Rhode Island Lab Worker Employment Contract - Self-Employed

Description

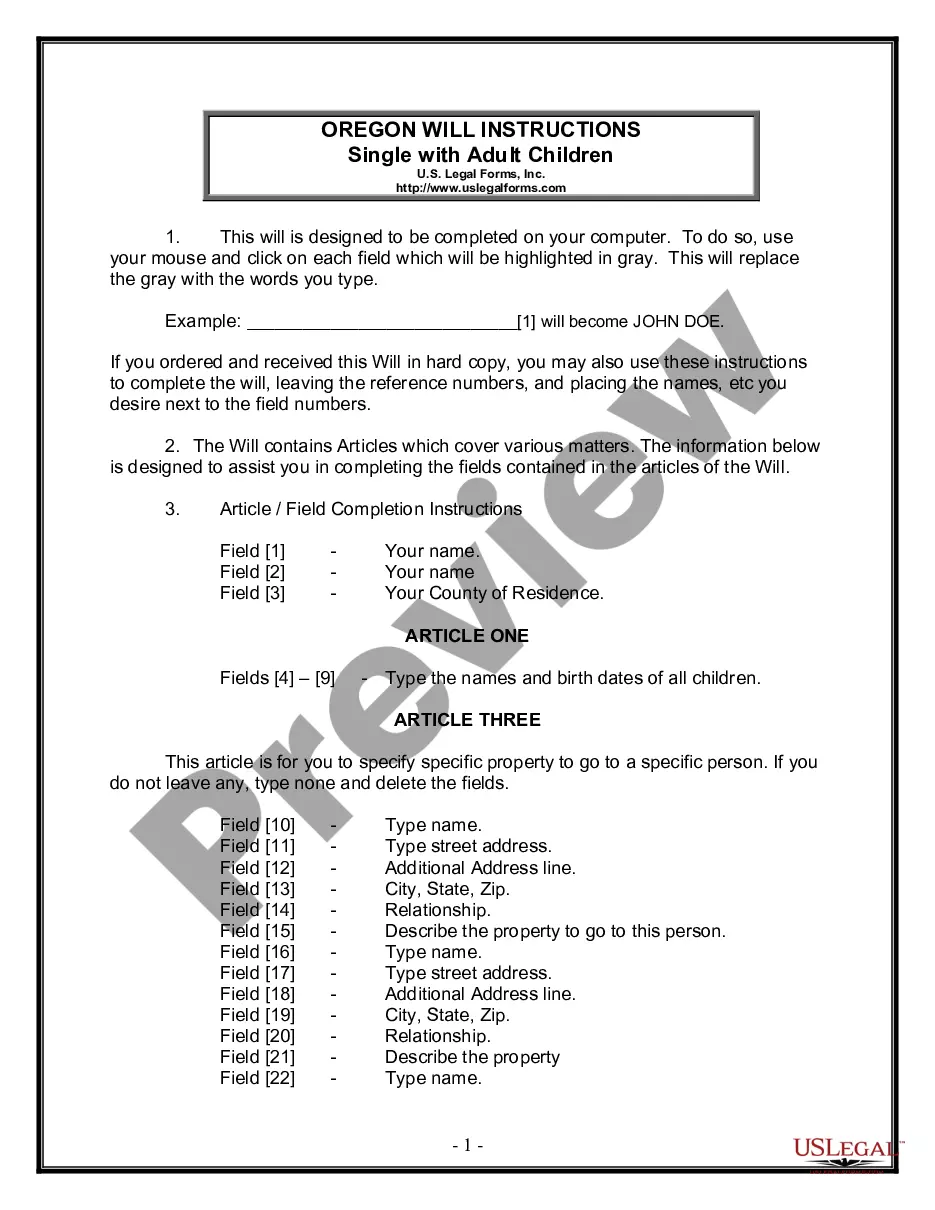

How to fill out Lab Worker Employment Contract - Self-Employed?

If you need to finalize, obtain, or create legal document formats, utilize US Legal Forms, the premier collection of legal templates available online.

