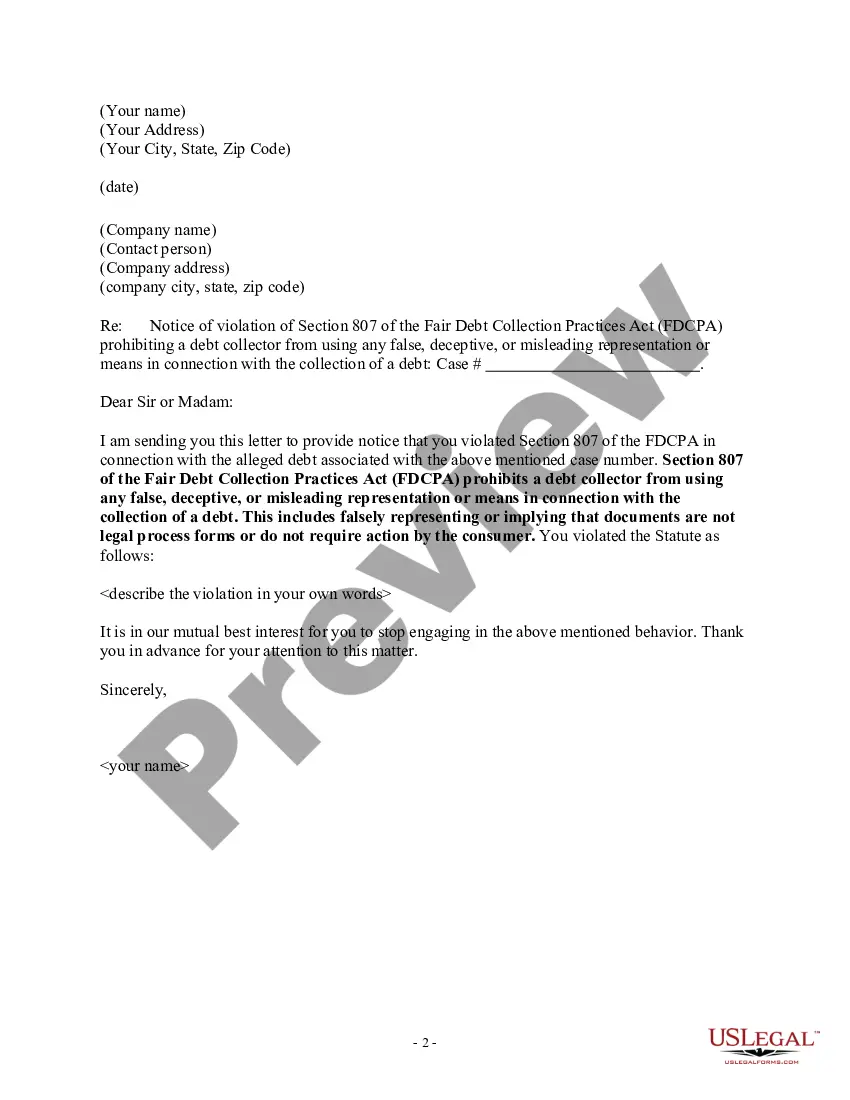

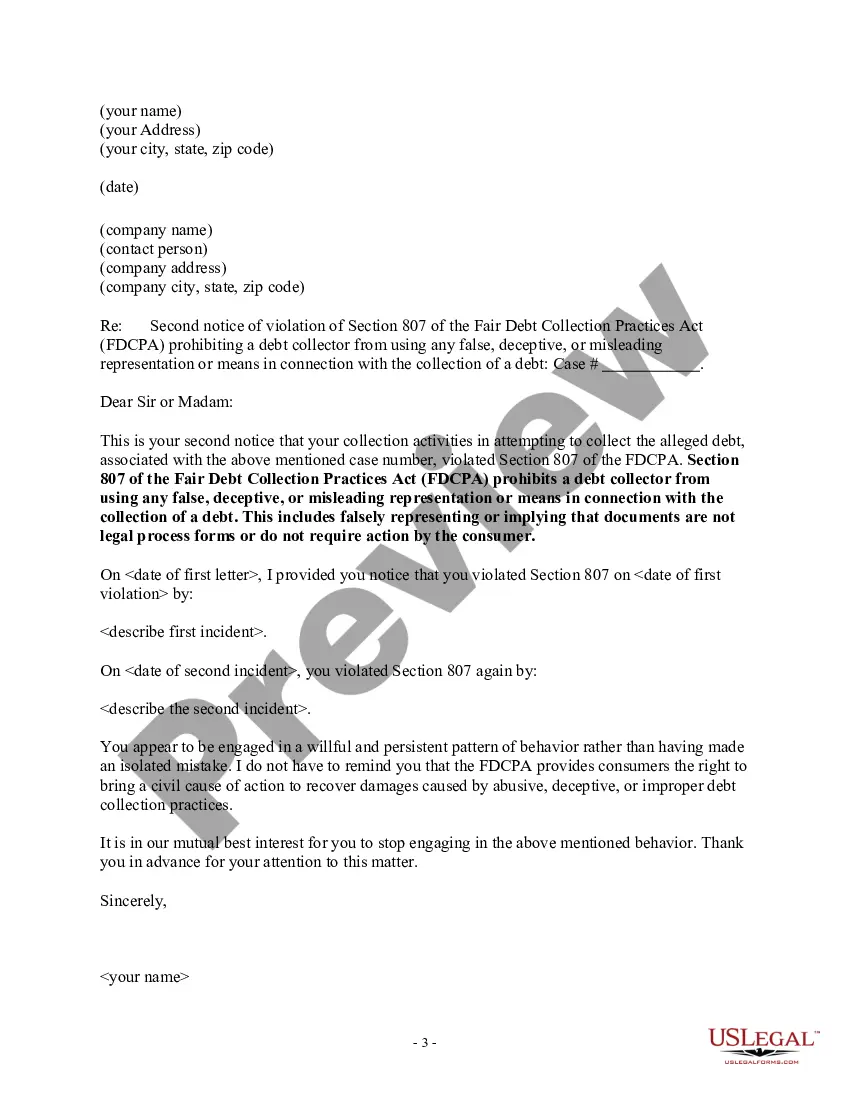

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that documents are not legal process forms or do not require action by the consumer.

Rhode Island Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action

Description

How to fill out Notice To Debt Collector - Falsely Representing Documents Are Not Legal Process Or Do Not Require Action?

Finding the correct legal document template can be challenging. Naturally, there are numerous templates available on the internet, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Rhode Island Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action, that you can utilize for business and personal purposes.

All the documents are reviewed by professionals and comply with state and federal regulations.

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the appropriate document for your city/county. You can review the form using the Review button and read the form details to ensure it is suitable for you. If the document does not meet your needs, use the Search field to find the correct form. Once you confirm the document is accurate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, edit, print, and sign the acquired Rhode Island Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action. US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Utilize the service to acquire professionally created documents that comply with state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the Rhode Island Notice to Debt Collector - Falsely Representing Documents are Not Legal Process or Do Not Require Action.

- Use your account to search for the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

