South Carolina Transferor Affidavit, Tax Lien Inapplicable

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out South Carolina Transferor Affidavit, Tax Lien Inapplicable?

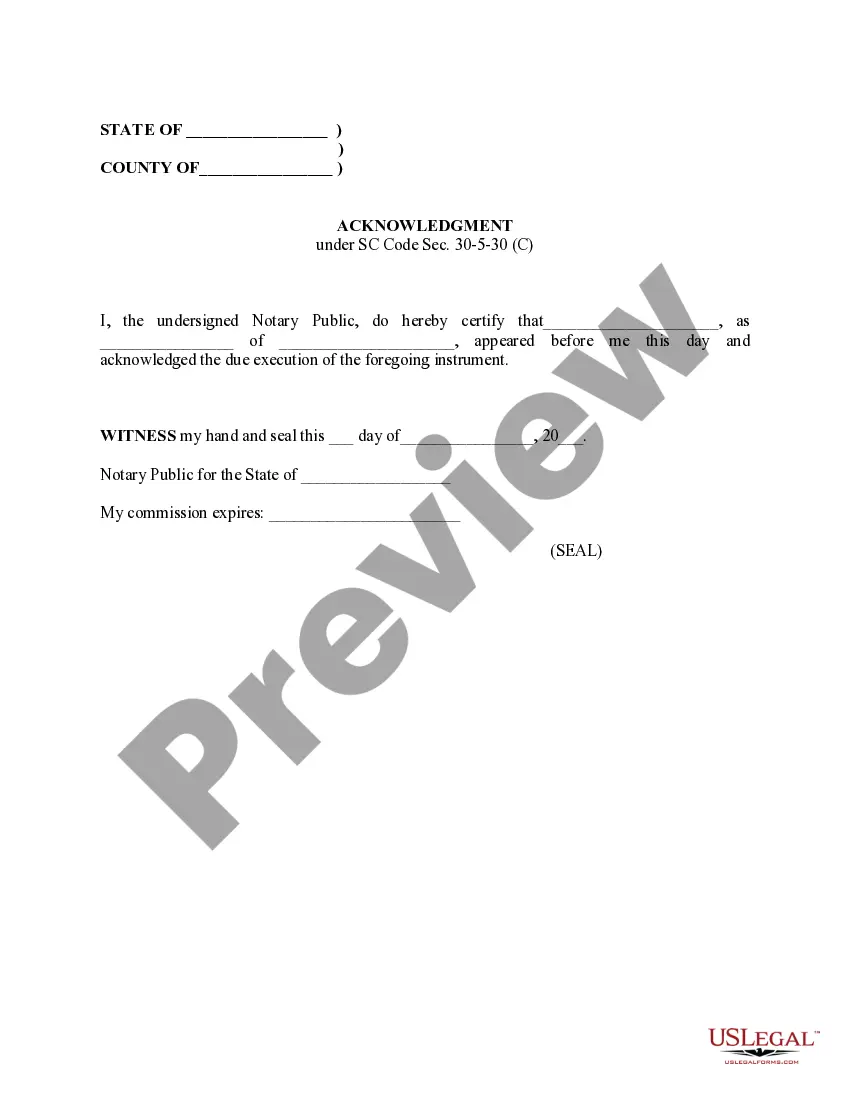

Handling legal paperwork requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your South Carolina Transferor Affidavit, Tax Lien Inapplicable template from our library, you can be certain it meets federal and state regulations.

Dealing with our service is straightforward and fast. To obtain the necessary paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to find your South Carolina Transferor Affidavit, Tax Lien Inapplicable within minutes:

- Remember to carefully check the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Search for an alternative official blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the South Carolina Transferor Affidavit, Tax Lien Inapplicable in the format you prefer. If it’s your first time with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the South Carolina Transferor Affidavit, Tax Lien Inapplicable you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in total legal compliance!

