Rhode Island Leased Personal Property Workform

Description

How to fill out Leased Personal Property Workform?

Are you in a circumstance where you frequently require documentation for possible business or personal purposes.

There are numerous valid template records accessible online, but sourcing versions you can trust is challenging.

US Legal Forms offers thousands of document templates, including the Rhode Island Leased Personal Property Workform, that are designed to satisfy federal and state regulations.

Select the pricing plan you want, provide the necessary information to create your account, and process your order using PayPal or a credit card.

Choose a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Rhode Island Leased Personal Property Workform template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the document you need and ensure it is for the correct area/county.

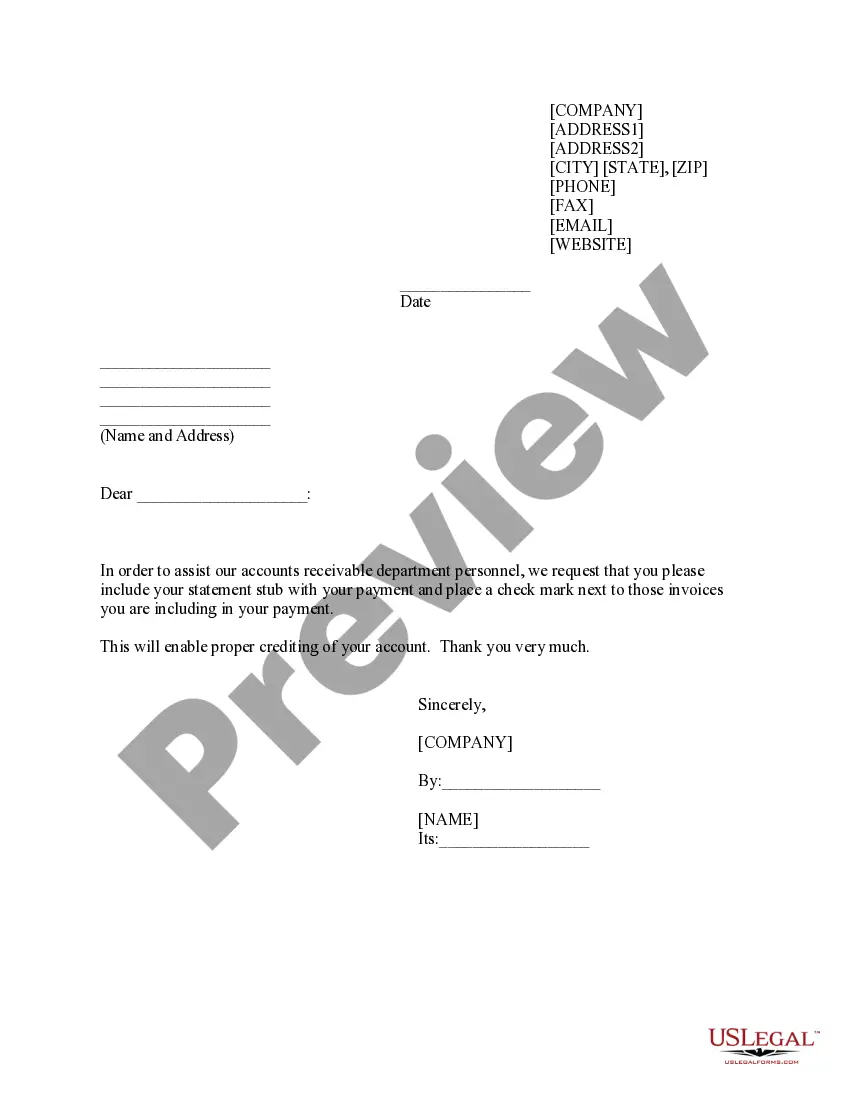

- Utilize the Preview feature to review the form.

- Check the description to verify that you have chosen the correct document.

- If the document does not meet your requirements, use the Search field to locate a document that fits your needs.

- Once you find the correct document, simply click Buy now.

Form popularity

FAQ

Missing the October 15 tax extension deadline can result in penalties and interest on unpaid taxes. It is essential to file as soon as you realize the deadline has passed. Utilizing the Rhode Island Leased Personal Property Workform may help in managing your filing effectively. Consider reaching out to a tax professional for personalized advice in this situation.

Currently, there is no confirmation that the tax deadline for 2025 has been extended. Taxpayers should plan to meet the regular deadlines to avoid penalties. Utilizing resources like the Rhode Island Leased Personal Property Workform can simplify your tax calculations. Always check for updates closer to the deadline.

As of now, there has been no official announcement regarding an extension of the audit date for 2025. It is recommended to keep track of official communications from the Rhode Island Department of Revenue for any updates. In preparation, consider using the Rhode Island Leased Personal Property Workform to maintain thorough records. Staying informed can help you manage potential audits effectively.

The deadline to file taxes in Rhode Island typically falls on April 15. However, it's wise to check for any changes or extensions each tax year. For those needing more time, the Rhode Island Leased Personal Property Workform may provide assistance in filing extensions. Remember to stay organized to avoid last-minute stress.

Form RI 941 is used by employers in Rhode Island to report payroll taxes. This form is crucial for maintaining accurate tax records. If you're navigating payroll taxes, using the Rhode Island Leased Personal Property Workform can help streamline your tax documentation process. Always ensure you are using the latest version of any required tax forms.

Yes, the RI 7004 has been discontinued. This means that taxpayers in Rhode Island cannot use this form anymore for their tax filings. Instead, you may want to explore the Rhode Island Leased Personal Property Workform for your tax reporting needs. It is important to stay updated on current forms to ensure compliance.

On your tax return, you should list the address where you were a legal resident on December 31 of the tax year. This helps ensure that your tax documents align with your residency status. If using the Rhode Island Leased Personal Property Workform, make sure to double-check that your address is accurately stated.

Allocating part-year resident income can be complex as it involves understanding your residency status during the tax year. You must accurately report income earned while residing in Rhode Island versus income earned while living elsewhere. Utilizing the Rhode Island Leased Personal Property Workform can aid you in correctly allocating your taxes.

To qualify for tax credits in Rhode Island, individuals usually need to meet specific income and residency requirements. These criteria can vary based on the type of credit you are pursuing. When filling out the Rhode Island Leased Personal Property Workform, ensure that you provide accurate information to maximize your chances of qualifying.

In Rhode Island, there is typically no specific age when you stop paying property taxes, but certain exemptions may apply to seniors. For seniors who meet specific income requirements, property tax relief credits can significantly help. For a complete understanding of exemptions, consider using the Rhode Island Leased Personal Property Workform.