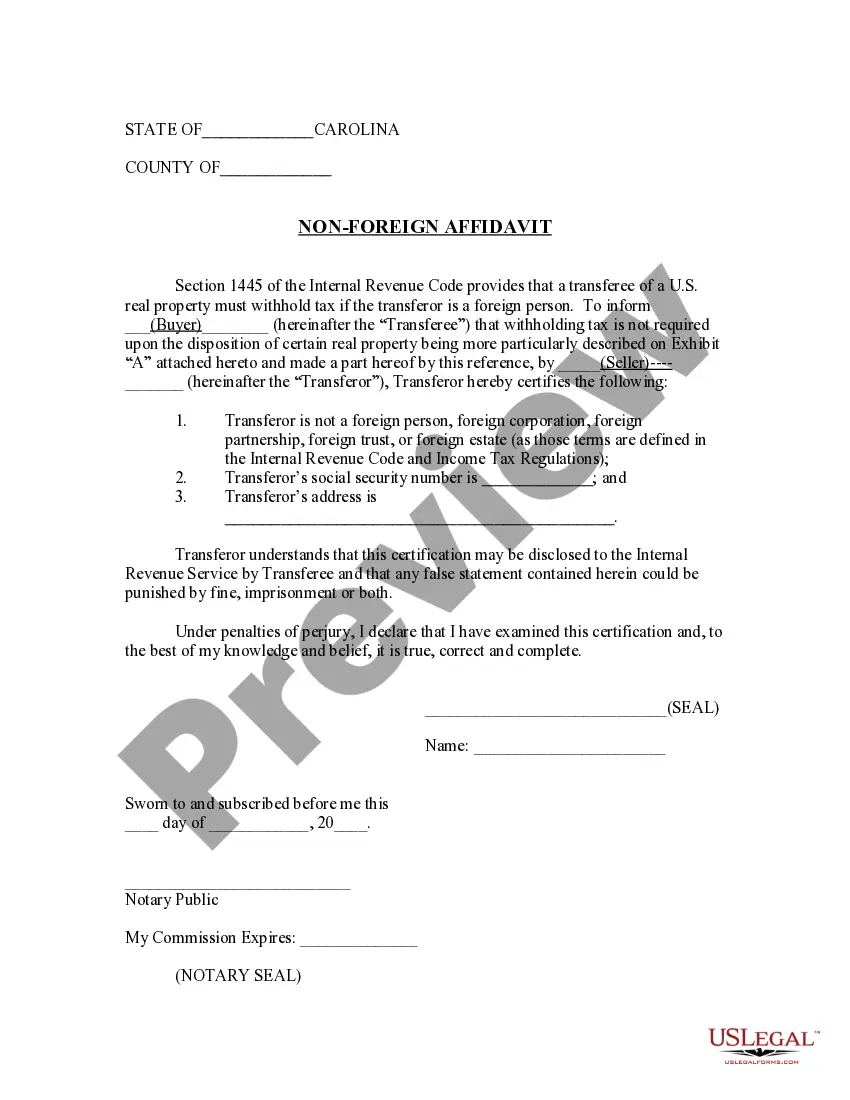

South Carolina Non- Foreign Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

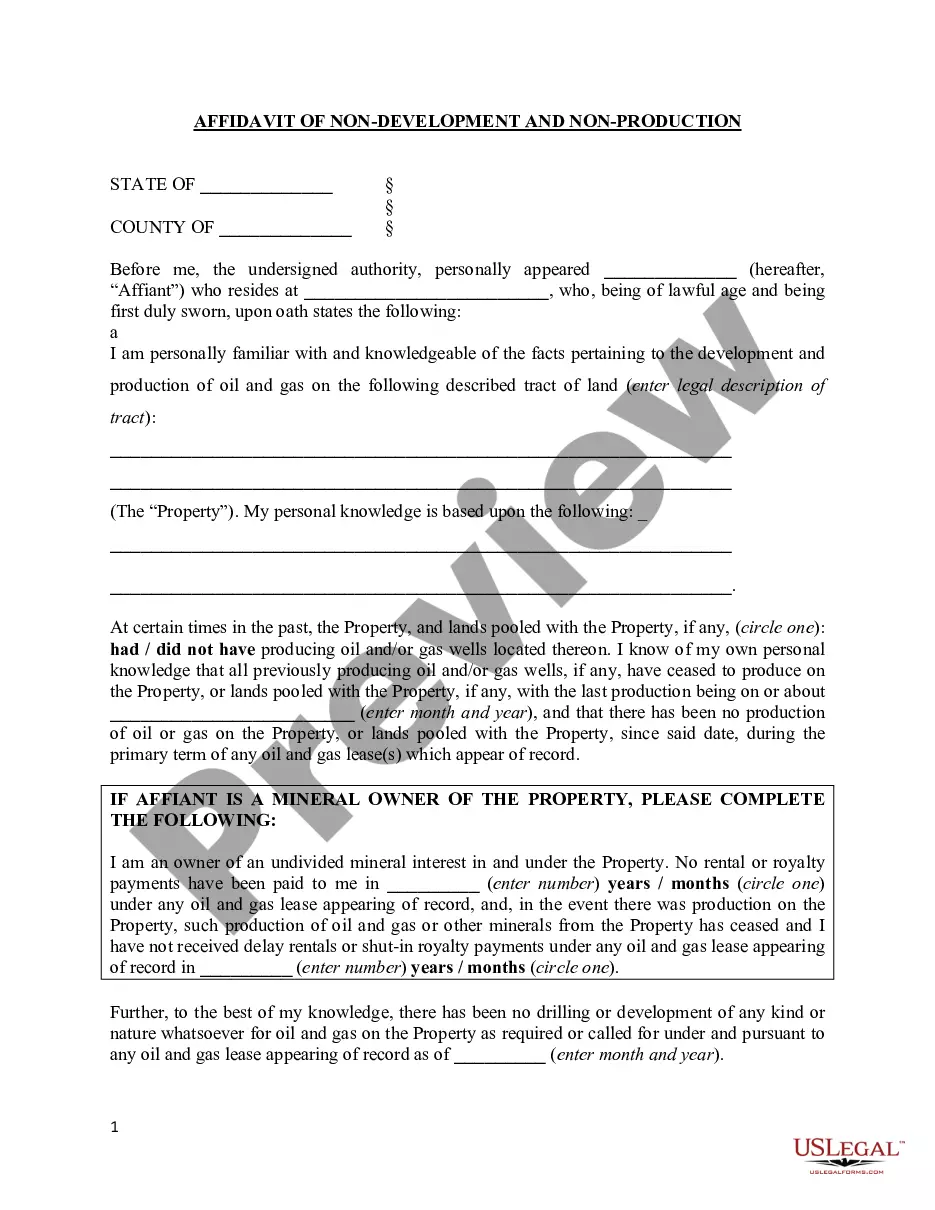

How to fill out South Carolina Non- Foreign Affidavit?

Preparing legal paperwork can be a real burden unless you have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be certain in the blanks you obtain, as all of them correspond with federal and state regulations and are verified by our experts. So if you need to prepare South Carolina Non- Foreign Affidavit, our service is the best place to download it.

Obtaining your South Carolina Non- Foreign Affidavit from our catalog is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button after they find the correct template. Afterwards, if they need to, users can use the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, registering with a valid subscription will take only a few moments. Here’s a brief guide for you:

- Document compliance check. You should attentively examine the content of the form you want and check whether it suits your needs and meets your state law regulations. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). If there are any inconsistencies, browse the library through the Search tab on the top of the page until you find an appropriate blank, and click Buy Now when you see the one you want.

- Account creation and form purchase. Register for an account with US Legal Forms. After account verification, log in and select your most suitable subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your South Carolina Non- Foreign Affidavit and click Download to save it on your device. Print it to fill out your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more efficiently.

Haven’t you tried US Legal Forms yet? Sign up for our service now to obtain any formal document quickly and easily every time you need to, and keep your paperwork in order!

Form popularity

FAQ

