Rhode Island Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

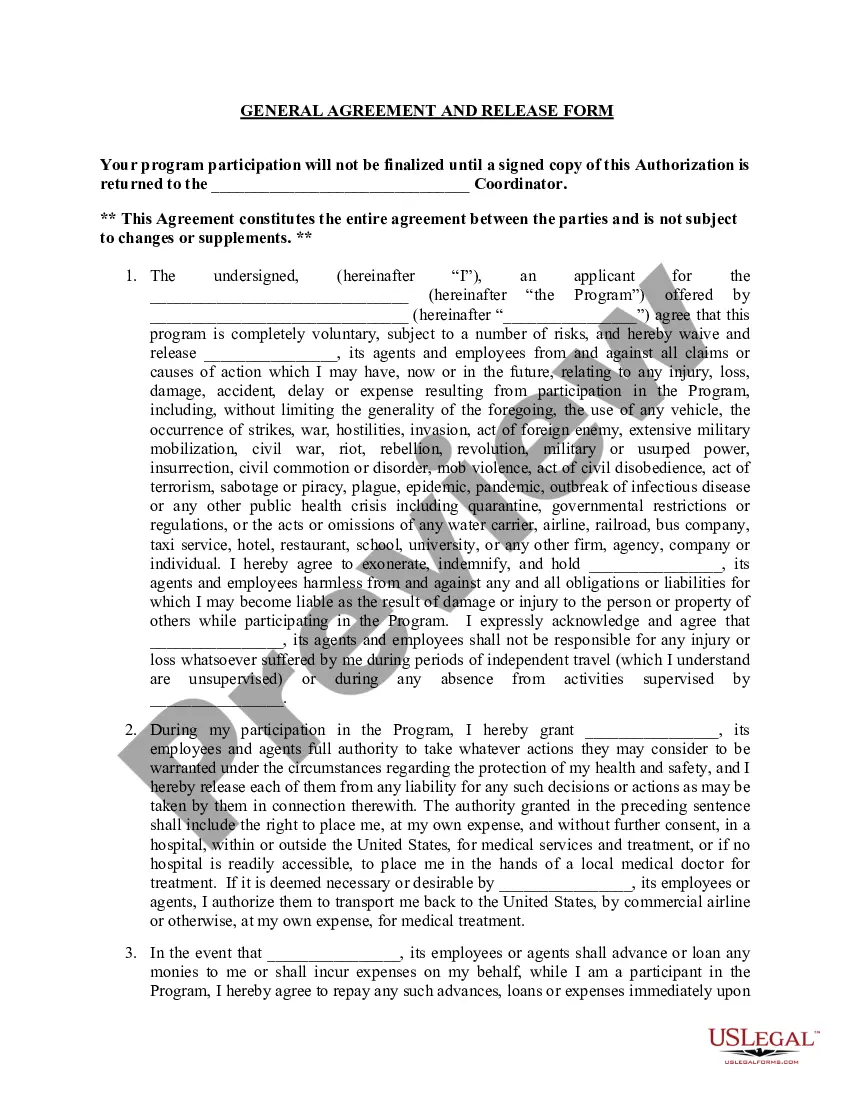

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

Discovering the right legitimate papers template can be quite a have difficulties. Needless to say, there are tons of web templates available on the Internet, but how do you obtain the legitimate kind you will need? Utilize the US Legal Forms web site. The support delivers a huge number of web templates, for example the Rhode Island Notice of Violation of Fair Debt Act - Improper Document Appearance, that can be used for enterprise and private demands. Each of the kinds are inspected by specialists and meet up with federal and state demands.

In case you are previously authorized, log in for your profile and click the Down load button to find the Rhode Island Notice of Violation of Fair Debt Act - Improper Document Appearance. Make use of your profile to appear throughout the legitimate kinds you have bought earlier. Proceed to the My Forms tab of the profile and acquire yet another copy of your papers you will need.

In case you are a whole new customer of US Legal Forms, here are easy directions so that you can stick to:

- Initial, ensure you have chosen the appropriate kind for your personal town/region. You are able to look through the form while using Review button and look at the form explanation to make sure it will be the right one for you.

- In case the kind fails to meet up with your requirements, make use of the Seach industry to discover the correct kind.

- When you are certain the form is suitable, select the Buy now button to find the kind.

- Choose the pricing program you need and enter in the required information and facts. Make your profile and pay money for the transaction using your PayPal profile or credit card.

- Opt for the file structure and obtain the legitimate papers template for your device.

- Complete, edit and print and indication the acquired Rhode Island Notice of Violation of Fair Debt Act - Improper Document Appearance.

US Legal Forms is definitely the most significant catalogue of legitimate kinds in which you can discover different papers web templates. Utilize the service to obtain appropriately-manufactured files that stick to state demands.

Form popularity

FAQ

Contact your creditors immediately; don't wait for them to contact you. Even if your payment history is less than perfect, you will still make better arrangements by being forthright. Explain your current situation. Tell them your family income is reduced and you are not able to keep up with your payments.

Refusal-to-pay letters are simple to write. The consumer only needs to send a letter to the debt collector stating something like ?I refuse to pay this debt? with the debt amount and account number listed for reference to eliminate confusion.

I enclose a copy of my financial statement. This shows income and expenses for me. You will see from this information that I am unable to make any offer of payment at the moment. I am making every effort to increase my income and will contact you again as soon as my financial circumstances improve.

I am responding to your contact about a debt you are attempting to collect. You contacted me by [phone/mail], on [date]. You identified the debt as [any information they gave you about the debt]. Please stop all communication with me and with this address about this debt.

However, I feel that it is in our mutual interest for me to decline your generous offer. This has been a difficult decision for me, but I believe it is the appropriate one for my career at this time. I want to thank you for the time and consideration you have extended to me.

However, they may file a lawsuit against you to collect the debt, and if the court orders you to appear or to provide certain information but you don't comply, a judge may issue a warrant for your arrest. In some cases, a judge may also issue a warrant if you don't comply with a court-ordered installment plan.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

A debt validation letter should include the name of your creditor and how much you owe, The letter will include information about when you need to pay the debt and how to dispute it.