Rhode Island Revocable Trust Agreement when Settlors Are Husband and Wife

Description

How to fill out Revocable Trust Agreement When Settlors Are Husband And Wife?

US Legal Forms - among the greatest libraries of legitimate forms in the States - gives an array of legitimate record themes it is possible to acquire or print out. While using web site, you will get 1000s of forms for organization and person functions, categorized by groups, suggests, or key phrases.You will find the newest versions of forms just like the Rhode Island Revocable Trust Agreement when Settlors Are Husband and Wife within minutes.

If you already possess a subscription, log in and acquire Rhode Island Revocable Trust Agreement when Settlors Are Husband and Wife from your US Legal Forms collection. The Acquire switch will show up on every single develop you view. You have access to all in the past acquired forms inside the My Forms tab of your respective profile.

If you wish to use US Legal Forms the very first time, listed below are easy directions to help you started out:

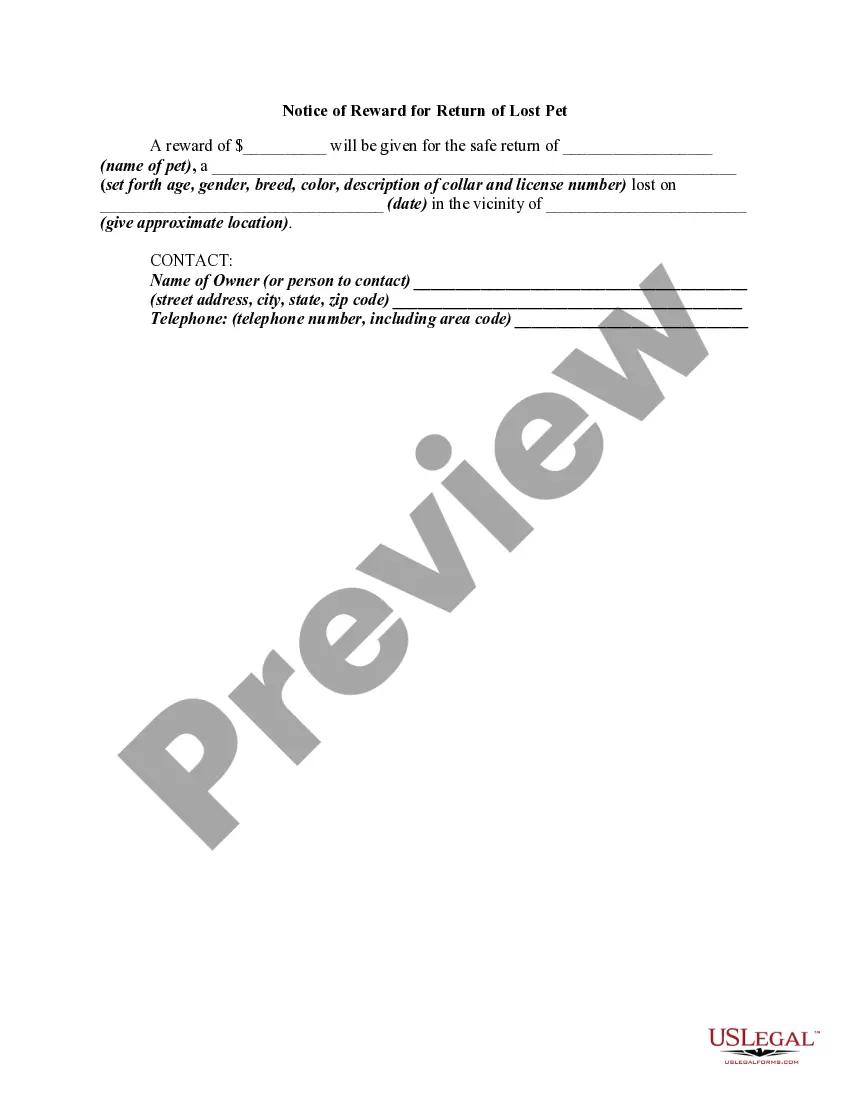

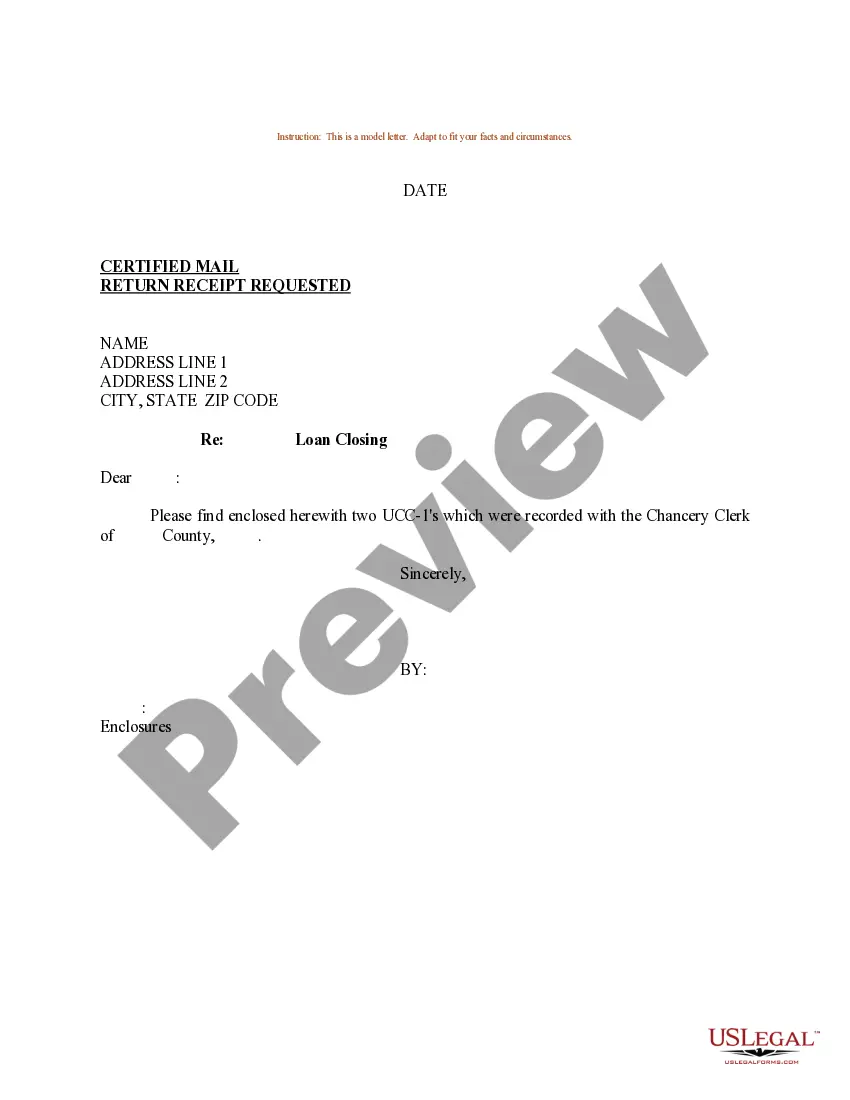

- Make sure you have picked out the best develop for your personal city/state. Select the Review switch to examine the form`s articles. Look at the develop explanation to actually have selected the right develop.

- If the develop does not fit your specifications, make use of the Research area on top of the display screen to obtain the the one that does.

- Should you be satisfied with the shape, confirm your selection by clicking on the Get now switch. Then, choose the prices strategy you prefer and offer your references to register for the profile.

- Approach the transaction. Use your charge card or PayPal profile to complete the transaction.

- Choose the structure and acquire the shape on the device.

- Make adjustments. Fill up, revise and print out and signal the acquired Rhode Island Revocable Trust Agreement when Settlors Are Husband and Wife.

Each template you added to your money lacks an expiration particular date and it is your own property forever. So, if you want to acquire or print out one more duplicate, just check out the My Forms area and click on about the develop you want.

Obtain access to the Rhode Island Revocable Trust Agreement when Settlors Are Husband and Wife with US Legal Forms, the most considerable collection of legitimate record themes. Use 1000s of specialist and state-distinct themes that satisfy your small business or person requirements and specifications.