Form popularity

FAQ

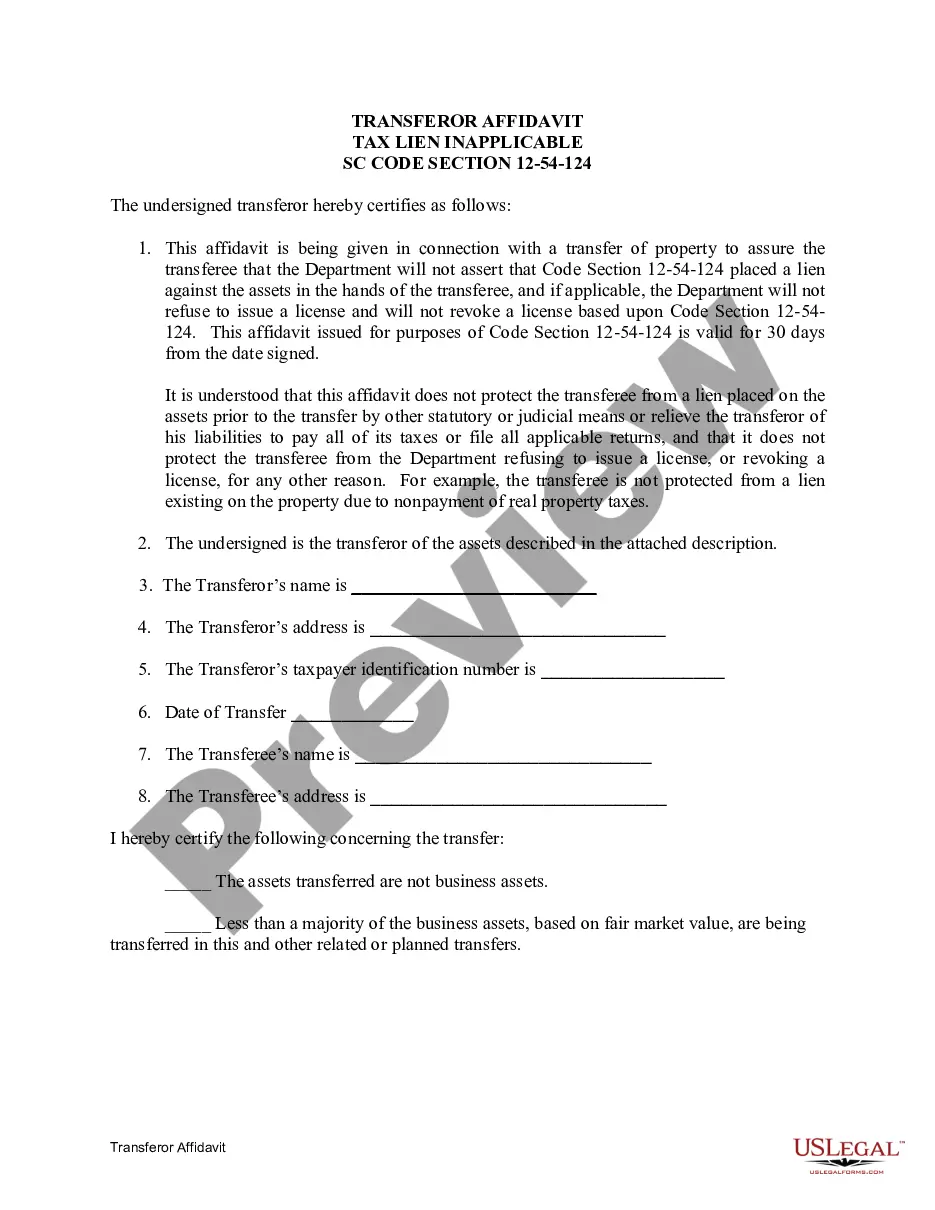

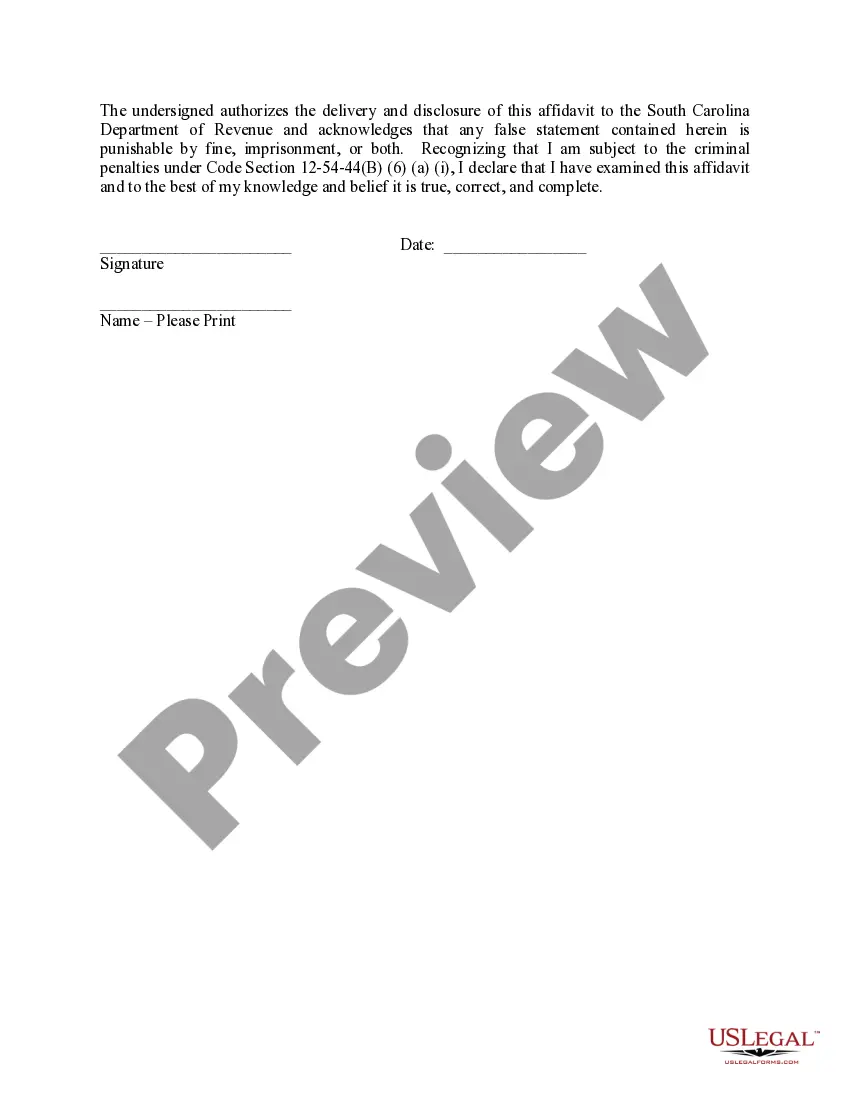

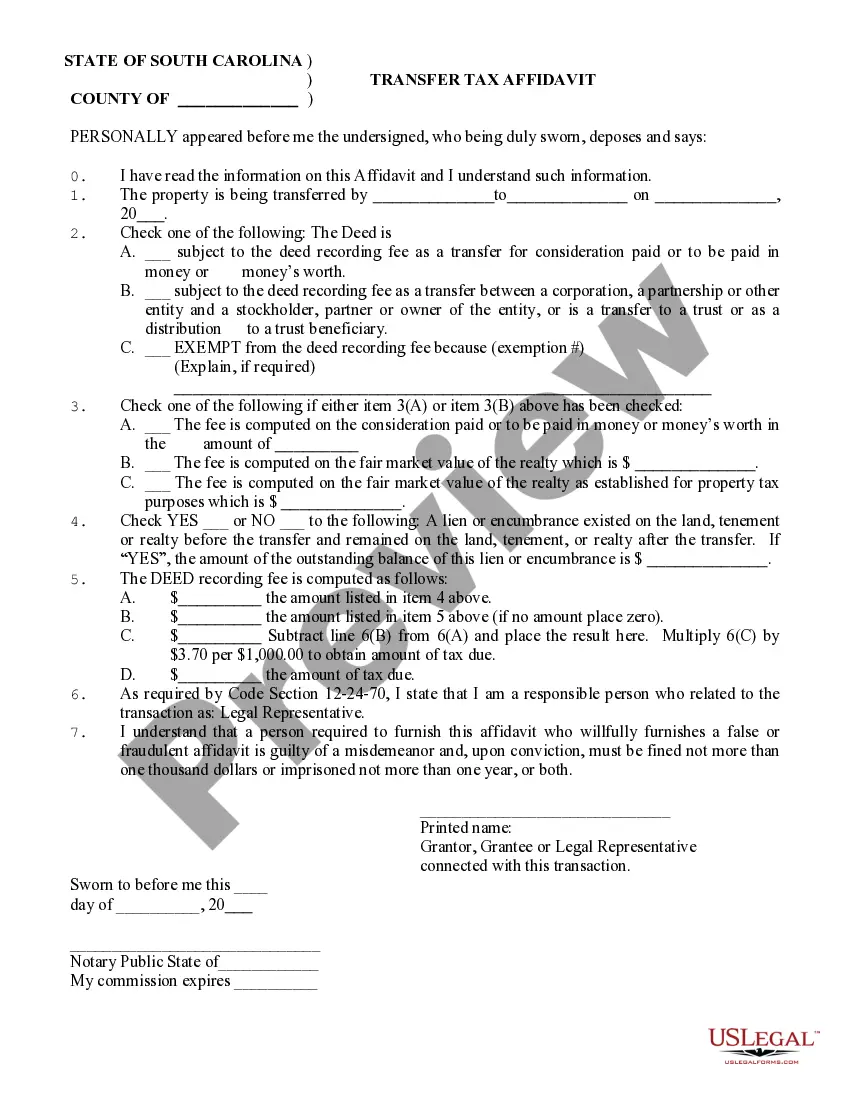

Section 12-54-124 - Transfer of business assets; tax liens; suspension of business license; certificate of compliance.

South Carolina considers anyone domiciled in South Carolina to be a resident individual for income tax purposes. ( Sec. 12-6-30, S.C. Code ) A part-year resident is someone who is a resident for only a portion of the tax year.

Following a tax sale in South Carolina, you get twelve months to redeem the property by paying off the delinquent amounts. Redeeming the home will prevent the purchaser from taking title to your property.

Is South Carolina a Tax Deed or Tax Lien State? South Carolina is a Tax Deed State.

Unlike North Carolina, which is a tax deed state, South Carolina has enacted legislation requiring the counties to sell tax liens. South Carolina is a tax lien state. So to answer the question: is South Carolina a tax deed state? The answer is no.

The high bidder at the auction will receive a Deed from the Delinquent Tax Collector provided, however, that the taxpayer has not redeemed the property by paying the taxes (and other penalties) in full within one year of the sale. The Deed that the highest bidder receives is often referred to as a ?Tax Deed?

If a taxpayer owes the SCDOR and neglects or fails to pay a tax debt, the SCDOR can issue a state tax lien. A state tax lien is a claim against your real and/or personal property located in South Carolina. Taxpayers who have an active lien must satisfy the debt prior to selling property.

In South Carolina the county officials are authorized to issue tax lien certificates which are sold at auction. Anyone can attend the auction. The state legislature makes all the rules and defines the process. The local board of supervisors or county commissioners dictate the processes within the county.