Employ the site's straightforward and user-friendly search to find the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to locate the Rhode Island Lab Worker Employment Contract - Self-Employed in just a few clicks.

Every legal document template you acquire is yours permanently. You will have access to every document you downloaded in your account. Click the My documents section and select a document to print or download again.

Complete and obtain, and print the Rhode Island Lab Worker Employment Contract - Self-Employed with US Legal Forms. There are many professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Rhode Island Lab Worker Employment Contract - Self-Employed.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's details. Remember to read the description.

- Step 3. If you are not satisfied with the document, utilize the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you need, click on the Buy now button. Choose your preferred pricing plan and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Fill out, modify, and print or sign the Rhode Island Lab Worker Employment Contract - Self-Employed.

Form popularity

FAQ

The self-employment tax in Rhode Island is based on your net earnings from self-employment. For self-employed individuals, this tax consists of both Social Security and Medicare taxes, which currently total 15.3%. It's important to factor this tax into your financial planning, especially if you are operating under a Rhode Island Lab Worker Employment Contract - Self-Employed. To help you navigate the complexities of self-employment, consider using platforms like uslegalforms, which can guide you through the necessary forms and requirements.

Yes, a worker who receives a 1099 form is generally considered self-employed. This classification arises because a 1099 signifies that you are not on a traditional payroll, thus aligning with the self-employed model under a Rhode Island Lab Worker Employment Contract - Self-Employed. By understanding these classifications, you can navigate your financial responsibilities more effectively.

A contract does not automatically signify self-employment, even when it relates to labor in Rhode Island. A Rhode Island Lab Worker Employment Contract - Self-Employed can clarify your status, yet actual self-employment depends on your operational control and financial responsibilities. It’s essential to understand the terms of your contract to determine your true status.

Contract work often overlaps with being self-employed, but they are not exactly the same. When you sign a Rhode Island Lab Worker Employment Contract - Self-Employed, you operate as an independent entity, handling your own taxes and benefits. However, some contractors might work under a more traditional employment structure, which may affect their self-employed classification.

Yes, contract work can count as employment, particularly if you have a Rhode Island Lab Worker Employment Contract - Self-Employed in place. This type of contract outlines the terms of your work, including your responsibilities and rights. However, the classification can vary based on how the work is structured and the relationship established. Understanding these factors helps in determining your employment status.

While it may sound unusual, you can create a private contract with yourself if you are operating a business entity. This can help you outline services, expectations, and even payment methods within your own operations. However, for clarity and legal standing, it's advisable to base this on a Rhode Island Lab Worker Employment Contract - Self-Employed to ensure all aspects are appropriately documented. Consulting uslegalforms can assist you in structuring this agreement correctly.

The terms self-employed and independent contractor can often be used interchangeably, but they may carry different implications. Self-employed emphasizes that you run your own business, while independent contractor suggests a contractual relationship with clients. Using the term appropriate for your context can enhance clarity, especially when drafting a Rhode Island Lab Worker Employment Contract - Self-Employed.

To become an independent contractor in Rhode Island, you need to register your business and obtain any necessary licenses. Begin with establishing a business structure and acquiring a unique business name. Then, create a Rhode Island Lab Worker Employment Contract - Self-Employed to outline your services and interactions with clients. Utilizing resources from platforms like uslegalforms can streamline this process.

Yes, you can be self-employed and still operate under a contract. In fact, a Rhode Island Lab Worker Employment Contract - Self-Employed can help you define your role, payment terms, and project expectations. This arrangement is beneficial as it clarifies the working relationship between you and your clients. A well-crafted contract protects your interests and outlines your work obligations.

New rules for self-employed individuals focus on taxation, benefits, and responsibilities. Self-employed individuals must ensure they are compliant with local regulations, including filing requirements. It’s essential to stay updated, especially regarding the Rhode Island Lab Worker Employment Contract - Self-Employed, as laws can change and affect how you structure your contracts and finances. Consult with a professional or uslegalforms to ensure compliance with the latest regulations.