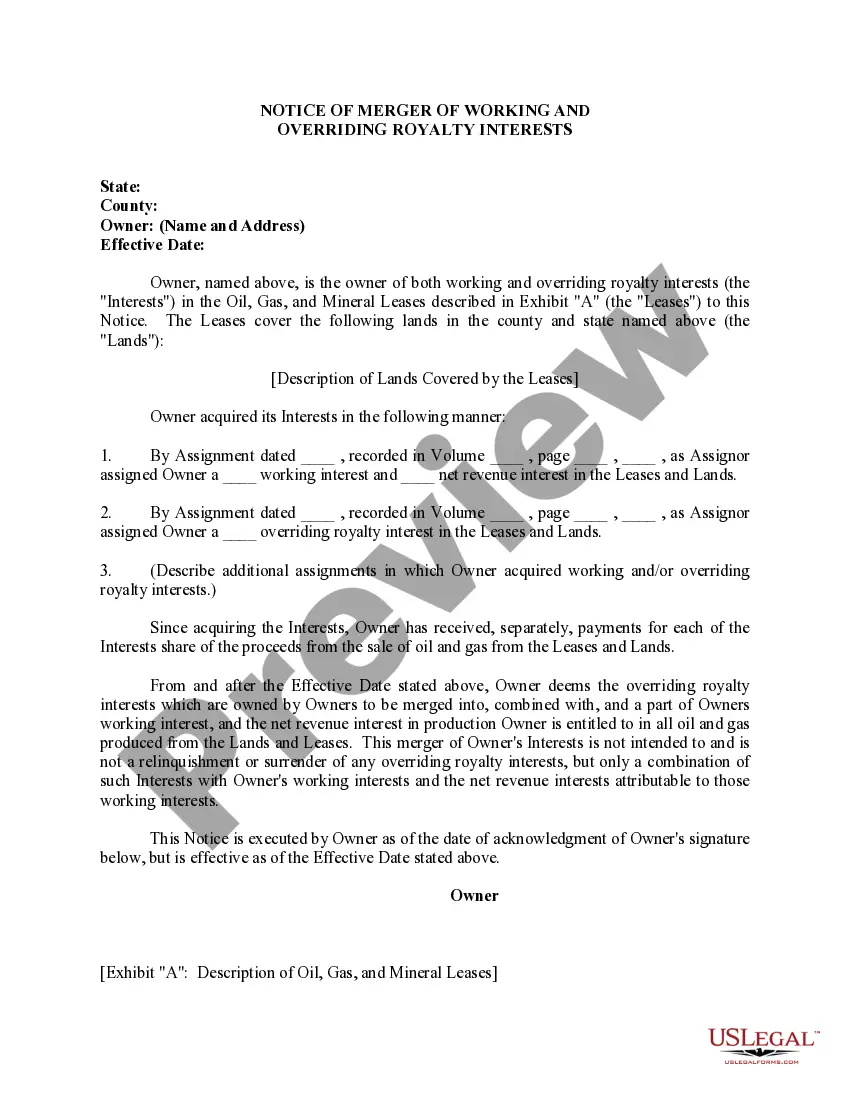

This form is used by the Owner to provide notice that the overriding royalty interests which are owned by Owners are to be merged into, combined with, and a part of Owners working interest, and the net revenue interest in production Owner is entitled to in all oil and gas produced from the Lands and Leases.

Rhode Island Notice of Merger of Working and Overriding Royalty Interests

Description

How to fill out Notice Of Merger Of Working And Overriding Royalty Interests?

You are able to spend time on the Internet looking for the legal papers design that fits the state and federal needs you need. US Legal Forms gives a large number of legal varieties that happen to be evaluated by pros. You can easily down load or print the Rhode Island Notice of Merger of Working and Overriding Royalty Interests from the service.

If you already have a US Legal Forms profile, it is possible to log in and click the Download option. Next, it is possible to complete, revise, print, or indication the Rhode Island Notice of Merger of Working and Overriding Royalty Interests. Each legal papers design you buy is yours forever. To acquire one more version of any acquired type, go to the My Forms tab and click the related option.

Should you use the US Legal Forms site for the first time, stick to the easy instructions listed below:

- First, be sure that you have selected the right papers design for your state/metropolis of your choosing. Read the type information to make sure you have picked the correct type. If accessible, take advantage of the Preview option to appear with the papers design at the same time.

- In order to get one more version of your type, take advantage of the Search industry to obtain the design that meets your needs and needs.

- When you have located the design you desire, just click Acquire now to carry on.

- Find the costs plan you desire, type in your references, and register for an account on US Legal Forms.

- Full the purchase. You can use your bank card or PayPal profile to cover the legal type.

- Find the structure of your papers and down load it in your device.

- Make modifications in your papers if possible. You are able to complete, revise and indication and print Rhode Island Notice of Merger of Working and Overriding Royalty Interests.

Download and print a large number of papers web templates using the US Legal Forms site, that offers the most important selection of legal varieties. Use specialist and status-certain web templates to take on your small business or individual needs.

Form popularity

FAQ

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

What is the difference between working interest and royalty interest? Working interests are oil and gas investments that give owners the right to exploit the resources on a property. Royalty interests are the rights belonging to the landowner who leased out the property to the working interest owner.

The value of non-producing minerals is usually determined by a price per net acre multiplier. This represents how much of the land is owned, and how much of that acreage is valuable.

You may have noticed on your check stubs an ?owner interest? or ?net revenue interest? or a ?decimal interest?. The operator will then multiply your interest by the quantity of oil and gas produced and the current price to determine your oil and gas royalty payments.

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.