Form popularity

FAQ

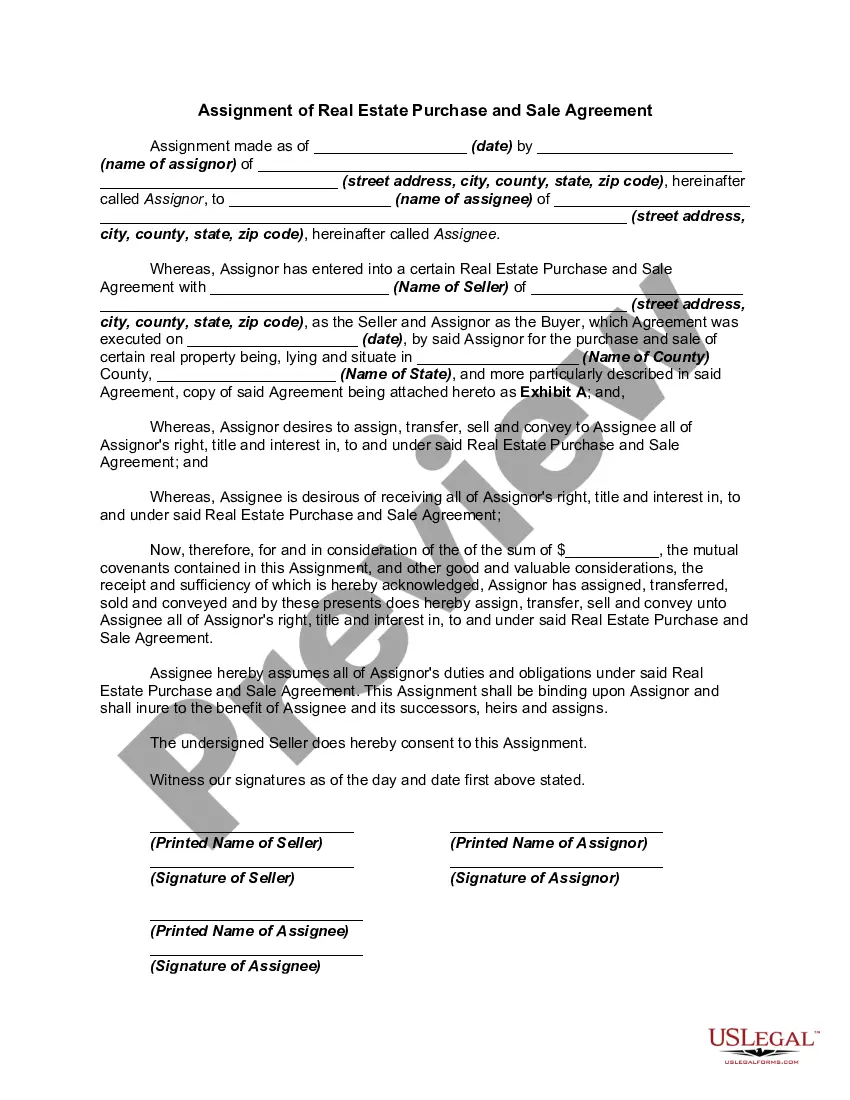

A transfer of property between spouses is legal and ethical. A deed of trust may also be referred to as a declaration of beneficial ownership trust document. They are the same document as both states that one property owner wishes to transfer of property between spouses.

Joint Trust: Because all assets are inside one trust, sometimes Joint Trusts can make things simpler. While both spouses are living, each has equal control regarding the management of joint assets held in the Joint Trust.

The surviving spouse is the sole Settlor/Trustee/Beneficiary if one dies. In short, nothing changes.

A joint trust gives the surviving spouse more flexibility to use all of the assets of the trust after the death of the first spouse. A joint revocable trust is also easier to fund and maintain during a couple's lifetime. All assets simply go into the same place; there's no need to decide which trust an asset goes into.

Recommended for you For married couples, a Joint Revocable Trust might be able to offer a sense of confidence that begins the day you both sign. Read more about Joint Trusts and whether or not they're a smart choice for your circumstances.