3 Things You Should NEVER Say To A Debt CollectorAdditional Phone Numbers (other than what they already have)Email Addresses.Mailing Address (unless you intend on coming to a payment agreement)Employer or Past Employers.Family Information (ex.Bank Account Information.Credit Card Number.Social Security Number.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

No harassment The Fair Debt Collection Practices Act (FDCPA) says debt collectors can't harass, oppress, or abuse you or anyone else they contact. Some examples of harassment are: Repetitious phone calls that are intended to annoy, abuse, or harass you or any person answering the phone. Obscene or profane language.

Many people are surprised to learn that debt collectors can sue debtors for the balance of any outstanding debt. Many times, debt collection agencies will bring a lawsuit for breach of contract because when individuals don't pay the debt they agreed to pay.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

You are not obliged let a debt collector into your home and they don't have the right to take goods away. It's very important to understand that a debt collector is not the same as an enforcement agent or bailiff. Debt collectors have no special legal powers.

Repeated calls. Threats of violence. Publishing information about you. Abusive or obscene language.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

One is to report them to the Financial Consumer Protection Department of the BSP (i.e. email consumeraffairs@bsp.gov.ph or call 632-708-7087). Be sure to document all communications with your debt collectors including text messages and e-mails. If you can, record your conversation with their consent.