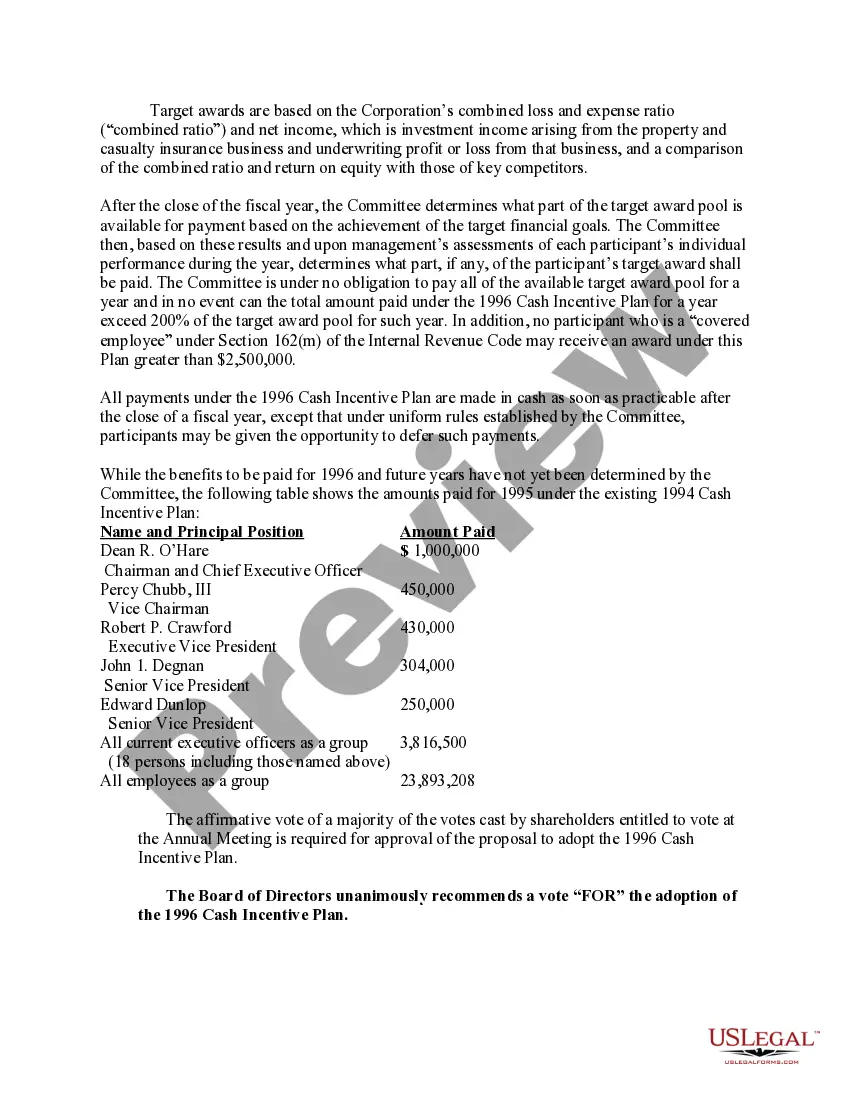

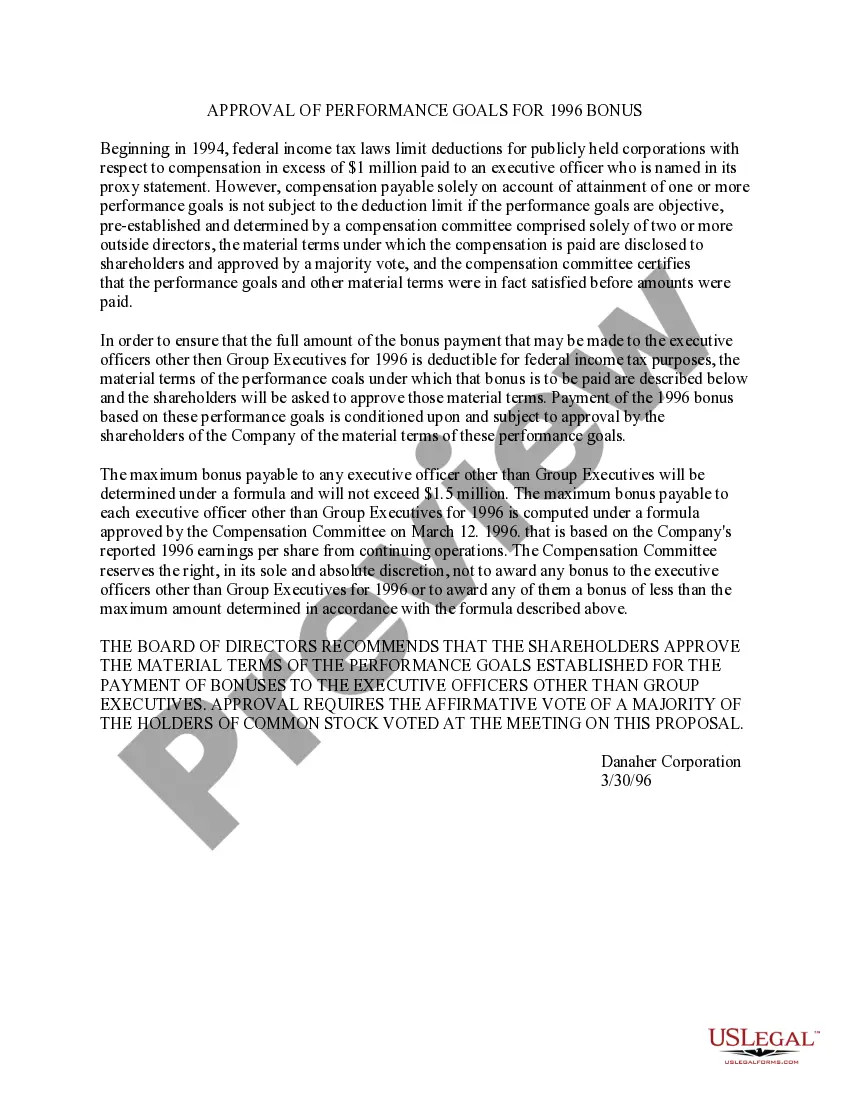

Arkansas Proposal to approve annual incentive compensation plan

Description

How to fill out Proposal To Approve Annual Incentive Compensation Plan?

Choosing the right legal record web template can be a battle. Needless to say, there are tons of web templates available online, but how would you obtain the legal form you require? Use the US Legal Forms web site. The assistance provides a large number of web templates, like the Arkansas Proposal to approve annual incentive compensation plan, which can be used for company and private demands. All the types are inspected by experts and satisfy federal and state requirements.

When you are currently listed, log in to your profile and click on the Acquire option to find the Arkansas Proposal to approve annual incentive compensation plan. Use your profile to check with the legal types you possess bought in the past. Go to the My Forms tab of your own profile and get an additional backup of the record you require.

When you are a brand new user of US Legal Forms, here are easy recommendations that you can adhere to:

- Very first, ensure you have chosen the right form for your town/state. You are able to examine the shape using the Preview option and study the shape outline to guarantee this is basically the right one for you.

- If the form fails to satisfy your expectations, utilize the Seach discipline to discover the proper form.

- When you are certain the shape is acceptable, go through the Get now option to find the form.

- Choose the rates prepare you need and enter in the required information and facts. Create your profile and pay for the transaction making use of your PayPal profile or Visa or Mastercard.

- Opt for the data file formatting and down load the legal record web template to your gadget.

- Full, change and print out and sign the received Arkansas Proposal to approve annual incentive compensation plan.

