Rhode Island Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Selecting the optimal legal document template can be challenging.

Certainly, there are numerous templates available online, but how do you locate the legal form you require.

Utilize the US Legal Forms website.

If you are already registered, Log In to your account and click the Download button to get the Rhode Island Notice of Violation of Fair Debt Act - Notice to Cease Contact. Use your account to access the legal documents you have previously acquired. Navigate to the My documents section of your account and obtain another copy of the documents you need.

- The service offers a plethora of templates, such as the Rhode Island Notice of Violation of Fair Debt Act - Notice to Cease Contact, which can be used for both business and personal purposes.

- All the templates are reviewed by experts and comply with federal and state regulations.

Form popularity

FAQ

For Rhode Island, the statute of limitations is between three and 10 years, depending on the type of debt. Knowing the statute of limitations on your debt is important so that you know if a debt collector still has a legal right to sue you although they can still try to otherwise pursue the debt.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

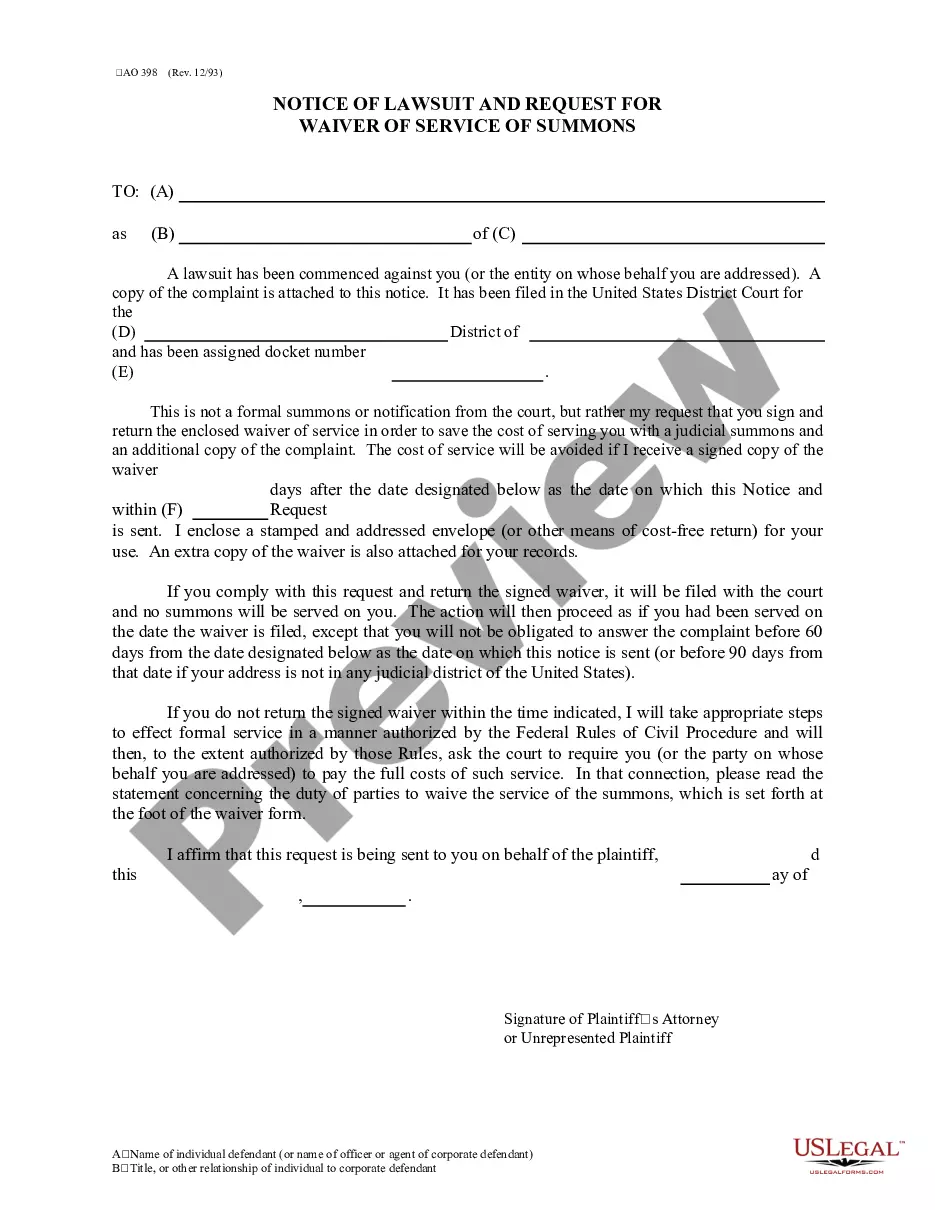

A cease and desist letter is a formal request that you send a debt collector to stop contacting you about a debt. This contact includes collection calls and demand letters. If you make this request over the phone, it won't be official or binding.

You have 30 days to dispute the validity of the debt. if you don't dispute the debt's validity, the collector will assume it is valid. if you do dispute the debt's validity within the 30 days, the agency will send you verification of it, and.

There are a few circumstances when using a Cease and Desist Letter is a good idea.The debt collector is harassing you and it is causing significant stress.The legal time limit for the creditor to collect on a debt has expired.The debt they are trying to collect is not your debt.

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time. Contact you at your place of employment.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Even if the debt is yours, you still have the right not to talk to the debt collector and you can tell the debt collector to stop calling you. However, telling a debt collector to stop contacting you does not stop the debt collector or creditor from using other legal ways to collect the debt from you if you owe it.

A cease and desist letter is a way to formally request that a debt collector stop contacting you about a debt. The Fair Debt Collection Practices Act (FDCPA) states that if you formally request that you no longer wish to be contacted by a collector, they must cease all further contact.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.