REQUIREMENTS TO MAKE WITHHOLDING PAYMENTS Code Section 12-8-550 requires persons hiring or contracting with a nonresident taxpayer to withhold 2% of each payment made to the nonresident where the payments under the contract exceed $10,000.

All taxes shall be levied on uniform assessment. Taxes for township, school, municipal and all other purposes provided for or allowed by law shall be levied on the same assessment, which shall be that made for county taxes.

South Carolina considers anyone domiciled in South Carolina to be a resident individual for income tax purposes. ( Sec. 12-6-30, S.C. Code ) A part-year resident is someone who is a resident for only a portion of the tax year.

Purpose of Affidavit The affidavit is used by a nonresident shareholder or partner to request an exemption from the withholding required pursuant to SC Code Section 12-8-590. Shareholders or partners who will be included in a composite Individual Income Tax return do not need to complete this affidavit.

Under Code Section 12-6-30(1) the definition of ?'Taxpayer' includes an individual, trust, estate, partnership, association, company, corporation, or any other entity subject to the tax imposed by this chapter or required to file a return.? emphasis added While ABC, a limited liability company taxed as a partnership,

South Carolina Code §12-6-3360(C)(1) provides a tax credit against South Carolina income tax, bank tax, or insurance premium tax for a qualifying business creating new jobs in this State.

Code Section 12-6-530 imposes a corporate income tax on the South Carolina taxable income of every corporation, other than those otherwise described in Code Sections 12-6-540 and 12-6-550, transacting, conducting, or doing business within South Carolina or having income within South Carolina, regardless of whether

To be an admissible Affidavit, the acknowledgment must be sworn to be true and correct to the best personal knowledge of the affiant. Furthermore, the affiant must declare that the statements contained in the Affidavit are true and correct under penalties of perjury.