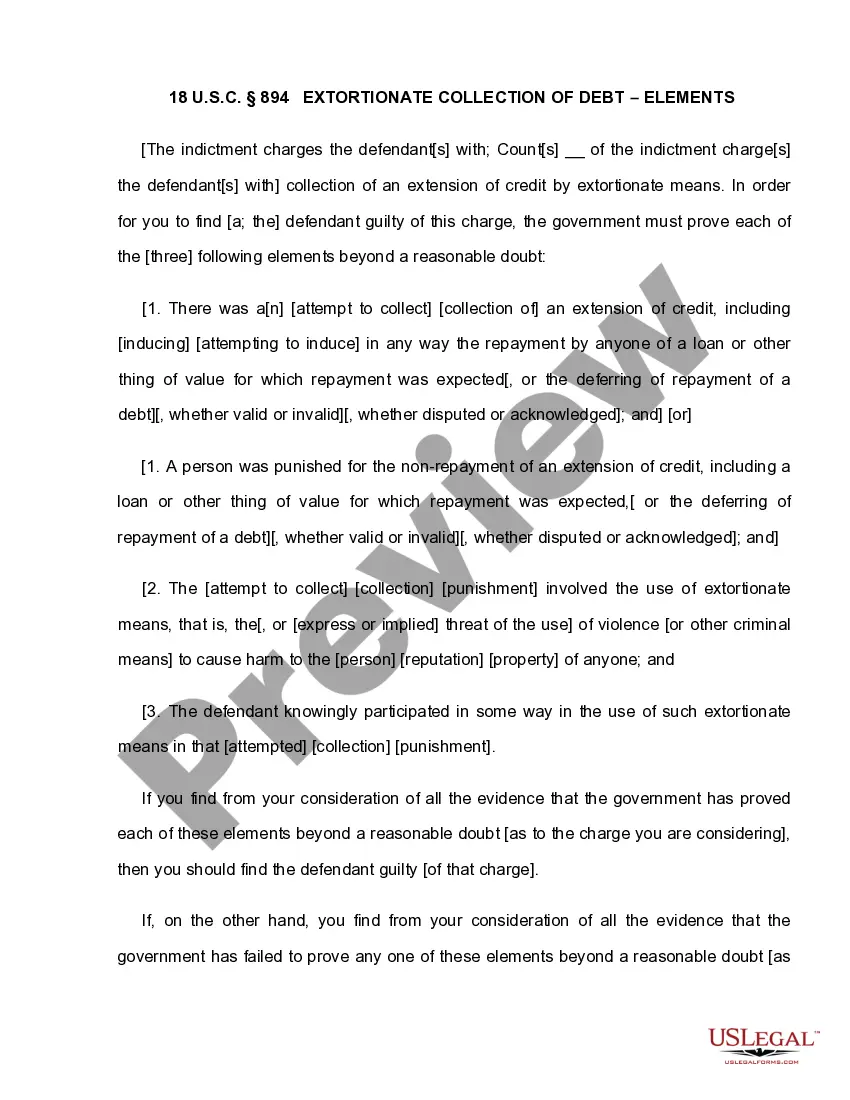

South Carolina COLLECTION OF EXTENSIONS OF CREDIT BY EXTORTIONATE MEANS

Description

How to fill out South Carolina COLLECTION OF EXTENSIONS OF CREDIT BY EXTORTIONATE MEANS?

How much time and resources do you usually spend on composing formal documentation? There’s a greater opportunity to get such forms than hiring legal specialists or spending hours browsing the web for an appropriate template. US Legal Forms is the leading online library that offers professionally drafted and verified state-specific legal documents for any purpose, like the South Carolina COLLECTION OF EXTENSIONS OF CREDIT BY EXTORTIONATE MEANS.

To get and prepare a suitable South Carolina COLLECTION OF EXTENSIONS OF CREDIT BY EXTORTIONATE MEANS template, follow these simple steps:

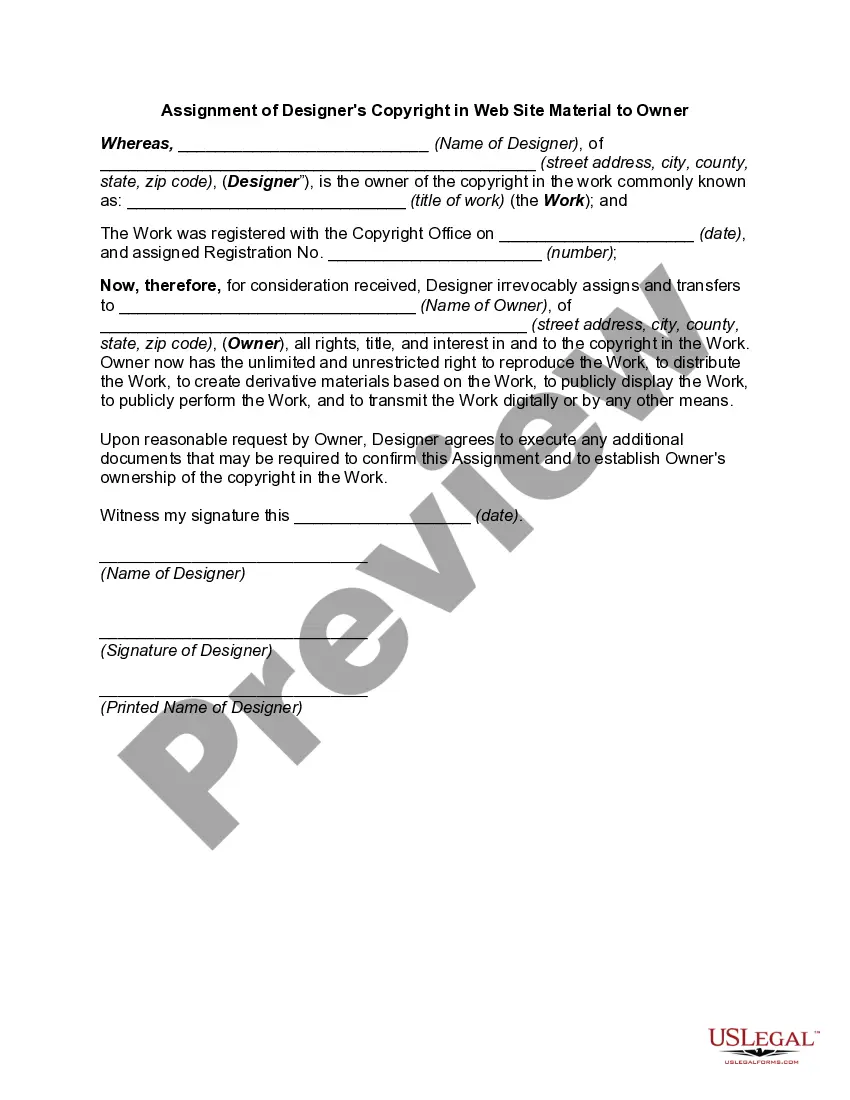

- Look through the form content to ensure it meets your state requirements. To do so, check the form description or utilize the Preview option.

- In case your legal template doesn’t meet your requirements, find a different one using the search bar at the top of the page.

- If you already have an account with us, log in and download the South Carolina COLLECTION OF EXTENSIONS OF CREDIT BY EXTORTIONATE MEANS. If not, proceed to the next steps.

- Click Buy now once you find the right document. Choose the subscription plan that suits you best to access our library’s full opportunities.

- Sign up for an account and pay for your subscription. You can make a transaction with your credit card or through PayPal - our service is totally secure for that.

- Download your South Carolina COLLECTION OF EXTENSIONS OF CREDIT BY EXTORTIONATE MEANS on your device and complete it on a printed-out hard copy or electronically.

Another benefit of our service is that you can access previously purchased documents that you securely keep in your profile in the My Forms tab. Obtain them at any moment and re-complete your paperwork as frequently as you need.

Save time and effort completing formal paperwork with US Legal Forms, one of the most reliable web services. Join us today!

Form popularity

FAQ

Section 37-10-102 of the South Carolina Consumer Protection Code requires a creditor to ascertain and comply with the consumer's preference as to the legal counsel the consumer wants to hire to conduct the transaction.

A South Carolina debt lawsuit is initiated when the plaintiff (the person or company suing) files a Summons and Complaint in court and serves you with copies of the documents. The Summons is the official notification of the lawsuit, while the Complaint lists the specific claims against you.

The state of South Carolina is one of four states that does not permit wage garnishment. However, state law does permit creditors to pursue garnishment against your bank account, effectively freezing your assets.

Your wages CANNOT be garnished for collection of a debt or a judgment incurred here in South Carolina. Wage garnishment is prohibited in South Carolina EXCEPT in 3 cases: 1) If money is owed to the government (i.e., unpaid taxes, defaulted federal student loans)

In South Carolina, judgment exemptions generally apply to a person's personal property and their homestead. Legally, a creditor cannot seize any of these exempt assets if they have a value below the threshold set by the law, essentially making a debtor judgment proof despite the existence of some known assets.

South Carolina is one of the few states in the country where a creditor of a consumer debt can't garnish your wages. But for some other types of debts, you might still lose some of your paycheck to a garnishment.

(6) An extortionate extension of credit is any extension of credit with respect to which it is the understanding of the creditor and the debtor at the time it is made that delay in making repayment or failure to make repayment could result in the use of violence or other criminal means to cause harm to the person,

In South Carolina, the statute of limitations for most types of consumer and business debt is three years. Residents of South Carolina have several rights when it comes to paying off debt and it is important to understand each one to avoid being taken advantage of by debt collectors.