Rhode Island Clauses Relating to Initial Capital contributions

Description

How to fill out Clauses Relating To Initial Capital Contributions?

If you need to total, down load, or print out authorized document templates, use US Legal Forms, the greatest selection of authorized varieties, that can be found online. Use the site`s basic and practical lookup to obtain the documents you need. Various templates for enterprise and person reasons are categorized by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Rhode Island Clauses Relating to Initial Capital contributions within a handful of clicks.

In case you are previously a US Legal Forms customer, log in in your account and then click the Down load option to obtain the Rhode Island Clauses Relating to Initial Capital contributions. You may also accessibility varieties you in the past acquired in the My Forms tab of your respective account.

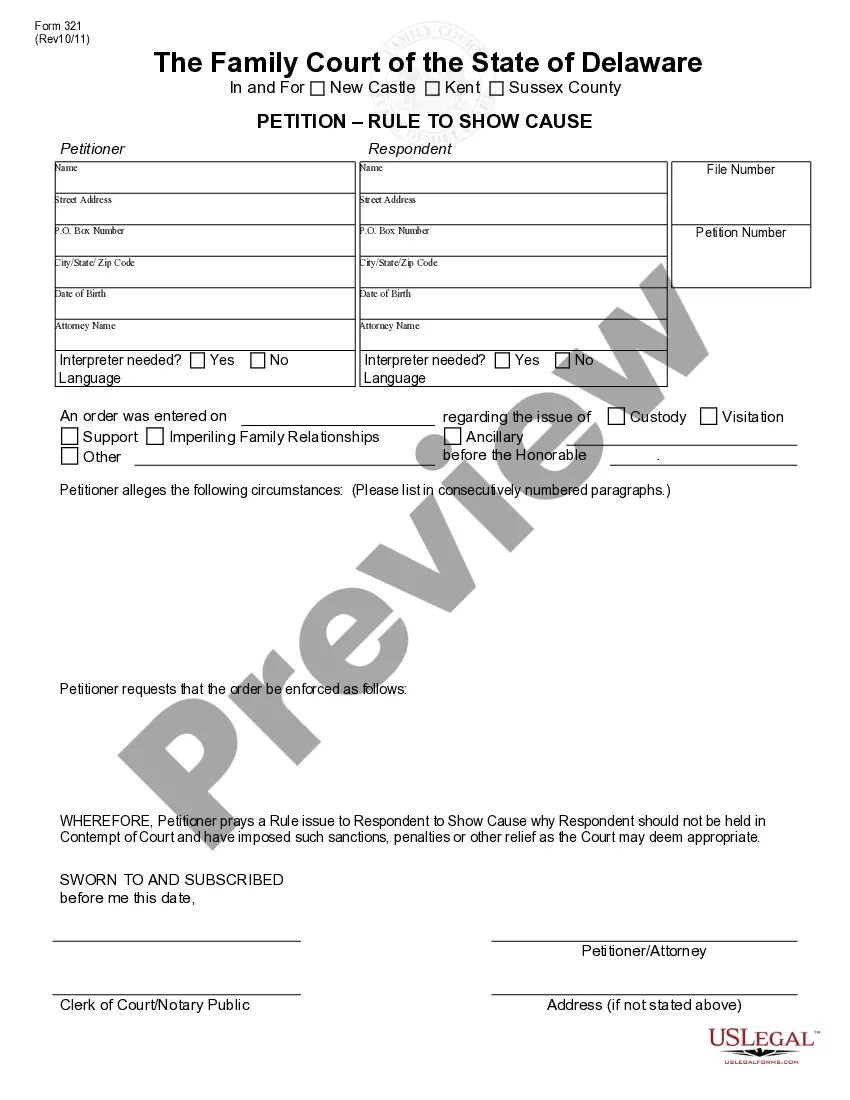

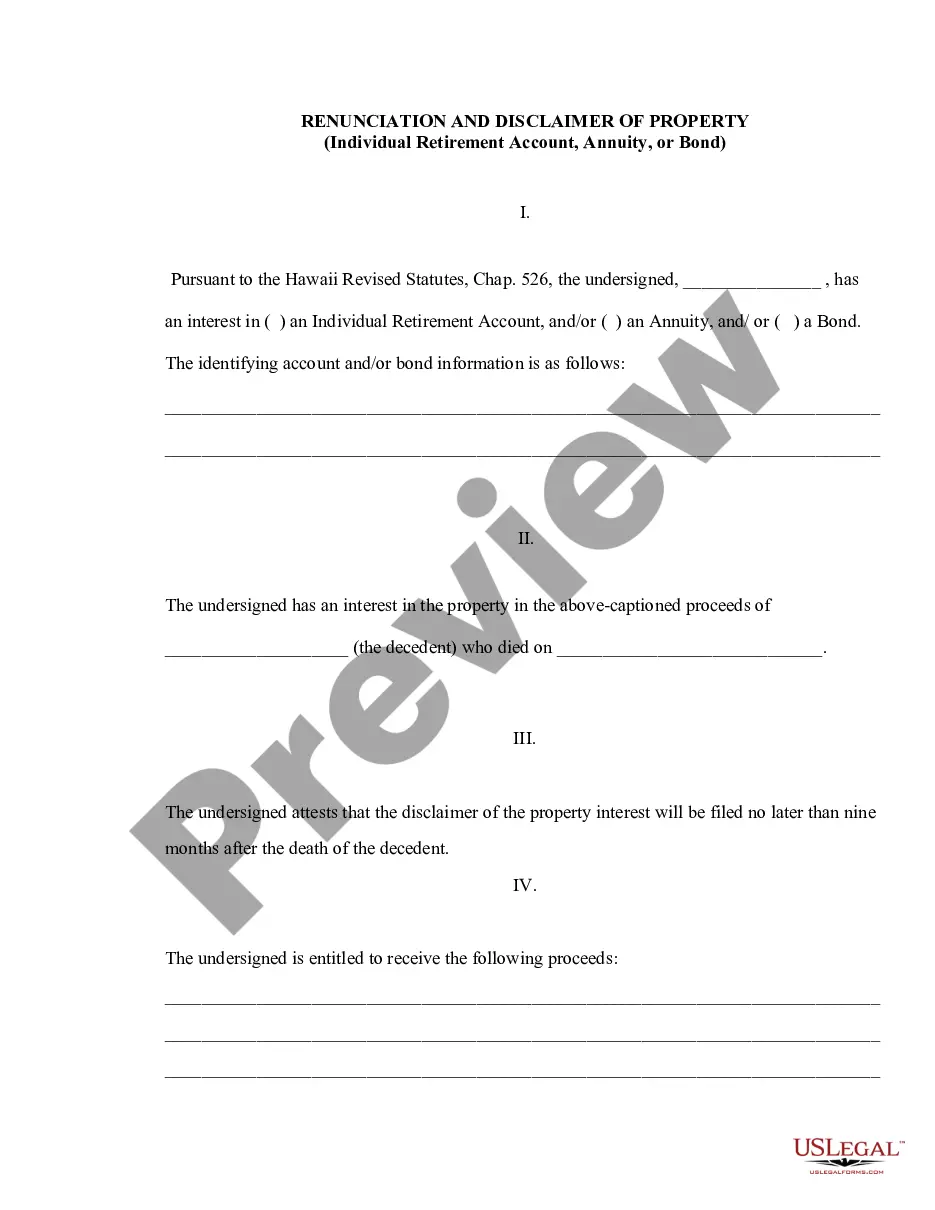

If you work with US Legal Forms the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the shape for that appropriate metropolis/region.

- Step 2. Utilize the Preview option to look through the form`s information. Do not overlook to read through the description.

- Step 3. In case you are not happy with the type, use the Research area on top of the display screen to discover other types from the authorized type format.

- Step 4. Once you have identified the shape you need, go through the Buy now option. Pick the rates plan you favor and add your credentials to sign up to have an account.

- Step 5. Procedure the purchase. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the structure from the authorized type and down load it in your system.

- Step 7. Complete, change and print out or sign the Rhode Island Clauses Relating to Initial Capital contributions.

Each authorized document format you acquire is the one you have forever. You might have acces to every type you acquired in your acccount. Go through the My Forms area and pick a type to print out or down load once more.