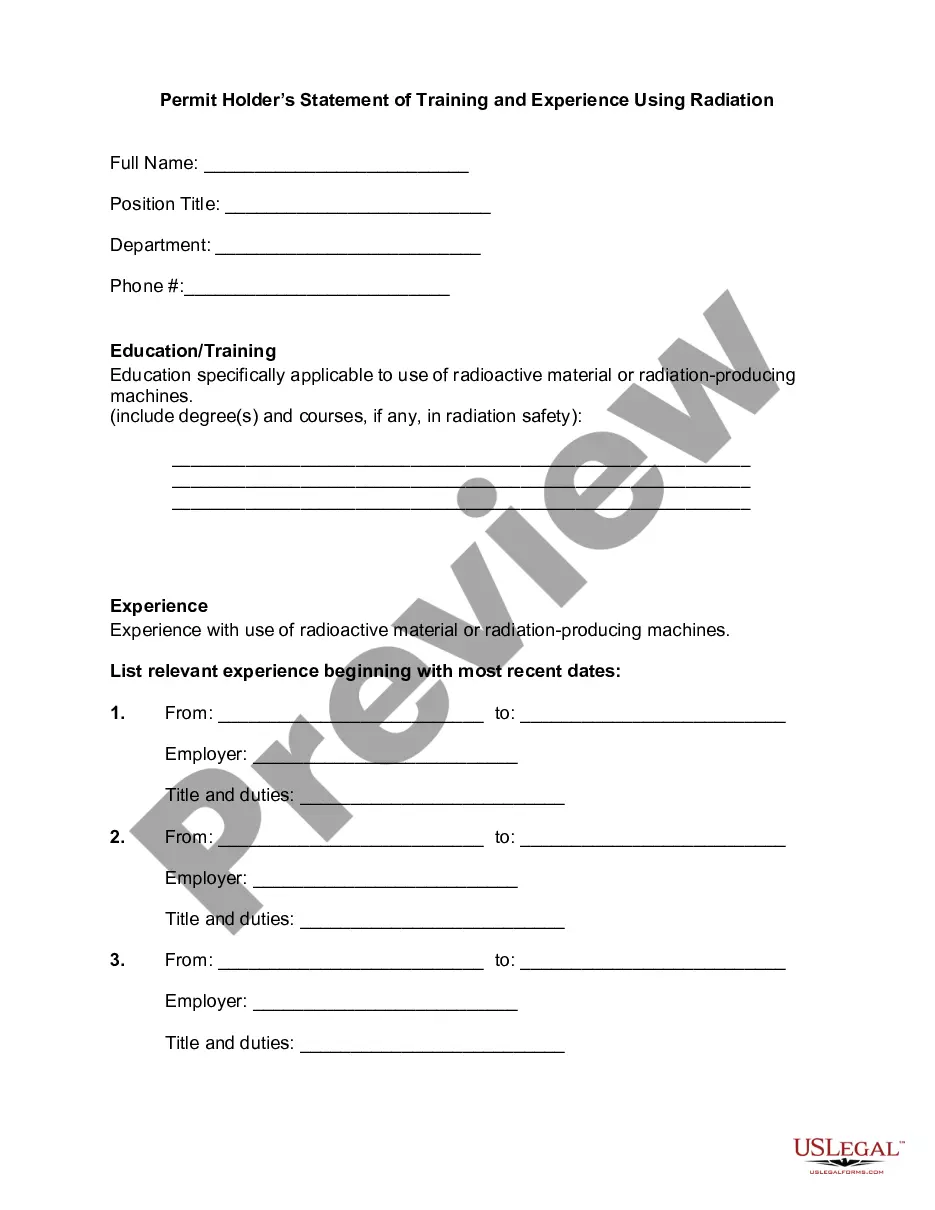

In general, to benefit from all the advantages that trusts can give, the settlor, the trustee and the beneficiary are usually different people or groups of people. But they don't have to be. A settlor or trustee can also be a beneficiary of same trust.

A joint trust gives the surviving spouse more flexibility to use all of the assets of the trust after the death of the first spouse. A joint revocable trust is also easier to fund and maintain during a couple's lifetime. All assets simply go into the same place; there's no need to decide which trust an asset goes into.

The disclaimer trust approach Disclaimer trusts offer maximum flexibility where there is substantial trust between spouses, and each spouse wants the other to keep and use the household's combined property after the first spouse passes away.