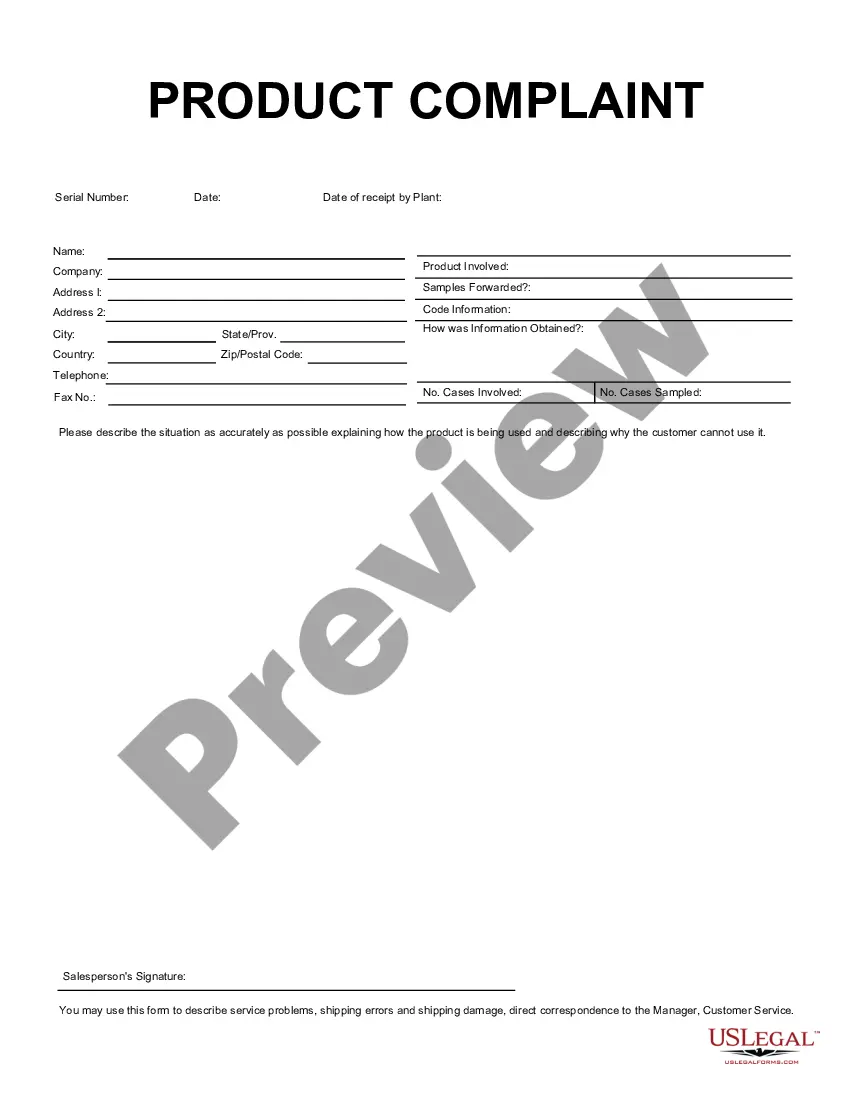

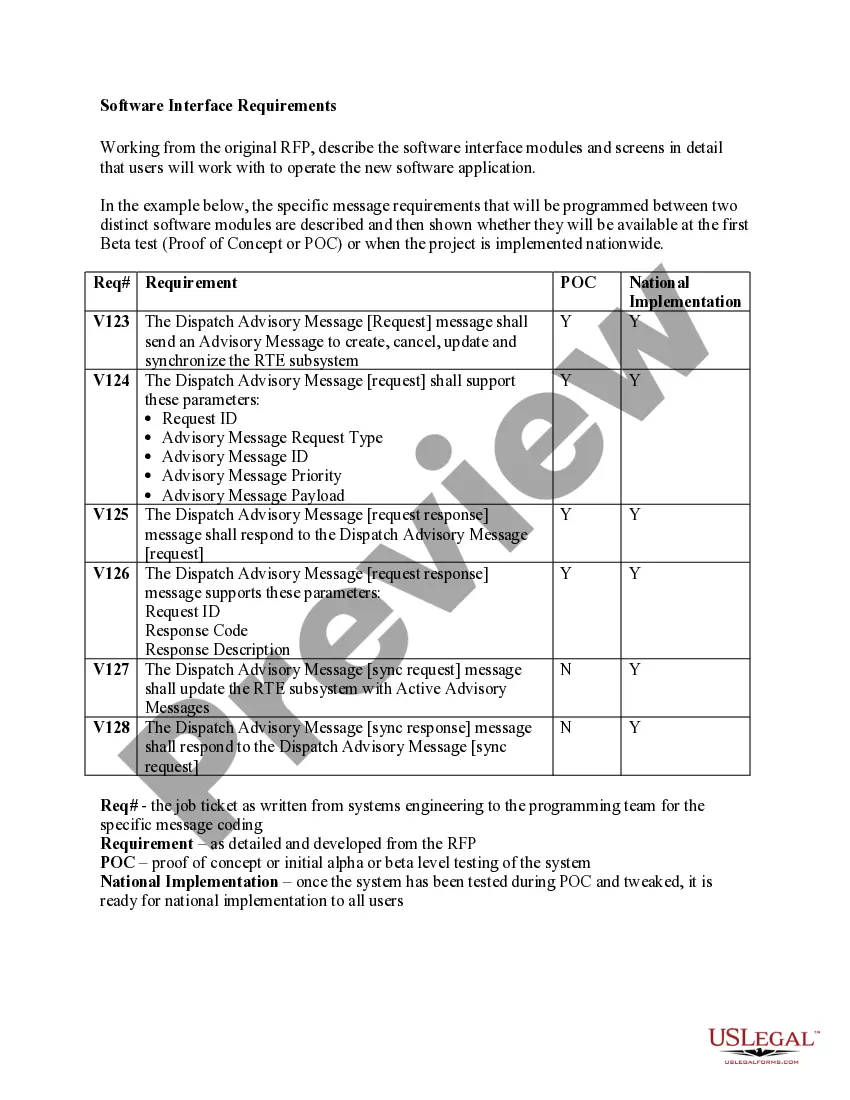

- Make sure the document you see on the page complies with your legal situation and state regulations by examining its text description or looking through the Preview mode.

- Enter the form title in the Search tab on the top of the page and select your state from the dropdown to locate another template in case of any inconsistencies.

- Repeat with the content check and click Buy now when you are confident with the paperwork compliance with all the demands.

- Log in to your account and click Download. Sign up for the service and opt for the subscription plan if you still don’t have one.

- Use your credit card or the PayPal option to purchase your US Legal Forms subscription. The document will be available to download right after.

- Decide in what format you want to get your South Carolina UCC Financing Statement and download it by clicking the appropriate button.

- Add your template to an online editor to complete and sign it rapidly or print it out to prepare your paper copy manually.

Another great advantage of US Legal Forms is that you never lose the paperwork you purchased - you can find any of your downloaded blanks in the My Forms tab of your profile whenever you need it.

Form popularity

FAQ

A UCC financing statement ? also called a UCC-1 financing statement or a UCC-1 filing ? is a legal form that allows a lender to announce a lien on an asset to secure a loan. By filing the UCC financing statement, the lender is giving notice that it has an interest in the property listed in the filing.

A fixture filing is a UCC financing statement with an addendum that is filed in the local jurisdiction where the real property is located and is then recorded in the real property records.

In the case of a loan secured by personal property collateral, the filing of a financing statement gives notice of a lien against the property so that other lenders or buyers of the personal property will know of the security interest.

Uniform Commercial Code Filings - General Information These public notices, called financing statements, indicate a commercial agreement between a debtor and a secured party. Financing statements are filed by banks, mortgage companies, and other lending institutions against secured collateral.

1 financing statement will automatically expire five years after the date of its filing 2.

UCC Financing Statement (usually called a UCC-1 Form) is a form that creditors file with states in which they have a security interest in a debtor's personal property.

When is a UCC-1 filed? UCC-1 filings typically happen when a loan is first originated. If the borrower has loans from more than one lender, the first lender to file the UCC-1 is first in line for the borrower's assets. This motivates lenders to file a UCC-1 as soon as a loan is made.

Essentially, a UCC-1 can be described as a financing statement. In fact, it is sometimes called a UCC financing statement. A creditor files a UCC-1 to provide notice to interested parties that he or she has a security interest in a debtor's personal property.