A corporation whose shares are held by a single shareholder or a closely-knit group of shareholders (such as a family) is known as a close corporation. The shares of stock are not traded publicly. Many of these types of corporations are small firms that in the past would have been operated as a sole proprietorship or partner¬ship, but have been incorporated in order to obtain the advantages of limited liability or a tax benefit or both. This type of employment agreement might be in order for the chief operating officer of such a corporation.

New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business

Description

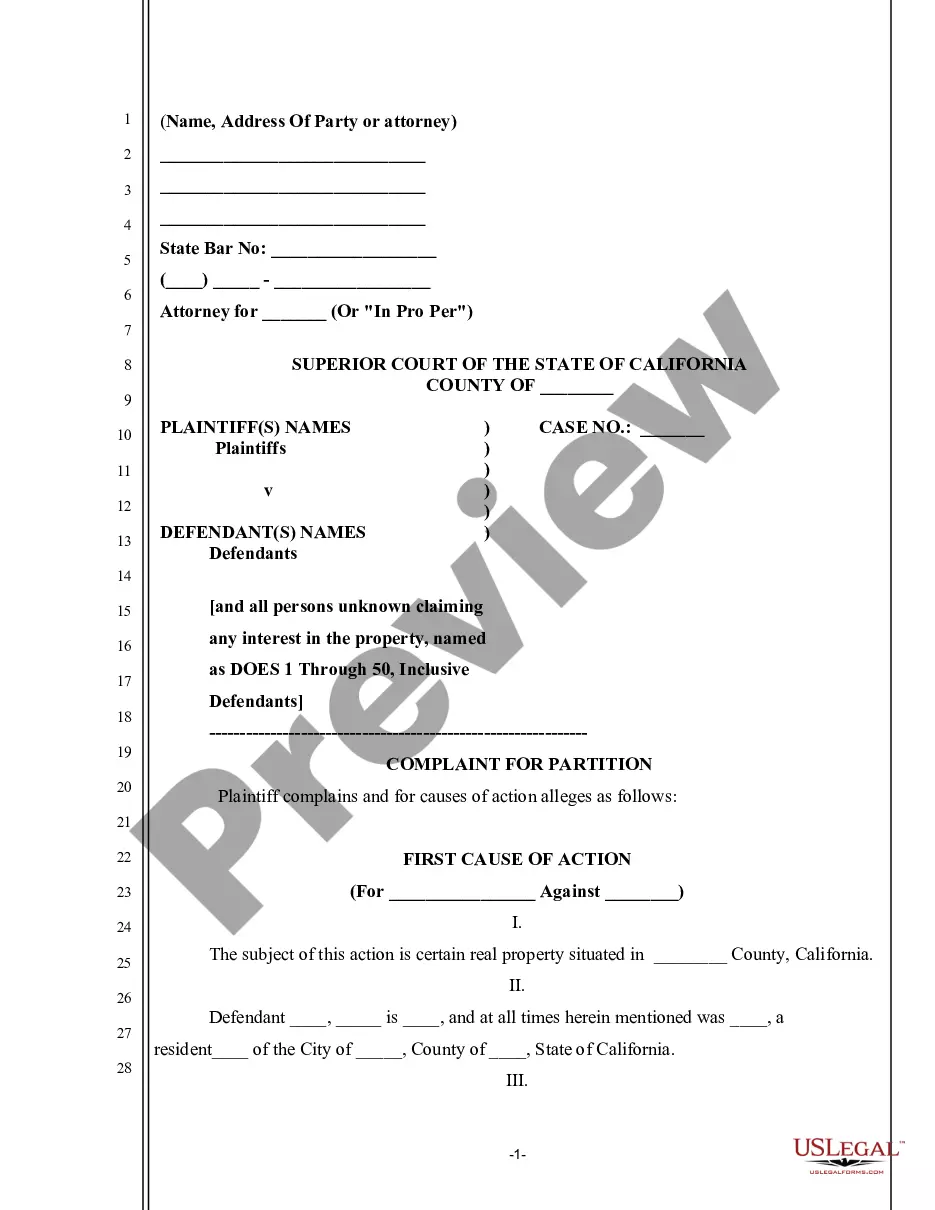

How to fill out Employment Of Executive Or General Manager In A Closely Held Corporate Business?

You can spend hours online attempting to locate the legal document template that fulfills the federal and state criteria you require.

US Legal Forms offers thousands of legal documents that can be reviewed by professionals.

It is easy to obtain or print the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business from the service.

If needed, use the Review button to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Afterwards, you can complete, modify, print, or sign the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business.

- Each legal document template you purchase is yours permanently.

- To get another copy of any acquired document, visit the My documents tab and click the corresponding button.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/region of your choice.

- Check the document description to ensure it is the right one.

Form popularity

FAQ

Salaried employees in New Mexico can work as many hours as their job requires, as they are typically considered exempt from hourly wage laws. This flexibility is crucial in the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business environment. However, it is wise for employers to monitor work hours and maintain a healthy work-life balance for their employees to ensure productivity and job satisfaction.

The statute of limitations on income tax in New Mexico is generally three years from the date the return was filed. This timeframe is vital for those managing New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business, as it impacts financial planning and audits. Being aware of this limitation helps businesses comply with legal requirements and avoid unexpected consequences.

Yes, New Mexico is considered an at-will employment state, meaning employers and employees can terminate the employment relationship at any time without cause. This principle is significant for those involved in New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business, as it provides flexibility for both parties. However, it is essential to understand the implications of at-will employment on job security and employee rights.

Statute 50-4-2 in New Mexico provides regulations on wage payments and establishes guidelines for timely payment of wages. This law is crucial for professionals involved in New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business, as it outlines employer responsibilities. Understanding these regulations assists businesses in maintaining compliance and ensuring employee satisfaction.

To make a company legally authorized in New Mexico, you need to register your business name, acquire a business license, and comply with state regulations. This process ensures that your business operates within the legal framework necessary for the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business. Utilizing resources like uslegalforms can assist you in navigating these requirements smoothly.

New Mexico offers various incentives for new business owners, including competitive tax structures and a supportive entrepreneurial community. The natural resources and cultural diversity in the state can provide a unique market advantage. Moreover, leveraging the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business can help guide you through important legal considerations as you establish your venture.

To obtain a New Mexico business tax identification number, you must apply through the New Mexico Taxation and Revenue Department. This process involves completing the required forms and providing necessary documentation about your business structure. Seeking guidance on the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business can simplify this application process, ensuring you are ready for tax obligations.

Yes, New Mexico requires most businesses to obtain a business license to operate legally. This requirement helps ensure compliance with local regulations. When delving into the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business, acquiring the appropriate business license is a vital step in establishing your company.

Wrongful termination occurs when an employee is fired for reasons that violate state or federal laws, such as discrimination or retaliation. In New Mexico, it is important to understand the legal protections available under the New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business. Employees who believe they have been wrongfully terminated should seek legal advice to explore their options.

New Mexico does not currently have predictive scheduling laws that require employers to provide advance notice of work schedules. However, businesses must still comply with federal and state labor regulations. The New Mexico Employment of Executive or General Manager in a Closely Held Corporate Business may necessitate determining suitable scheduling practices to align with employee expectations and legal standards.