Contend and down load, and print out the Rhode Island Clauses Relating to Initial Capital contributions with US Legal Forms. There are many specialist and express-specific varieties you can use for your personal enterprise or person requirements.

Form popularity

FAQ

And I found it necessary to include eleven! (1) Captain DANIEL FONES of Wickford, 1713-1790. ... (2) Governor STEPHEN HOPKINS of Providence, 1707-1785. ... (3) The Reverend EZRA STILES of Newport, 1727-1795. ... (4) Architect PETER HARRISON of Newport, 1716-1775. ... (5) Furniture-Maker JOHN GODDARD of Newport, 1723-1785.

Rhode Island was the first colony in America to declare independence on , a full two months before the United States Declaration of Independence. Rhode Islanders had attacked the British warship HMS Gaspee in 1772 as one of the first acts of war leading to the American Revolution.

47 Fascinating Facts About Rhode Island Rhode Island is the smallest US state. Until 2020, it had the longest state name. ... Despite its diminutive size, Newport has over 400 miles of coastline. Rhode Island is one of the original US colonies. ... Connecticut, Massachusetts, and New York surround Rhode Island.

Rhode Islanders were the first to take military action against England by sinking one of her ships in the Narragansett Bay located between Newport and Providence. The English ship was called "The Gaspee".

Providence, city, capital of Rhode Island, U.S. It lies in Providence county at the head of Narragansett Bay on the Providence River.

During the colonial period, Newport was a major hub for shipping and trade, and in the 19th century, Rhode Island was at the forefront of the Industrial Revolution and the establishment of power-driven textile mills.

Government of Rhode IslandPolity typePresidential RepublicConstitutionConstitution of Rhode IslandLegislative branchNameGeneral Assembly24 more rows

It is the policy of the state of Rhode Island that public officials and employees must adhere to the highest standards of ethical conduct, respect the public trust and the rights of all persons, be open, accountable and responsive, avoid the appearance of impropriety, and not use their position for private gain or ...