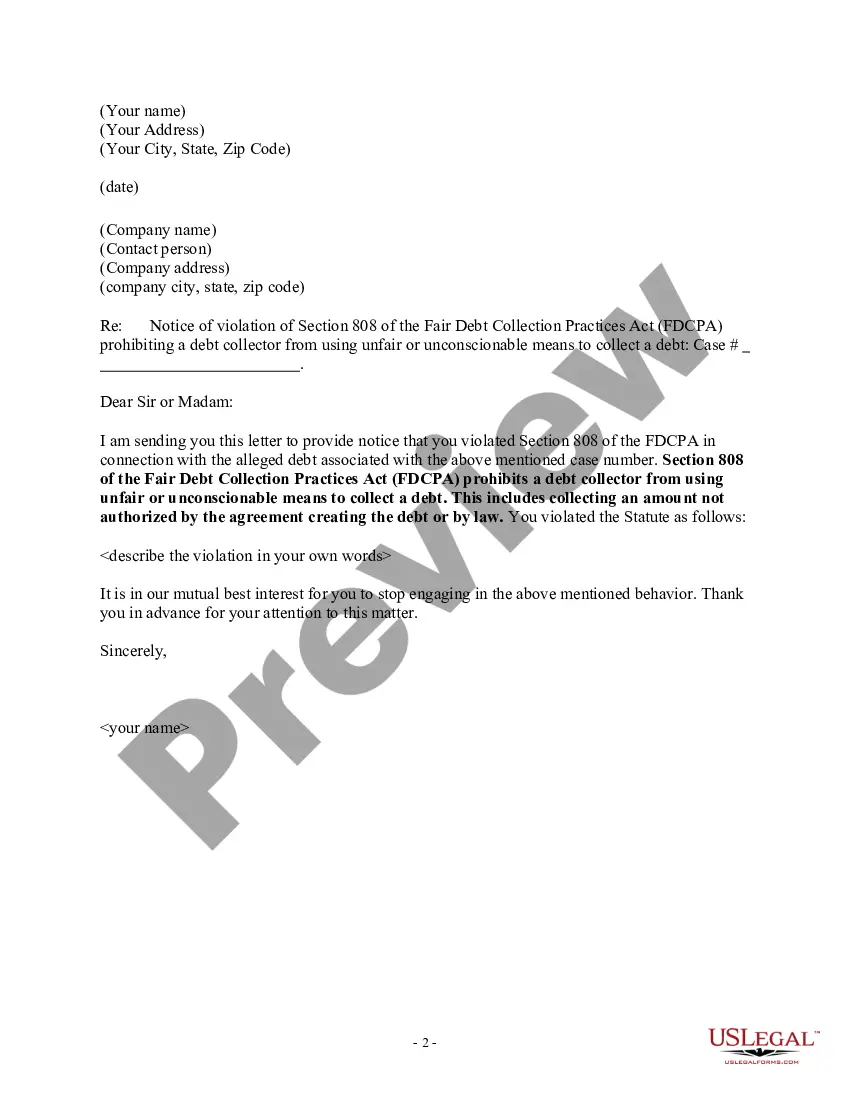

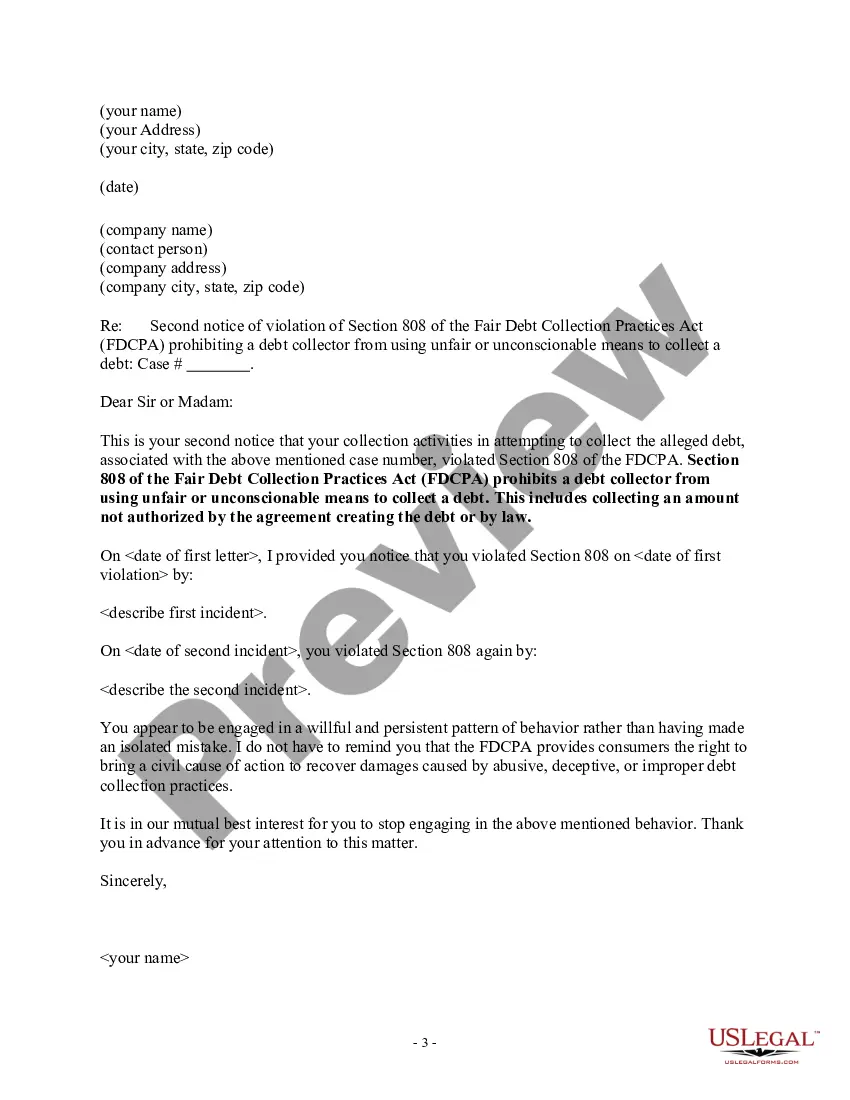

A debt collector may not use unfair or unconscionable means to collect a debt. This includes collecting an amount not authorized by the agreement creating the debt or by law.

Rhode Island Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law

Description

How to fill out Notice To Debt Collector - Collecting An Amount Not Authorized By Agreement Or By Law?

Have you ever been in a situation where you are required to have documentation for certain companies or particular operations almost every workday.

There are numerous legal document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers a vast array of form templates, such as the Rhode Island Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law, which can be generated to meet both federal and state regulations.

Select the pricing plan you prefer, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

Choose a convenient paper format and download your copy. Retrieve all the document templates you have purchased in the My documents section. You can easily obtain an additional copy of the Rhode Island Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law at any time if needed. Click the desired form to download or print the template. Take advantage of US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid mistakes. This service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you may download the Rhode Island Notice to Debt Collector - Collecting an Amount Not Authorized by Agreement or by Law template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you require and ensure it is tailored to the appropriate region/state.

- Utilize the Preview option to check the document.

- Review the details to confirm that you have chosen the correct form.

- If the form isn’t what you’re looking for, make use of the Search section to find a form that matches your needs and requirements.

- Once you find the correct form, click Buy now.

Form popularity

FAQ

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

For Rhode Island, the statute of limitations is between three and 10 years, depending on the type of debt. Knowing the statute of limitations on your debt is important so that you know if a debt collector still has a legal right to sue you although they can still try to otherwise pursue the debt.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.

Yes, but the collector must first sue you to get a court order called a garnishment that says it can take money from your paycheck to pay your debts. A collector also can seek a court order to take money from your bank account.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

The validation notice is meant to help you recognize whether the debt is yours and dispute the debt if it is not yours. The notice generally must include: A statement that the communication is from a debt collector. The name and mailing information of the debt collector and the consumer.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

A debt validation letter is what a debt collector sends you to prove that you owe them money. This letter shows you the details of a specific debt, outlines what you owe, who you owe it to, and when they need you to pay. Get help with your money questions.