US Legal Forms is definitely the biggest catalogue of legal types for which you can see different record web templates. Use the service to down load skillfully-created files that adhere to state requirements.

Form popularity

FAQ

Research and Development in Area of Strategic Value The income tax credit is equal to 33% of qualified research expenditures. The maximum tax credit that may be claimed by a taxpayer under this program is $50,000 per tax year.

Arkansas allows credits for taxes paid to another state by its residents. This credit is available only when Arkansas and the other state both seek to tax the same income and is only allowable for income taxes. Arkansas also allows a childcare credit equal to 20 percent of the federal credit.

What are government revenue and spending? Government revenue is the money the state government receives from all the taxes Arkansans pay, voluntary fees Arkansans pay (such as college tuition), and transfers from the federal government.

Under the PITL and CTL, this bill would, for each taxable year beginning on or after January 1, 2020, and before January 1, 2024, allow a taxpayer a credit in an amount equal to $1 for each hour a registered apprentice worked during the taxable year, up to $1,000 for each registered apprentice trained by the taxpayer ...

The State of Arkansas rewards companies that employ apprentices by offering employer tax credits. Companies with USDOL Registered Apprenticeship (RA) programs are eligible for a tax credit of up to $2,000 per apprentice up to a maximum amount of $10,000 per year, or 10% of the wages earned in a taxable year.

ArkPlus Income Tax Credit (ACA §15-4-2706(b)) The Consolidated Incentive Act 182 of 2003, as amended, allows the Arkansas Economic Development Commission (AEDC) to provide a ten percent (10%) income tax credit to eligible businesses based on the total investment in a new location or expansion project.

New Arkansas tax cut bill The latest Arkansas tax cut bill signed into law by Gov. Sanders on Sept. 14 further reduces the state's top income tax rate from 4.7% to 4.4%, (This rate was previously reduced from 4.9% in April 2023.)